Bexar Texas Storage Services Contract - Self-Employed

Description

How to fill out Storage Services Contract - Self-Employed?

Whether you intend to launch your business, enter a contract, apply for your ID renewal, or address family-related legal matters, you need to organize specific documentation in accordance with your local laws and regulations.

Locating the appropriate documents may demand considerable time and effort unless you utilize the US Legal Forms library.

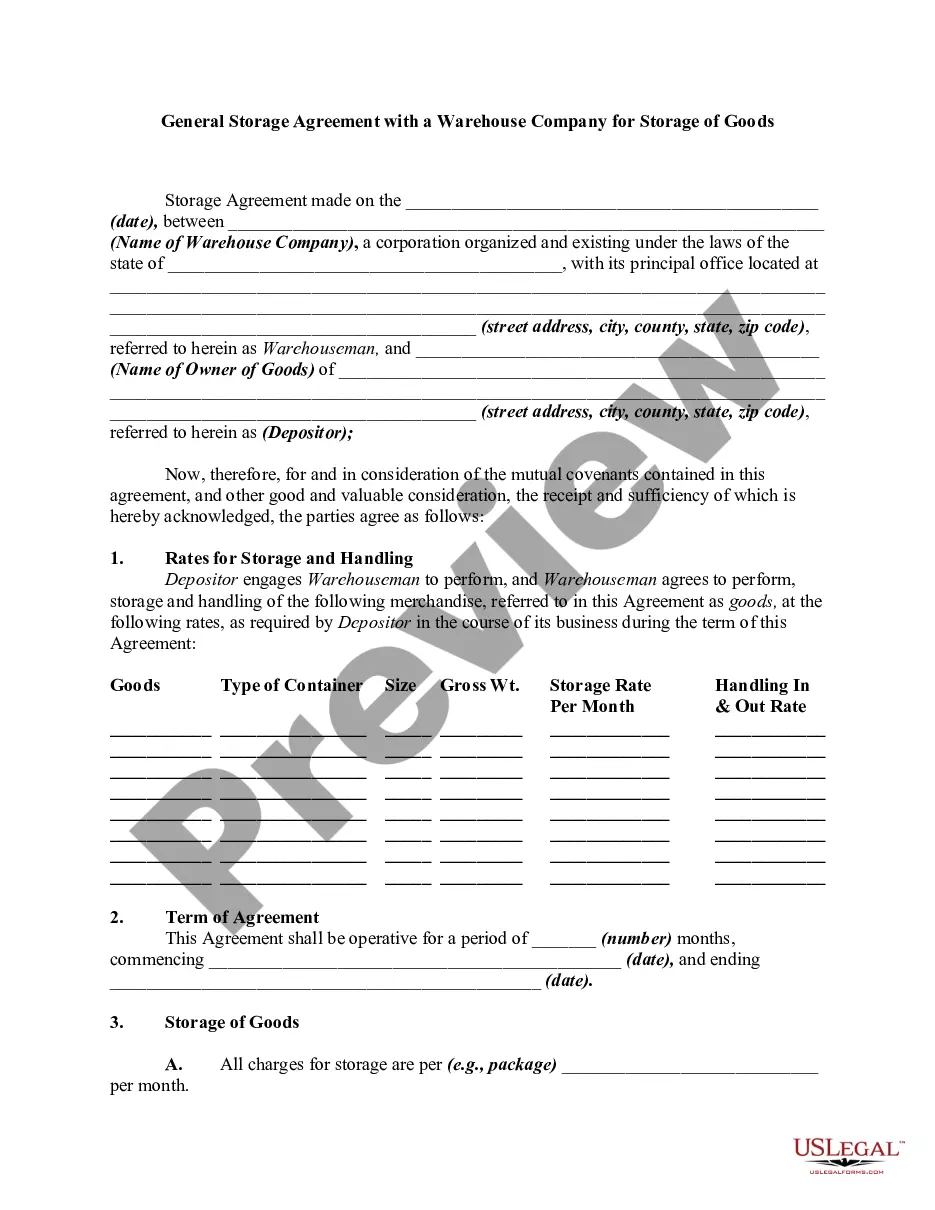

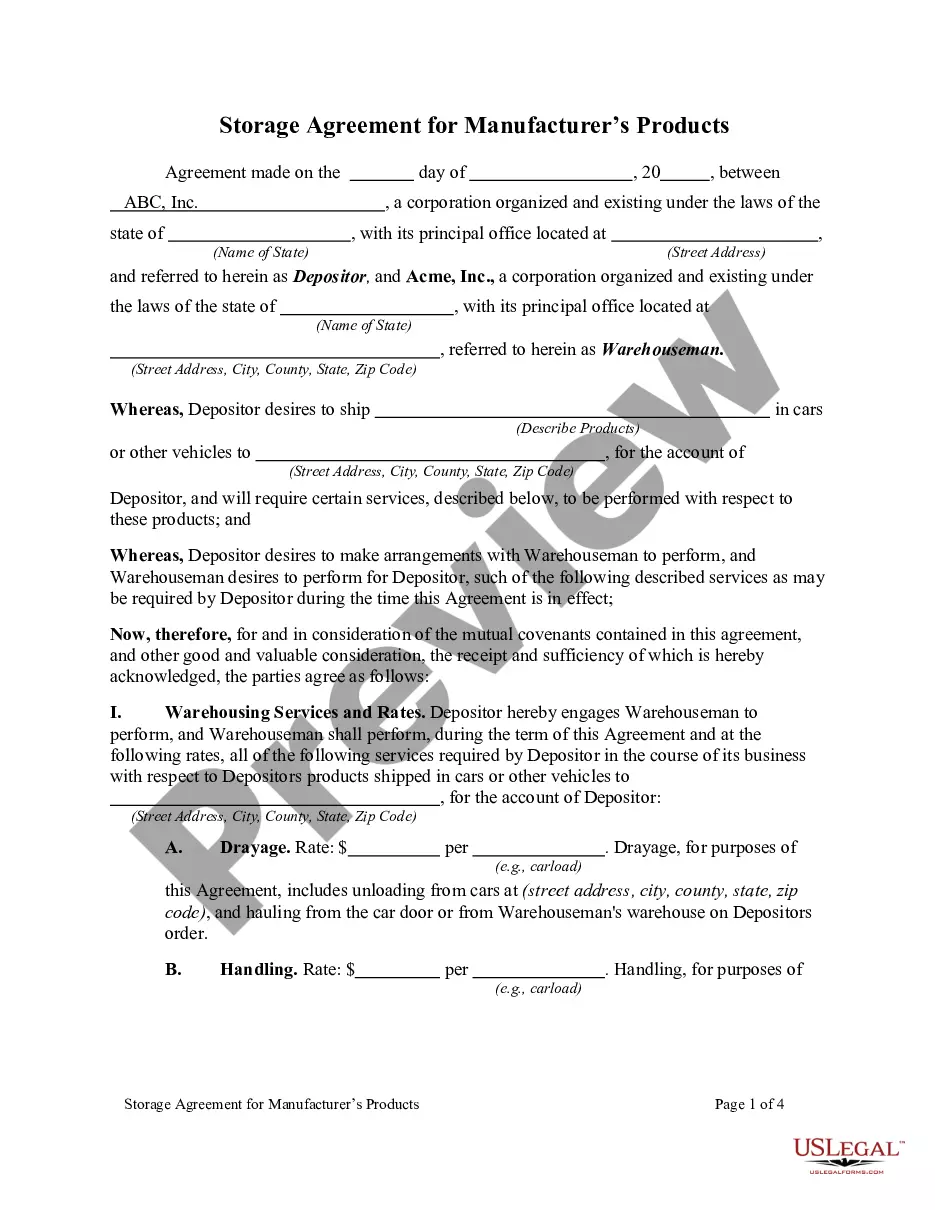

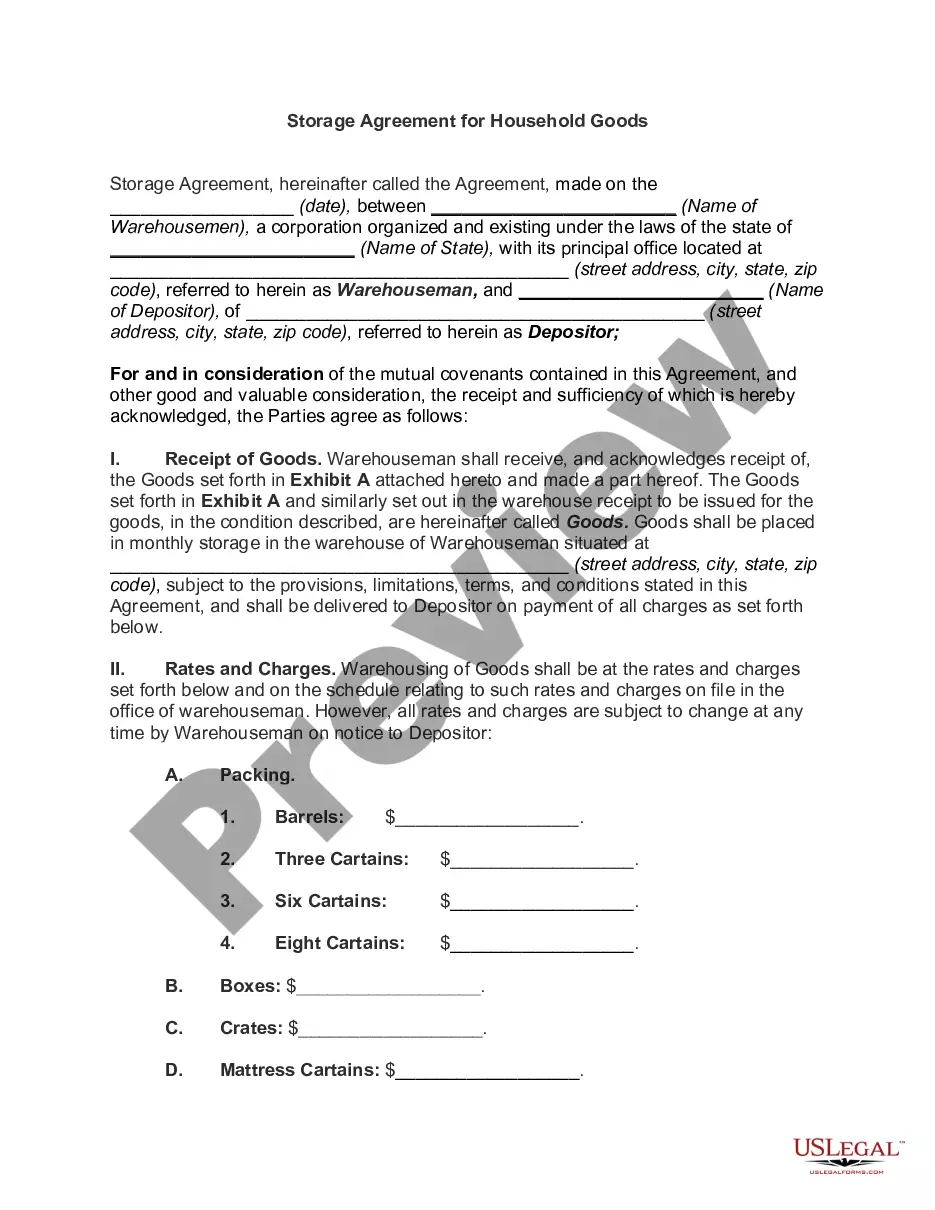

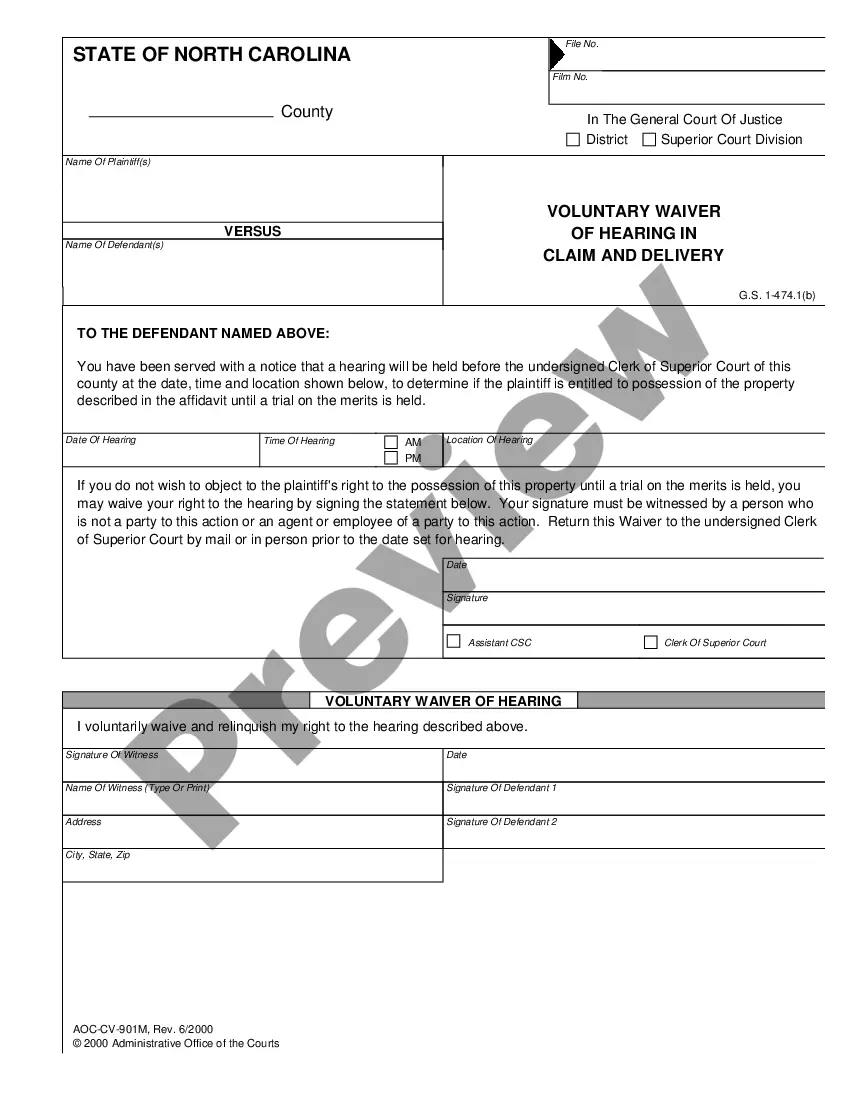

