Nassau New York Storage Services Contract - Self-Employed

Description

How to fill out Storage Services Contract - Self-Employed?

A document procedure consistently accompanies any legal activity you undertake.

Establishing a business, applying for or accepting a job offer, transferring ownership, and many other life situations necessitate formal documentation that differs across the country.

That’s why having everything consolidated in one location is incredibly beneficial.

US Legal Forms boasts the largest online compilation of current federal and state-specific legal documents.

This is the simplest and most reliable way to obtain legal documentation. All samples offered by our library are professionally crafted and validated for compliance with local laws and regulations. Prepare your documentation and manage your legal affairs effectively with US Legal Forms!

- Here, you can conveniently locate and download a document for any personal or business purpose utilized in your area, such as the Nassau Storage Services Contract - Self-Employed.

- Finding forms on the platform is exceptionally straightforward.

- If you already possess a subscription to our service, Log In to your account, locate the sample using the search bar, and click Download to save it on your device.

- Subsequently, the Nassau Storage Services Contract - Self-Employed will be available for future use in the My documents section of your profile.

- If you are using US Legal Forms for the first time, adhere to this straightforward guideline to obtain the Nassau Storage Services Contract - Self-Employed.

- Make sure you have accessed the correct page with your regional form.

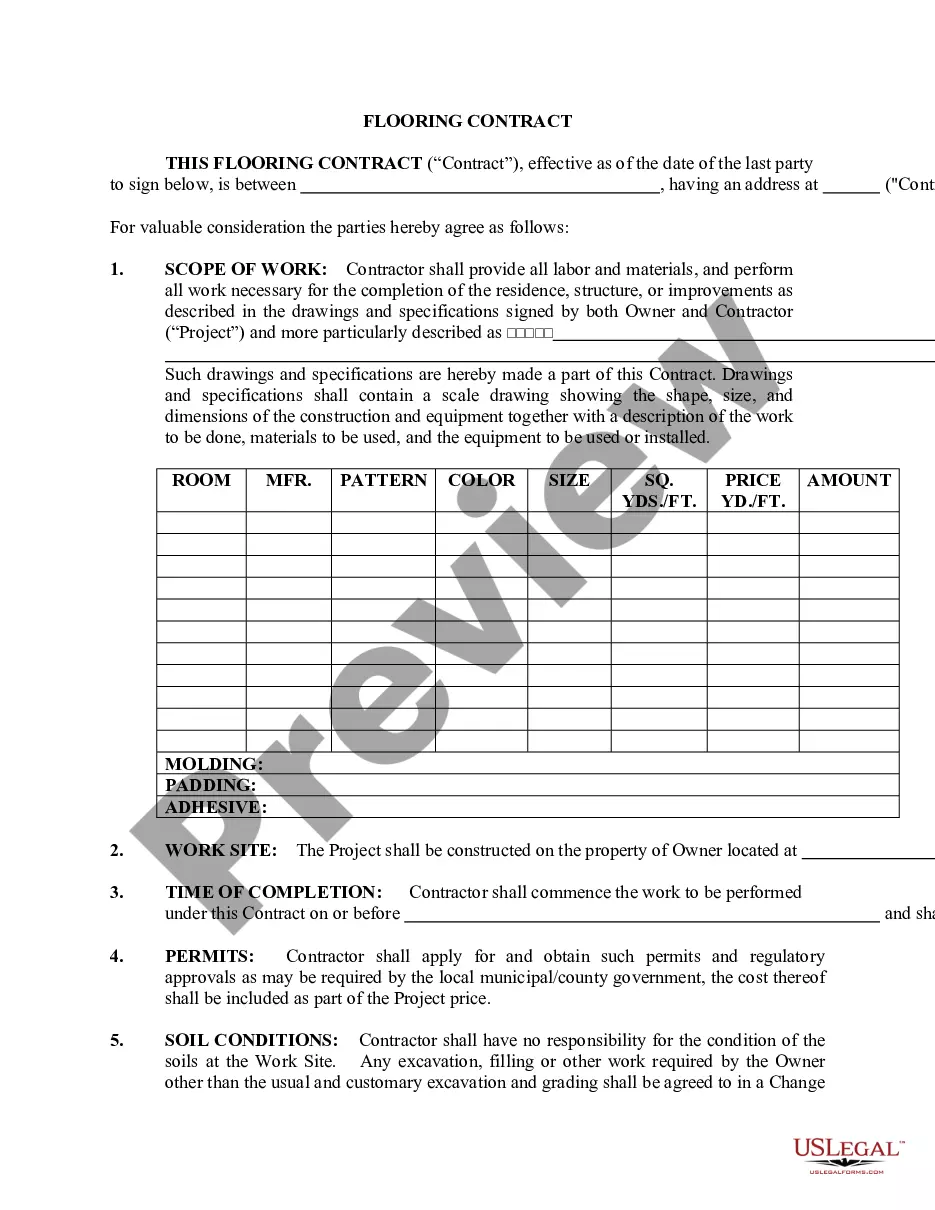

- Employ the Preview mode (if available) and peruse the template.

- Examine the description (if any) to ensure the form meets your requirements.

- Look for an alternative document via the search feature if the sample does not suit you.

- Click Buy Now once you locate the desired template.

- Select the appropriate subscription plan, then Log In or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Select file format and download the Nassau Storage Services Contract - Self-Employed onto your device.

- Utilize it as required: print it or fill it in electronically, sign it, and submit where necessary.

Form popularity

FAQ

To officially add self-employed status, you must register with the appropriate local authorities and obtain necessary licenses. You should also consider creating a business plan that outlines your objectives and structure. The Nassau New York Storage Services Contract - Self-Employed can facilitate this process by providing guidance on compliance.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

Assuming you are already registered with SARS personally, then by default your sole proprietorship will also be registered. If you are not yet registered with SARS, you can register at a physical SARS branch, or online through the SARS eFiling service.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

What percent do independent contractors pay in taxes? The self-employment tax rate is 15.3%, of which 12.4% goes to Social Security and 2.9% goes to Medicare. Income tax obligations vary based on net business profits and losses, among other factors.

Nevertheless, independent contractors are usually responsible for paying the Self-Employment Tax and income tax. With that in mind, it's best practice to save about 2530% of your self-employed income to pay for taxes.

Contractors can also be self-employed, but they perform tasks on a contractual basis, rather than selling any products or rolling, bookable services. For example, a plumber would work for a client according to an agreed, one-off contract.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.