Bexar Texas Ratification of Royalty Commingling Agreement

Description

How to fill out Ratification Of Royalty Commingling Agreement?

Navigating legal documents is essential in the contemporary world. Nonetheless, you don’t always have to seek professional assistance to create some of them from the ground up, such as the Bexar Ratification of Royalty Commingling Agreement, using a service like US Legal Forms.

US Legal Forms offers over 85,000 templates to choose from across various categories, ranging from living wills to real estate documents to divorce forms. All templates are organized by their relevant state, making the search process less cumbersome. You can also discover comprehensive materials and guides on the platform to simplify any tasks related to document preparation.

Here’s how to buy and download the Bexar Ratification of Royalty Commingling Agreement.

If you are already a subscriber to US Legal Forms, you can find the required Bexar Ratification of Royalty Commingling Agreement, Log In to your account, and download it. It is important to note that our platform cannot completely replace an attorney. We recommend utilizing a lawyer's services if you have to manage a particularly complex situation for document verification before finalizing and submitting it.

With over 25 years in the industry, US Legal Forms has established itself as a trusted provider for various legal documents for millions of customers. Join them today and conveniently acquire your state-specific paperwork!

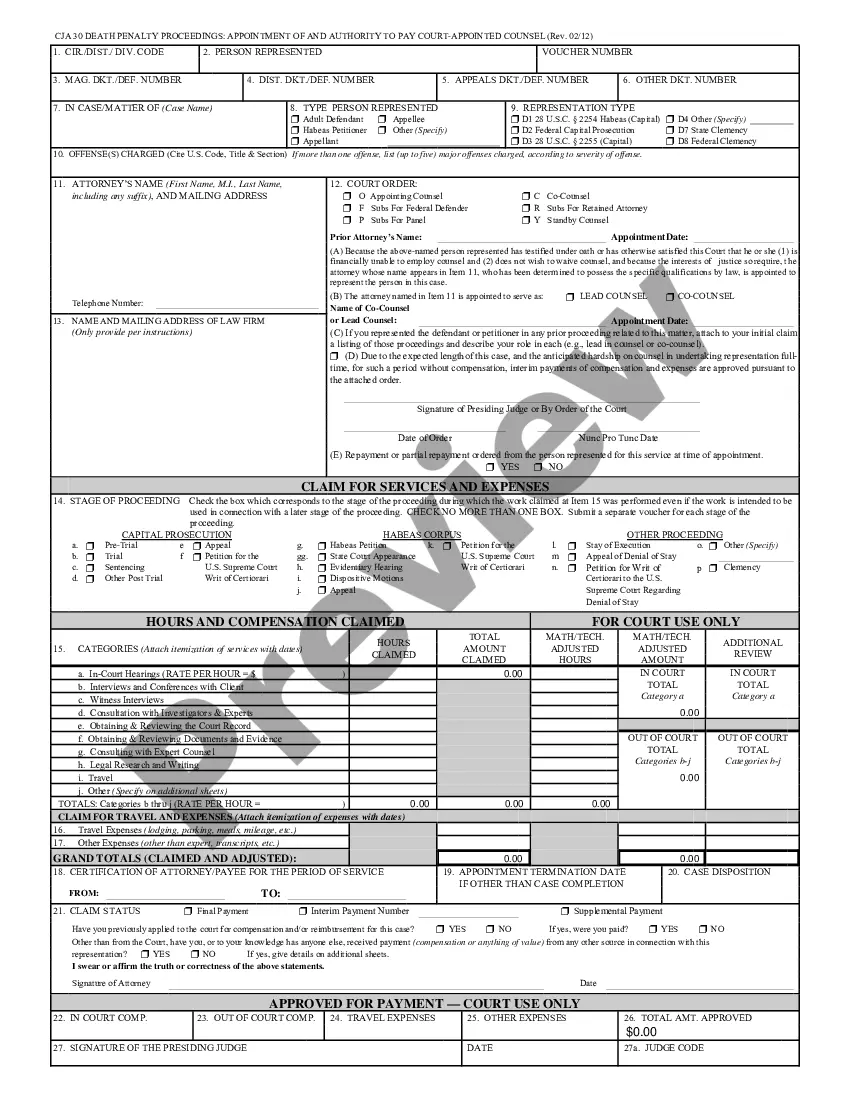

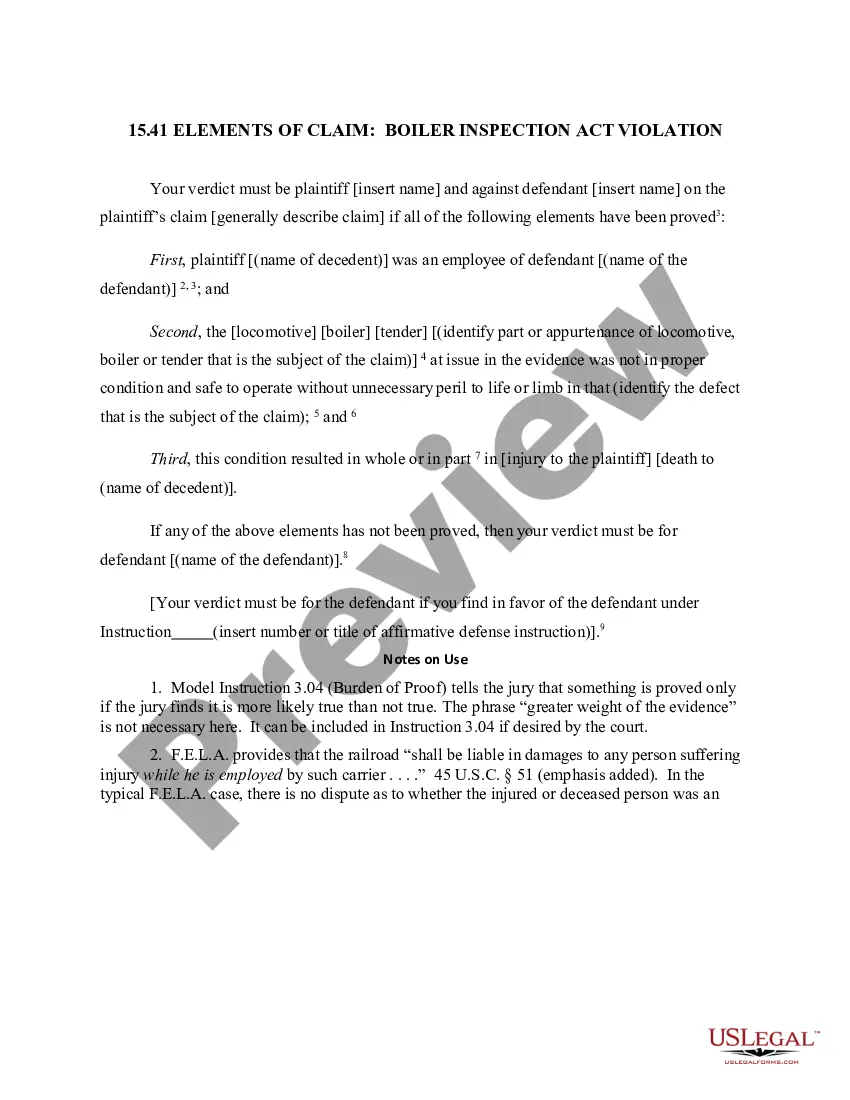

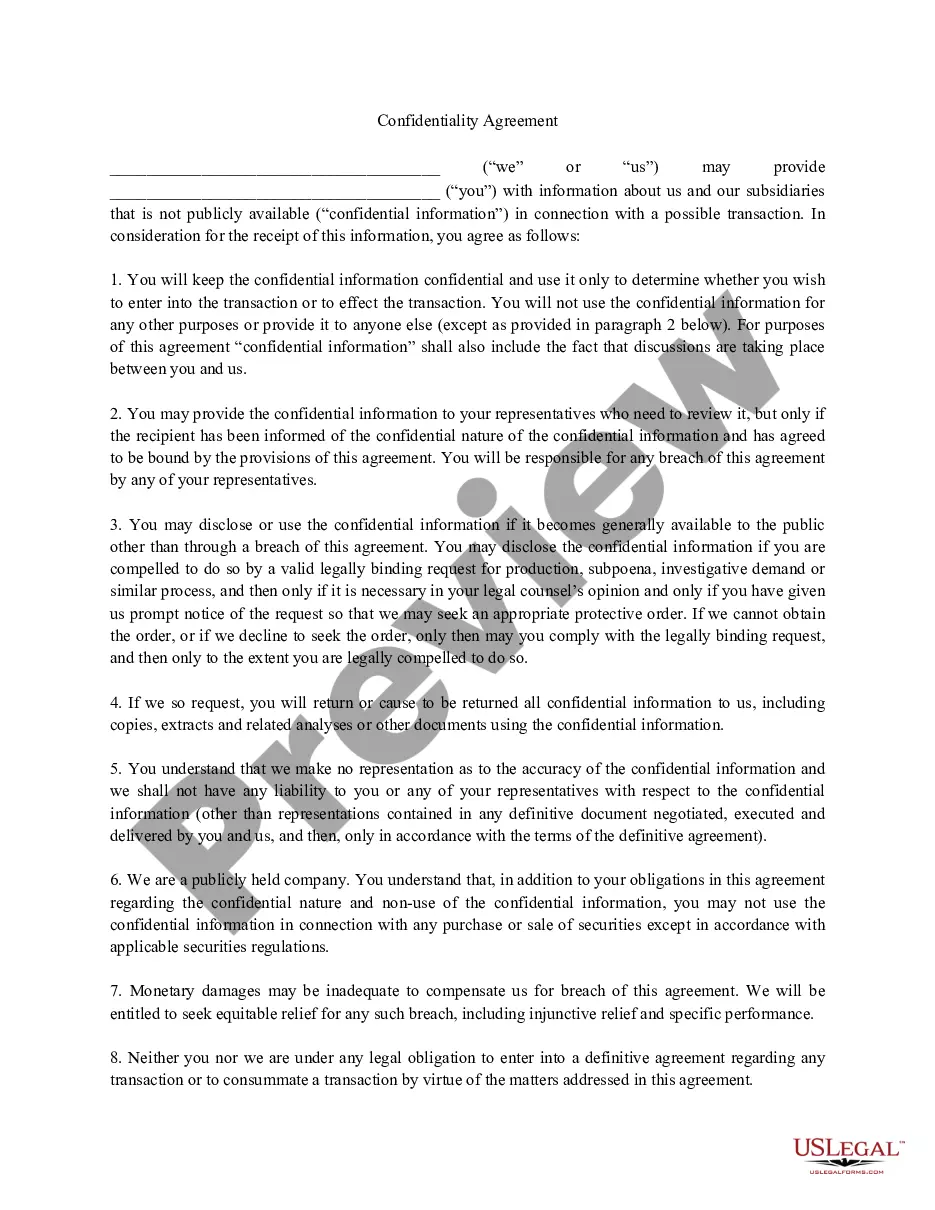

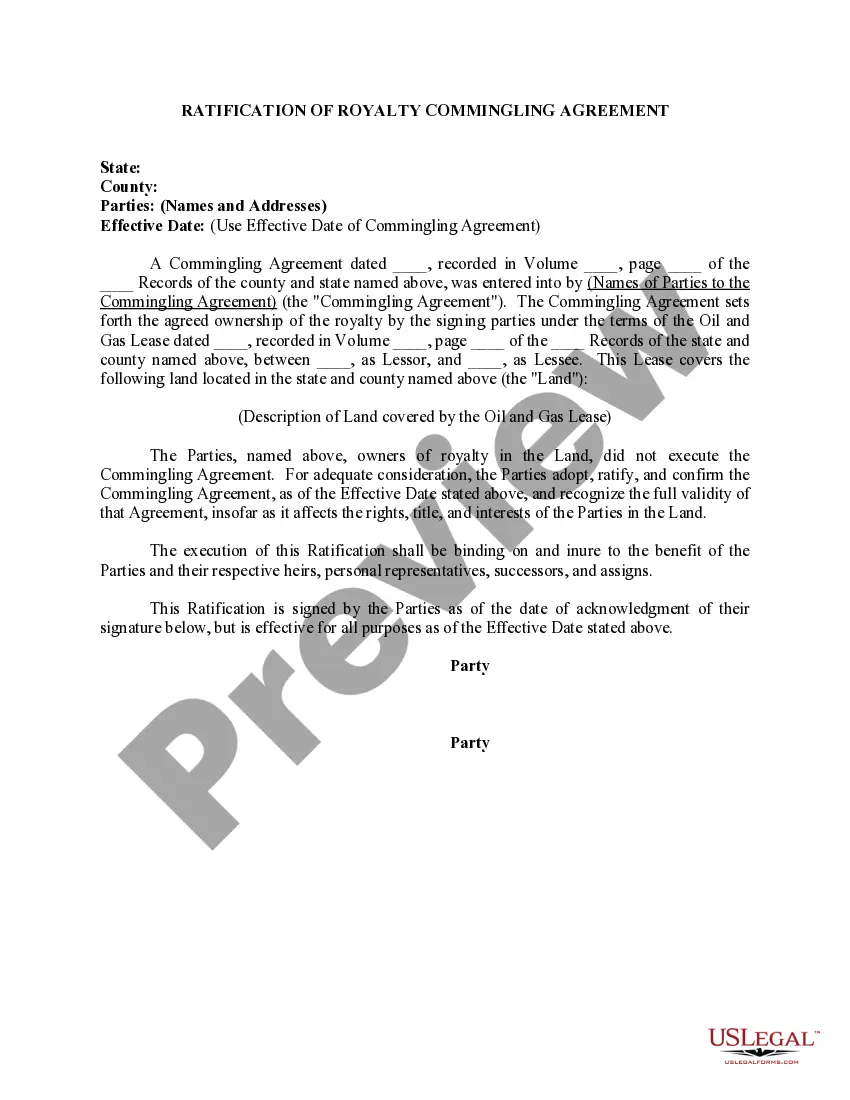

- Review the document’s preview and description (if available) to gain basic information about what you will receive after obtaining the form.

- Confirm that the document you selected is suited to your state/county/region as local laws may impact the applicability of certain documents.

- Look at similar documents or start a new search to find the correct file.

- Click Buy now and set up your account. If you already have an account, choose to Log In.

- Select the pricing {plan, then an appropriate payment method, and purchase the Bexar Ratification of Royalty Commingling Agreement.

