San Diego California Loan Commitment Form and Variations

Description

How to fill out Loan Commitment Form And Variations?

A document protocol consistently accompanies any legal undertaking you engage in.

Launching a business, seeking or accepting a job offer, transferring ownership, and various other life situations necessitate you to prepare official documentation that differs from one state to another.

That is the reason having everything organized in one location is incredibly beneficial.

US Legal Forms represents the largest online repository of current federal and state-specific legal documents.

- On this site, you can effortlessly find and obtain a document for any individual or business need utilized in your county, including the San Diego Loan Commitment Form and Variants.

- Finding templates on the site is remarkably simple.

- If you currently possess a subscription to our library, Log In to your account, search for the sample using the search bar, and click Download to save it to your device.

- Afterward, the San Diego Loan Commitment Form and Variants will be available for further use in the My documents section of your profile.

- If this is your first experience with US Legal Forms, follow this straightforward guide to acquire the San Diego Loan Commitment Form and Variants.

- Ensure you access the correct page for your localized form.

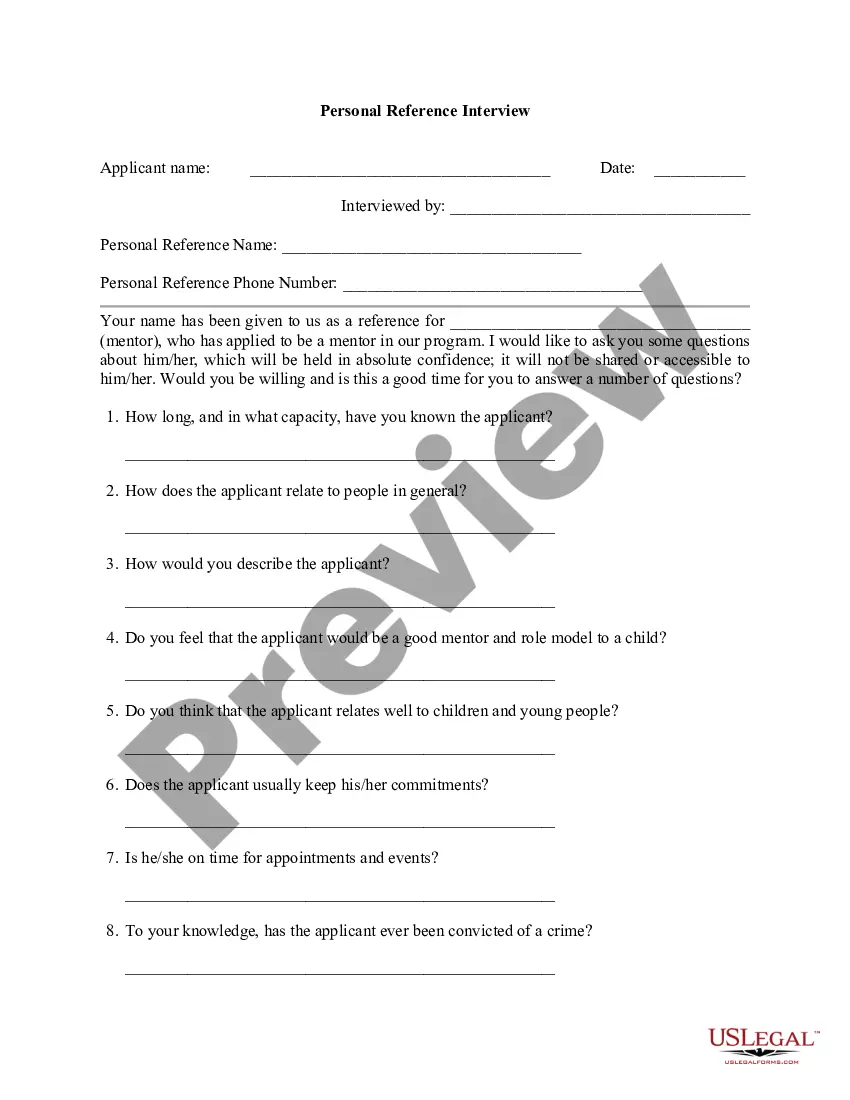

- Utilize the Preview mode (if accessible) and navigate through the sample.

- Examine the description (if present) to verify the template meets your needs.

Form popularity

FAQ

In your mortgage commitment letter, your lender will go over the underwriting conditions you'll need to meet to become clear to close. To determine that you've met these conditions, your lender may typically request: Current bank statements, tax returns, paycheck stubs and other verifications of your income and assets.

The basic contents of a letter of commitment include the following details: Names and addresses of the borrower and lender. The type of loan applied for. The loan amount. The agreed upon loan repayment period. The interest rate for the loan. Date of lock expiration (if the loan is locked in) for the interest rate.

The short answer is that a clear to close doesn't have any strings attached. You've already met all the conditions set by the lender. Getting the clear to close from your lender is the equivalent of getting the final mortgage commitment letter.

A letter of commitment is a formal binding agreement between a lender and a borrower. It outlines the terms and conditions. of the loan and the nature of the prospective loan. It serves as the agreement that initiates an official loan borrowing process.

We can define a commitment letter as a formal and legally binding document that a lender issues to a loan applicant. The commitment letter indicates that a loan applicant has passed the various underwriting guidelines and that their loan agreement or mortgage note has been approved.

Tips for writing letters of commitment Agree upon terms before writing.Keep letters short and succinct.Use correct formatting.Be direct.Write clearly.Only include the terms that both parties have agreed on.Consider the terms for availability.Be fair.

What's the difference between commitment and final approval? Commitment letters are a pledge that a lender will loan money to a borrower assuming all final conditions are met. A final approval, clear to close, means everything is complete; there are no loose ends.

A loan commitment is a formal letter from a lender stating that the applicant has met all of the qualifications for receiving a loan, and that the lender promises a specific amount of money to the borrower.

The average time to close a home is 47 days, from the day an application for a loan is submitted to the final signed documents. However, this number can fluctuate depending on your financial situation, your lender, and the seller who is moving away from the property.