Austin Texas Pool Services Agreement - Self-Employed

Description

Form popularity

FAQ

The 3 C's of pool cleaning are circulation, chemistry, and cleaning. Proper circulation ensures that pool water moves effectively, chemistry maintains balanced water conditions, and cleaning removes debris and contaminants. Understanding these elements is crucial for providing excellent service under your Austin Texas Pool Services Agreement - Self-Employed. By mastering the 3 C's, you enhance customer satisfaction and ensure pool safety.

Yes, you should add tax to your invoices for taxable services, including pool cleaning and maintenance. When creating invoices, ensure that the tax is clearly itemized to avoid confusion. Your Austin Texas Pool Services Agreement - Self-Employed can also highlight your billing practices, making the payment process smoother for both you and your clients. Keeping accurate records will help you manage your taxes effectively.

Yes, water treatment services are considered taxable in Texas. This includes services related to pool water maintenance and chemical treatments. When drafting your Austin Texas Pool Services Agreement - Self-Employed, ensure you specify the services offered and their tax implications. This clarity can help you maintain compliance and build trust with clients.

Yes, pool services in Texas are generally considered taxable. However, certain services may qualify for exemptions. It's important to understand the specific regulations that apply to your Austin Texas Pool Services Agreement - Self-Employed. Consulting with a tax professional can provide clarity on your obligations.

To start a pool cleaning service, you need the right tools, equipment, and a solid business plan. Essential items include a skimmer, vacuum, chemicals, and safety gear. Additionally, having an Austin Texas Pool Services Agreement - Self-Employed will help you outline your services and protect your business interests. Consider using platforms like uslegalforms to create this essential agreement.

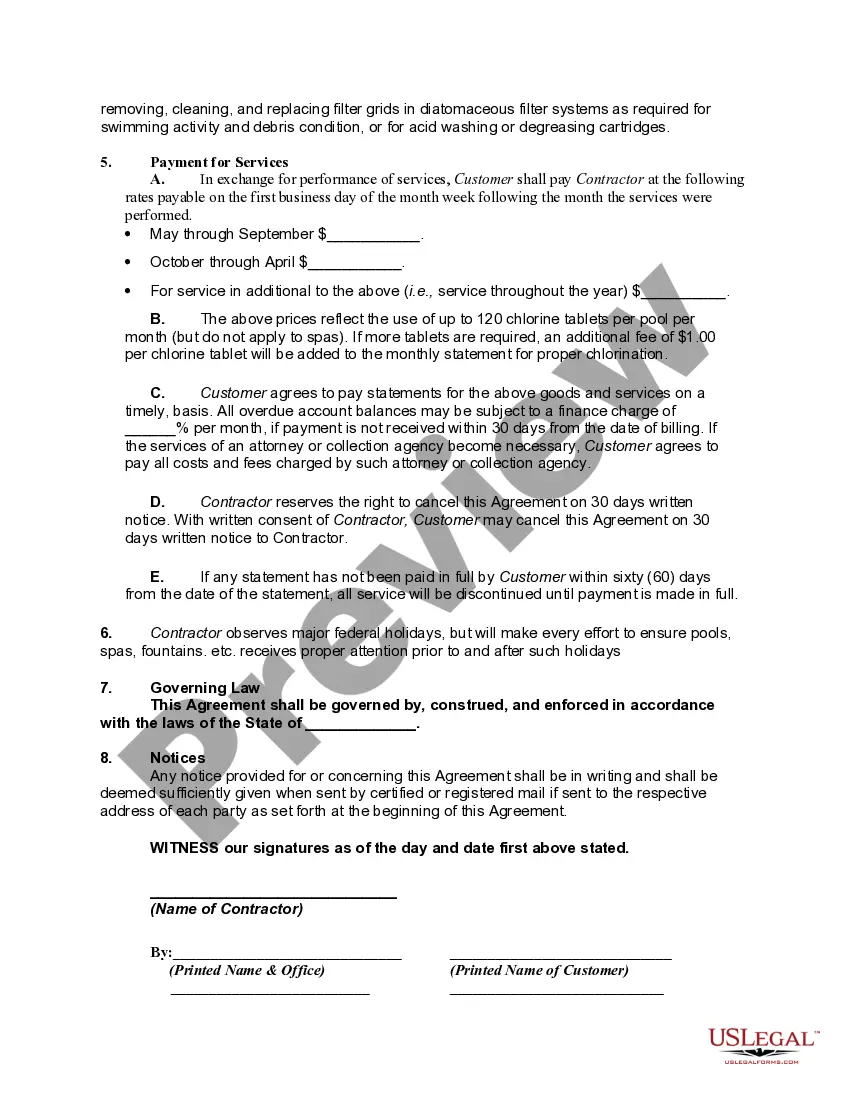

Writing an independent contractor agreement involves outlining the terms of the working relationship clearly. Start by defining the scope of work, payment terms, and duration of the contract. It’s also important to include clauses regarding confidentiality and termination. For a well-structured Austin Texas Pool Services Agreement - Self-Employed, you can access templates and legal resources on the US Legal Forms platform, making the process much easier.

In Texas, most services provided for pool cleaning, maintenance, and repair are generally considered taxable. As a self-employed individual offering these services, you should be aware of the Texas sales tax regulations. It's essential to include this aspect in your Austin Texas Pool Services Agreement - Self-Employed to ensure compliance. For further guidance, you might consider consulting with a tax professional or using resources available on the US Legal Forms platform.