Columbus Ohio Mortgage Demand Letter

State:

Multi-State

City:

Columbus

Control #:

US-LTR-MORT-010

Format:

Word;

Rich Text

Instant download

Description

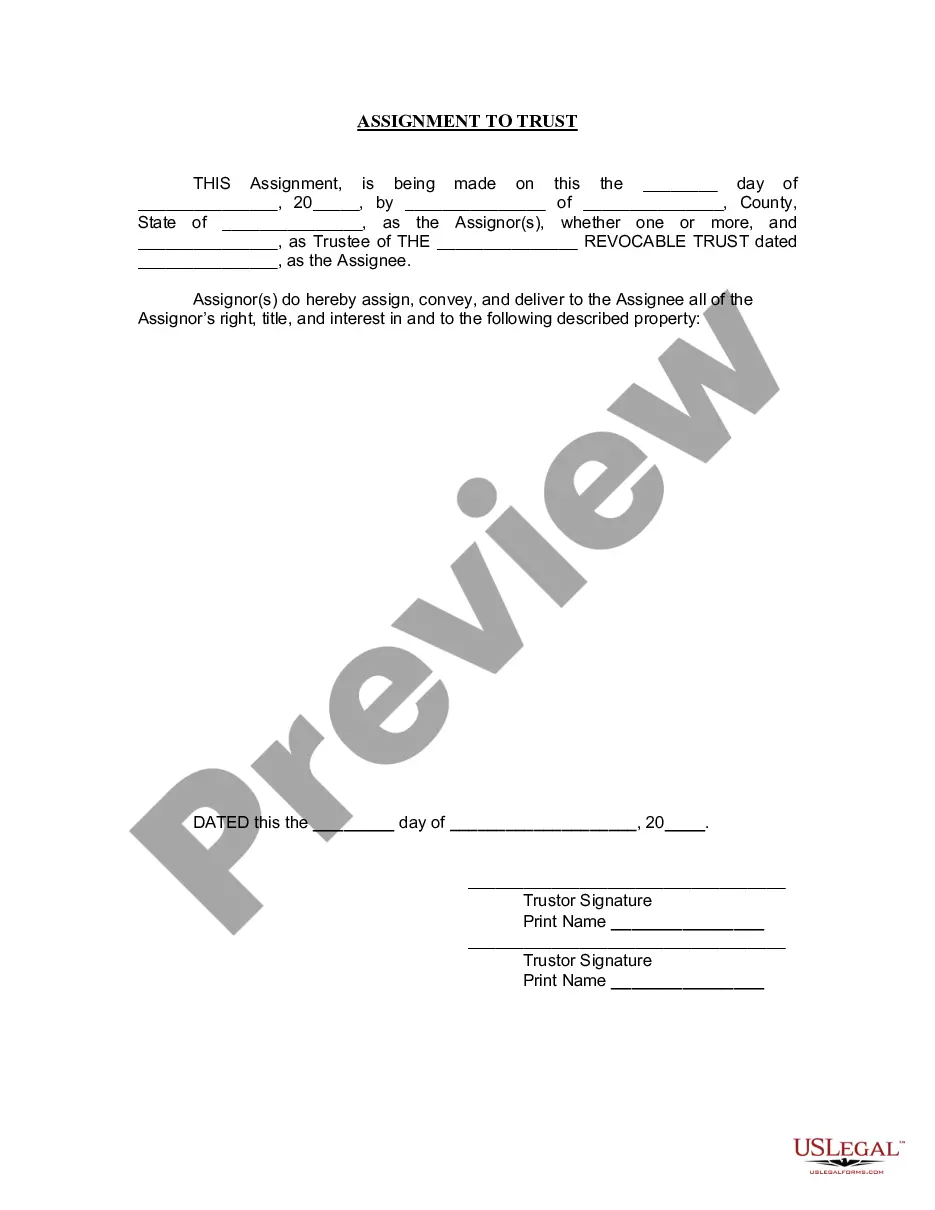

This is a sample mortgage demand letter. It is basically a letter demanding payment of the mortgage in full or all delinquent payments in full.