King Washington Assignment and Conveyance of Overriding Royalty Interest

Description

How to fill out Assignment And Conveyance Of Overriding Royalty Interest?

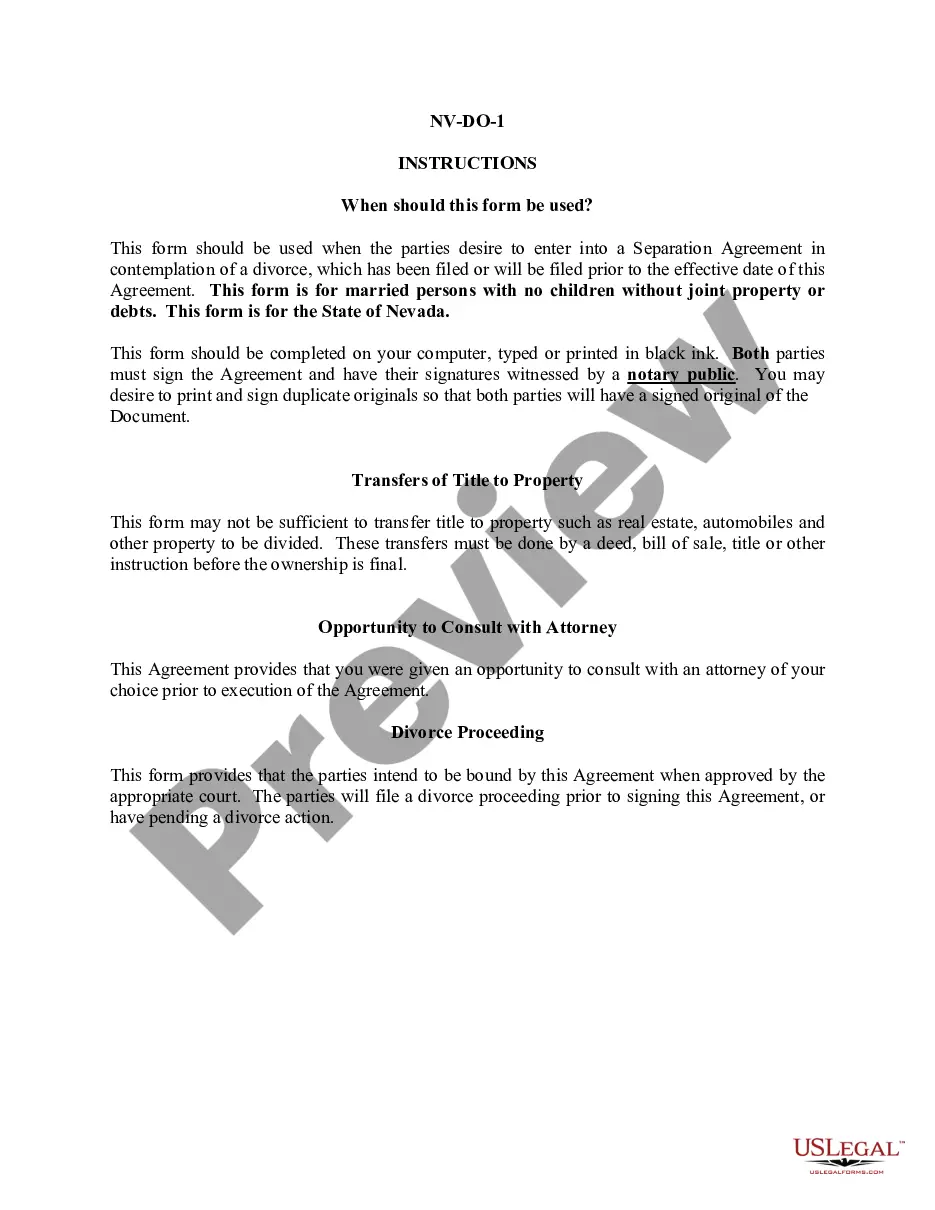

Laws and statutes in every sector vary across the nation.

If you’re not an attorney, it’s simple to become confused by the different standards when it comes to creating legal documents.

To prevent costly legal fees when drafting the King Assignment and Conveyance of Overriding Royalty Interest, you require a validated template suitable for your county.

This is the easiest and most cost-effective method to obtain current templates for any legal matters. Find them all with a few clicks and keep your paperwork organized with US Legal Forms!

- That's why the US Legal Forms platform is incredibly useful.

- US Legal Forms is a widely recognized online library housing over 85,000 state-specific legal templates.

- It’s an excellent resource for professionals and individuals looking for DIY templates for various personal and business situations.

- All the documents are reusable: once you select a template, it remains stored in your account for later access.

- Therefore, if you have a registered account with an active subscription, you can simply Log In and re-download the King Assignment and Conveyance of Overriding Royalty Interest from the My documents section.

- For new users, a few additional steps are needed to secure the King Assignment and Conveyance of Overriding Royalty Interest.

- Review the page content to ensure you've located the correct template.

- Use the Preview option or check the form description if present.

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.