San Bernardino California Deed in Lieu of Prior Deed to Correctly Identify the Amount of Interest intended to Be Conveyed A San Bernardino California Deed in Lieu of Prior Deed to Correctly Identify the Amount of Interest intended to Be Conveyed refers to a legal document that is executed when there is a need to correct the previously recorded deed in order to accurately determine the specific amount of interest being conveyed in a property located in San Bernardino, California. Typically, this type of deed is utilized in situations where there has been an error or ambiguity in the initial deed, and the parties involved wish to rectify the mistake and provide a clear and unambiguous description of the conveyed interest. By utilizing a San Bernardino California Deed in Lieu of Prior Deed, all parties involved can ensure that the interests being conveyed in the real property are accurately reflected, reducing the possibility of future disputes or legal complications. This document serves as a valuable instrument to correct any inaccuracies in the initial deed, allowing for a smooth and accurate transfer of ownership. Types of San Bernardino California Deed in Lieu of Prior Deed to Correctly Identify the Amount of Interest intended to Be Conveyed: 1. General Warranty Deed in Lieu of Prior Deed: This type of deed is commonly used when the granter wishes to provide the utmost assurance to the grantee that the property is free from any defects or claims against the title. It guarantees the grantee's ownership rights and provides protection against any future title issues. 2. Special Warranty Deed in Lieu of Prior Deed: Unlike a general warranty deed, this type of deed only guarantees against any defects or claims that may have arisen during the ownership of the granter. It does not provide protection against claims that may have existed before the granter's ownership. 3. Quitclaim Deed in Lieu of Prior Deed: A quitclaim deed is commonly used to transfer ownership interest without any warranties or guarantees. In this case, the granter simply relinquishes any interest they may have in the property, without making any claims about the title. It is often employed in situations such as divorces or transfers between family members. Regardless of the specific type of San Bernardino California Deed in Lieu of Prior Deed used, it is crucial to consult with a knowledgeable real estate attorney to ensure that the document is executed properly and accurately reflects the intentions of the parties involved. Properly identifying the amount of interest being conveyed is essential to avoid any future legal complications or disputes related to the property.

San Bernardino California Deed in Lieu of Prior Deed to Correctly Identify the Amount of Interest intended to Be Conveyed

Description

How to fill out San Bernardino California Deed In Lieu Of Prior Deed To Correctly Identify The Amount Of Interest Intended To Be Conveyed?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including San Bernardino Deed in Lieu of Prior Deed to Correctly Identify the Amount of Interest intended to Be Conveyed, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different categories ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find detailed materials and tutorials on the website to make any tasks associated with paperwork completion straightforward.

Here's how you can locate and download San Bernardino Deed in Lieu of Prior Deed to Correctly Identify the Amount of Interest intended to Be Conveyed.

