Bronx New York Statement to Add to Credit Report

Description

How to fill out Statement To Add To Credit Report?

Preparing documents, such as Bronx Statement to Add to Credit Report, to manage your legal matters is a challenging and time-consuming task. Numerous situations necessitate an attorney’s involvement, which also renders this undertaking costly. Nonetheless, you can take control of your legal challenges and address them independently. US Legal Forms is here to assist you.

Our website offers over 85,000 legal templates designed for various situations and life circumstances. We guarantee each document adheres to the laws of each state, so you don’t need to worry about potential legal issues related to compliance.

If you’re already familiar with our offerings and hold a subscription with US, you understand how easy it is to obtain the Bronx Statement to Add to Credit Report template. Just Log In to your account, download the template, and customize it according to your requirements. Have you misplaced your document? Don’t fret. You can retrieve it from the My documents section in your account - whether on a computer or mobile device.

It’s a straightforward process to find and purchase the suitable template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up now if you want to discover what additional advantages you can gain with US Legal Forms!

- Verify that your template is tailored to your state/county as the rules for generating legal documents may vary from one state to another.

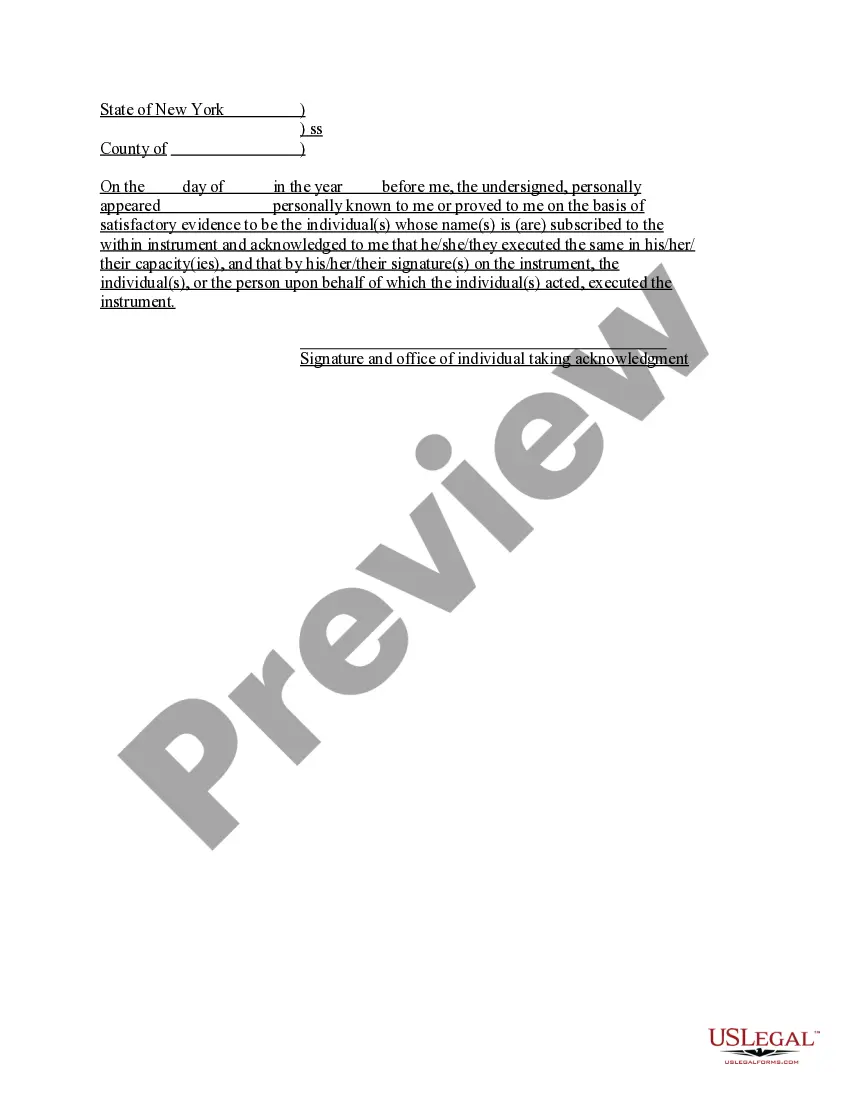

- Learn more about the form by previewing it or reading a brief introduction. If the Bronx Statement to Add to Credit Report isn’t what you needed, then utilize the header to locate another option.

- Log in or create an account to begin using our website and download the document.

- Everything satisfactory on your end? Click the Buy now button and select the subscription plan.

- Choose the payment method and input your payment details.

- Your template is ready for download. You can proceed to download it.

Form popularity

FAQ

How to File a Personal Statement with Experian If you don't have an account use this link to create one.Use this link to sign in and click on Start New Dispute. Click View All under Personal Information. Scroll down the page to Personal Statements and click Add personal statement.

When it comes to your credit report, you have the right to add a personal statement. This statement can be up to 100 words long and gives you the opportunity to explain information in your file. You can address any aspect of your credit file, including multiple items.

If you keep up with your utility and phone bills and that activity is reported to credit bureaus, it could help boost your credit. But keep in mind, those bills are just one possible factor in credit scoring. And falling behind on them or other bills could have negative effects.

Consumer statements can be added to your credit report at your request through each of the three major credit bureaus (Experian, TransUnion and Equifax). These statements are generally limited to pre-written options or up to 100 words you write yourself.

Third-party services like PayYourRent and RentTrack, for example, will report your rental payments to all three of the major credit bureaus. Signing up for Experian Boost lets you add phone and utility bills to your Experian report, and a history of on-time payments can boost your credit score.

Adding a Consumer Statement to your Equifax credit report does not add it to your credit reports with the other nationwide consumer reporting agencies, TransUnion or Experian, or any other consumer reporting agency. If you want to add a Consumer Statement to those credit reports, you'll need to contact them separately.

Credit card issuers typically report your statement balance to the credit bureaus monthly, but if you have multiple cards with different issuers, you'll likely have credit card balances reported at various times throughout the month.

Bills Commonly Reported to Credit Bureaus In general, car payments, mortgage payments, student loan payments and credit card payments are often reported to the bureaus. Many of these traditional lenders report to all three bureaus, but not all do.

Third-party services like PayYourRent and RentTrack, for example, will report your rental payments to all three of the major credit bureaus. Signing up for Experian Boost lets you add phone and utility bills to your Experian report, and a history of on-time payments can boost your credit score.