- Choose to download the form template in any available file format.

- Navigate to the My documents section to re-download the file.

Form popularity

FAQ

A clause in an oil & gas lease that provides that if the leased land is later owned by separate parties, such as in a sale of part of the property, the lessee can continue to operate, develop, and treat the lease as a whole and pay royalties to each owner based on its percentage of ownership of the entire area.

Under Texas law, there is a rule of non-apportionment. It sets out that when the property is subdivided after the lease is already in place on the tract, the royalties are not apportioned but given to the royalty interest owner on whose property the well physically sits. Delay rentals however are apportioned.

Non-Apportionment Rule The rulefollowed in the majority of statesthat royalties accruing under a lease on property that has been subdivided after the lease grant are not to be shared by the owners of the various subdivisions but belong exclusively to the owner of the subdivision where the producing well is located.

Non-Apportionment Rule The rulefollowed in the majority of statesthat royalties accruing under a lease on property that has been subdivided after the lease grant are not to be shared by the owners of the various subdivisions but belong exclusively to the owner of the subdivision where the producing well is located.

In Texas, courts have held that division orders are executed without consideration, but that they are an enforceable agreement until they are revoked. A division order can be revoked at any time by either party, after which it has no further effect.

In terms of the oil and gas industry, ratification of a lease is the term for requesting acceptance of an existing lease agreement, with or without changes, from landowners who have purchased parcels to which the original leaseholder gave permission to drill and produce. Leases can last for decades.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

In oil and gas exploration and production, leasehold interest refers to the lease the company enters into with the mineral rights owner. Other names for leasehold interest are working interest and operating interest.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.