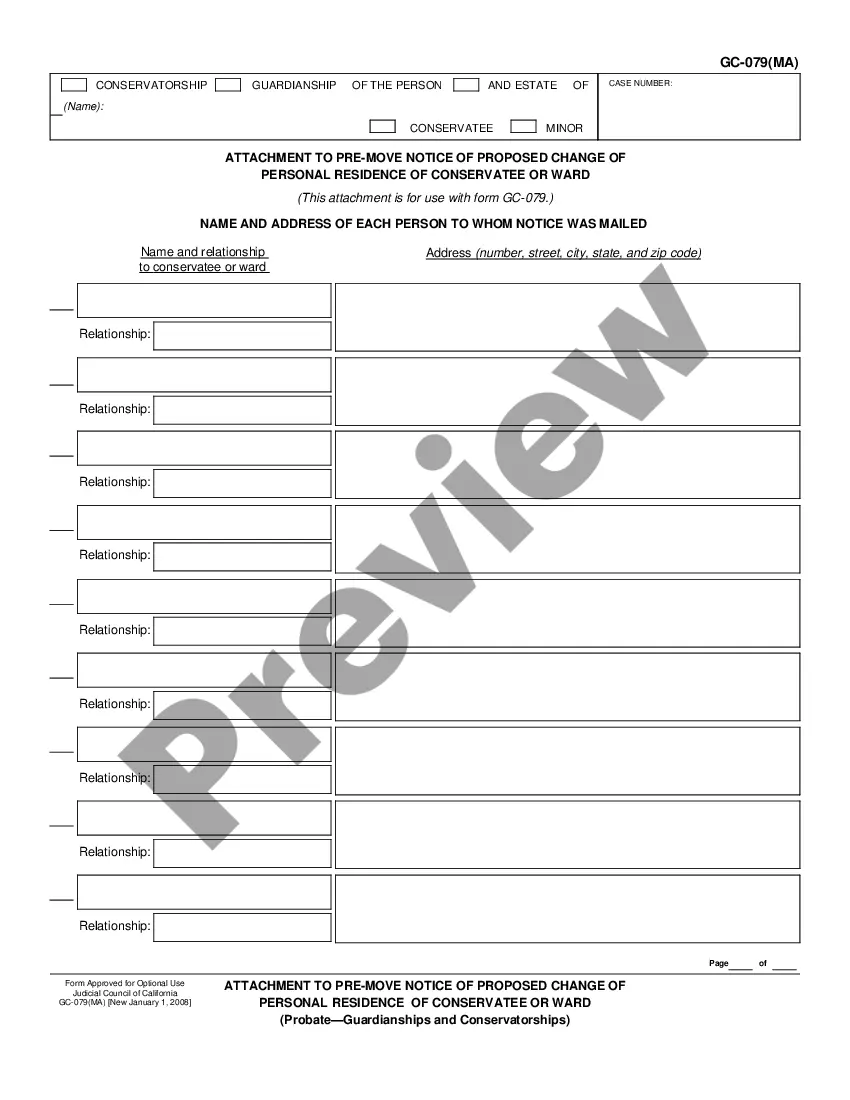

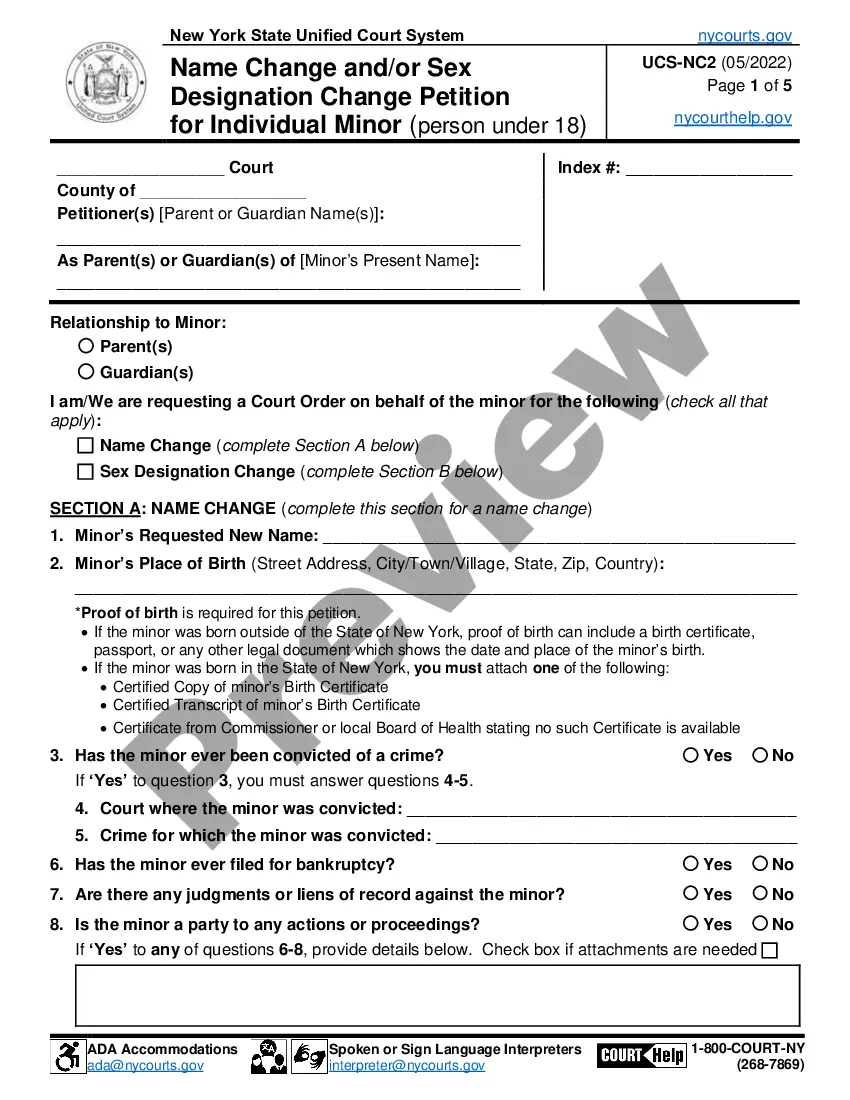

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the related forms or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and purchase San Bernardino Deed in Lieu of Prior Deed to Correctly Identify the Amount of Interest intended to Be Conveyed.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed San Bernardino Deed in Lieu of Prior Deed to Correctly Identify the Amount of Interest intended to Be Conveyed, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you have to cope with an extremely complicated situation, we recommend using the services of an attorney to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-specific documents with ease!

Form popularity

FAQ

Documentary Transfer Tax (DTT) Statement Documentary Transfer Tax is due on all taxable conveyances in excess of $100 at a rate of $. 55 per $500 or fractional portion of real property value, excluding any liens or encumbrances already of record. Transfer tax is collected at the time of recording.

Recorder Offices San Bernardino County Recorder. Hall of Records - 222 West Hospitality Ln, 1st floor, San Bernardino, California 92415-0022.Joshua Tree-Satellite Office. 63665 29 Palms Highway-1st Floor, Joshua Tree, California 92252.High Desert Office. Government Center - 15900 Smoke Tree St, Hesperia, California 92345.

What is Documentary Transfer Tax? A tax collected when an interest in real property is conveyed. Collected by the County Recorder at the time of recording. A Transfer Tax Declaration must appear on each deed. There is a County tax and in some cases, a City tax.

Upon taking effect, the recorder's office will impose a fee of $75.00 to be paid when recording every real estate instrument, paper, or notice required or permitted by law to be recorded, per each single transaction per single parcel of real property, not to exceed $225.00.

The Recorder's Office probably has a notary available. Date the form and have the grantor and grantee sign in front of the notary. Fill in the state and county names and have the notary public date the form, print and sign her name, and apply her seal. Complete a Change of Ownership Report, required by California law.

Call the office you wish to visit. Please call the office you wish to visit to search our Public Official Record index. Map copies may only be purchased at the San Bernardino Hall of Records location.

State law requires the buyer of real property to file a Preliminary Change of Ownership Report with the County Recorder's Office at the time a document is recorded which transfers ownership of the property. If this form is not filed, the recorder will charge an additional fee of $20.

You may also call our office at (909) 387-8308. To estimate your new tax bills enter what you know about your property and select the property. Pay your property taxes conveniently and securely using our website. FREE eCheck (electronic check) is a digital version of the paper check.