Dallas Texas Pipeline Service Contract - Self-Employed

Description

How to fill out Dallas Texas Pipeline Service Contract - Self-Employed?

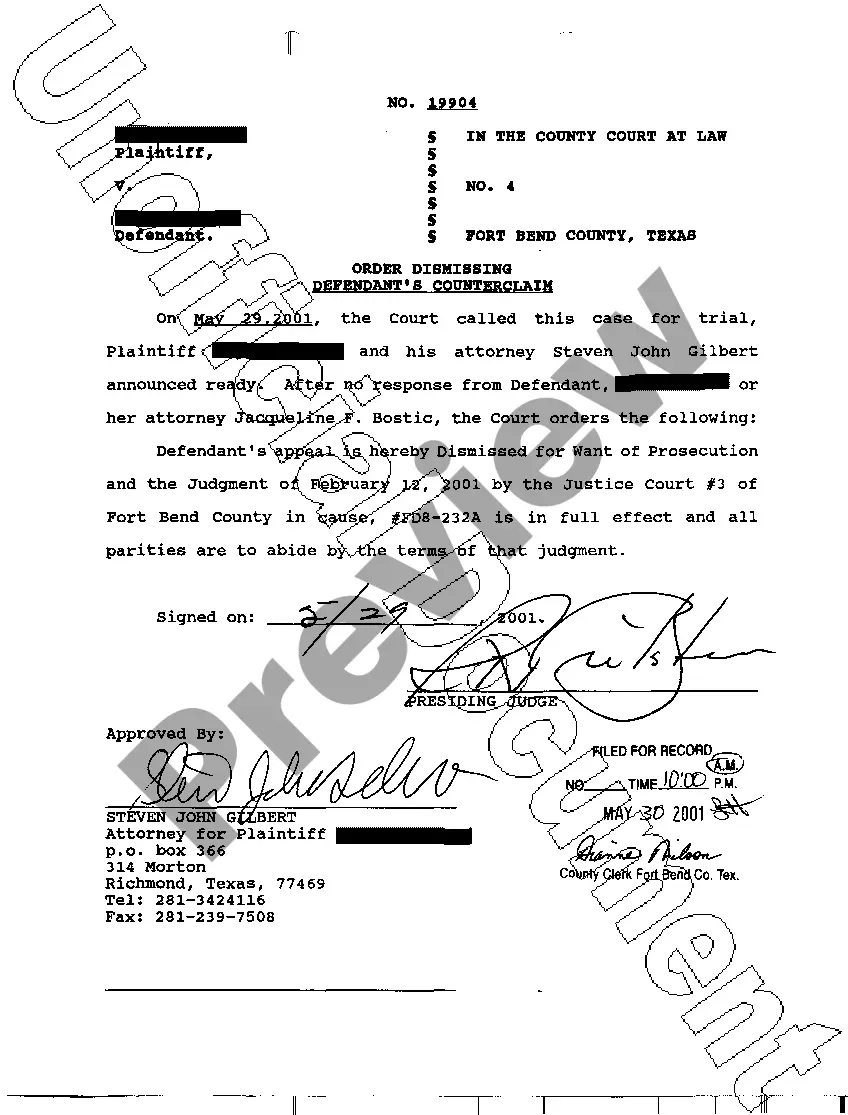

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life sphere, finding a Dallas Pipeline Service Contract - Self-Employed meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Apart from the Dallas Pipeline Service Contract - Self-Employed, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Experts check all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Dallas Pipeline Service Contract - Self-Employed:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Dallas Pipeline Service Contract - Self-Employed.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).

For independent contractors and others who are self-employed, these taxes are called "self-employment taxes." You'll need to use Schedule SE to calculate the total self-employment tax you owe. Then, you must add this amount to your personal tax return (Form 1040/1040-SR).

Generally, you must withhold and pay income taxes, social security taxes and Medicare taxes as well as pay unemployment tax on wages paid to an employee. You do not generally have to withhold or pay any taxes on payments to independent contractors.

As an independent contractor, if you made more than $400, you need to pay income tax and self-employment tax. If you save 30% of your earnings, you'll cover your small business and income taxes each quarter.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

An independent contractor is self-employed, bears responsibility for his or her own taxes and expenses, and is not subject to an employer's direction and control. The distinction depends upon much more than what the parties call themselves.

Your state's unemployment commission will reduce your benefit payment for that week based on the amount you received in compensation for your 1099 work. The reduction may not be dollar for dollar. For example, in Texas, you can earn up to 125 percent of your normal benefit amount before your benefit is eliminated.

If you are an independent contractor, a gig worker, or are self-employed in Texas, and you are out of work due to COVID-19, you may qualify for unemployment benefits through Pandemic Unemployment Assistance (PUA).

What percent do independent contractors pay in taxes? The self-employment tax rate is 15.3%, of which 12.4% goes to Social Security and 2.9% goes to Medicare. Income tax obligations vary based on net business profits and losses, among other factors.