Travis Texas Self-Employed Awning Services Contract

Description

How to fill out Self-Employed Awning Services Contract?

Laws and statutes in various fields vary across the nation.

If you're not an attorney, it's simple to become confused by numerous regulations when it comes to creating legal documents.

To prevent costly legal fees when drafting the Travis Self-Employed Awning Services Agreement, you require a verified template applicable for your region.

That's the simplest and most budget-friendly method to acquire current templates for any legal purposes. Discover them all within clicks and maintain your paperwork organized with US Legal Forms!

- That's when utilizing the US Legal Forms platform becomes highly beneficial.

- US Legal Forms is recognized by millions as a reliable online repository of over 85,000 state-specific legal forms.

- It's an excellent resource for professionals and individuals seeking do-it-yourself templates for various personal and business situations.

- All documents can be reused: once you acquire a template, it remains available in your account for future use.

- Thus, when you have an account with an active subscription, you can simply Log In and re-download the Travis Self-Employed Awning Services Agreement from the My documents tab.

- For new users, a few additional steps are required to obtain the Travis Self-Employed Awning Services Agreement.

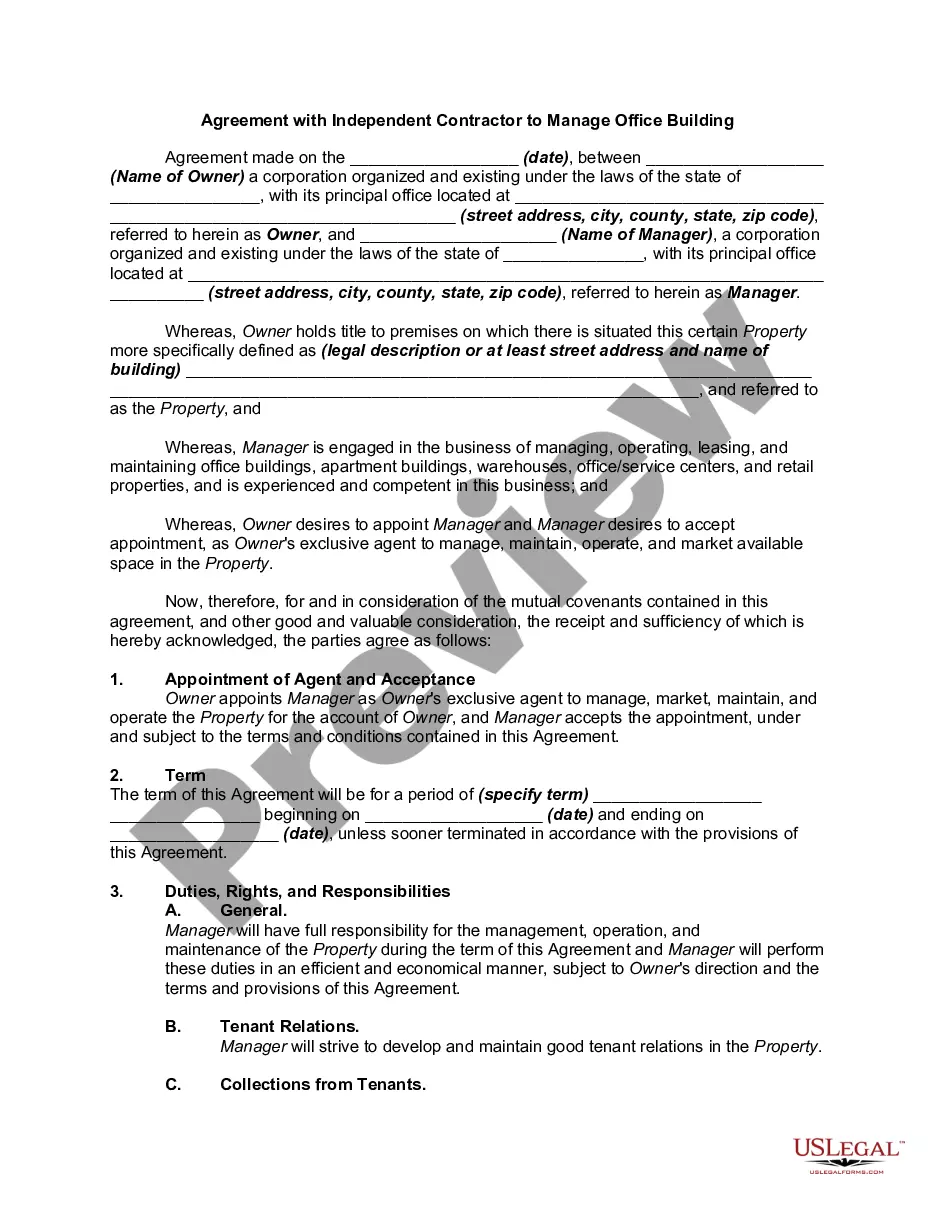

- Review the page contents to confirm you have located the correct template.

- Utilize the Preview feature or read the form description if provided.

Form popularity

FAQ

What percent do independent contractors pay in taxes? The self-employment tax rate is 15.3%, of which 12.4% goes to Social Security and 2.9% goes to Medicare. Income tax obligations vary based on net business profits and losses, among other factors.

A basic rule of thumb that most people suggest would be to determine your hourly rate as a permanent employee, and then add 50-75%. If you were earning $65,000/year, that equates to $31.25/hr. By adding 50%, your rate would be $47/hr, and at 75%, your rate would be $55/hr.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

A simple rule of thumb would be to ask for a minimum of 15.3% more than if you were a W-2 employee. For example, if you would make $70,000 as a W-2 employee then as a 1099 employee ask for a minimum of $80,170 ($70,000 x 1.153).

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

You can create 1099s by using accounting software or using the copy the IRS provides online. Where to Get Form 1099. You can retrieve 1099s from your accounting or tax software.Required Business Information. Enter your name and your company name.Enter Amounts Paid.Payee's Taxpayer Identification Number.Filing 1099 Forms.

To order these instructions and additional forms, go to . Caution: Because paper forms are scanned during processing, you cannot file certain Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS website. Filing and furnishing.

Call the Taxpayer Assistance Center at 1-888-745-3886 to obtain a form. Create your own form with all of the required information. Visit your nearest Employment Tax Office.

As many already know, 1099 contractors must pay both the employee and employer portion of the payroll taxes. In the simplest case, you can simply add/subtract 7.65% (half of the total FICA taxes) as an easy 1099 vs W2 pay difference calculator for hourly rate.

Use the following calculations to determine your rates: Add your chosen salary and overhead costs together.Multiply this total by your profit margin.Divide the total by your annual billable hours to arrive at your hourly rate: $99,000 ÷ 1,920 = $51.56.Finally, multiply your hourly rate by 8 to reach your day rate.