The service offers users over 85,000 expertly crafted and verified legal documents for any personal or business purpose. All forms are categorized by state and area of application, making it quick and easy to choose a copy like the Bexar Storage Services Contract - Self-Employed.

Documents offered by our website are reusable. With an active subscription, you can access all your previously obtained paperwork at any time in the My documents section of your profile. Stop wasting time on a never-ending hunt for current official documents. Join the US Legal Forms platform and maintain your paperwork organized with the most comprehensive online form library!

- Ensure the template meets your individual requirements and state legal conditions.

- Review the form description and check the Preview if available on the page.

- Utilize the search bar above to find another template specific to your state.

- Select Buy Now to acquire the document once you identify the suitable one.

- Choose the subscription plan that best fits your needs to move forward.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Bexar Storage Services Contract - Self-Employed in your preferred file format.

- Print the document or fill it out and sign it electronically via an online editor to save time.

Form popularity

FAQ

Yes, storage rental income can be subject to self-employment tax if you manage the rental activity actively. As a self-employed individual, you must report this income accurately for tax purposes. It is beneficial to review your Bexar Texas Storage Services Contracts to ensure compliance.

To become self-employed in Texas, decide what services or products you want to offer and create a business plan. Register your business name and select a structure that suits your needs, possibly an LLC for added protection. USLegalForms can offer guidance and essential documents, including the Bexar Texas Storage Services Contract - Self-Employed, making the process smoother as you embark on your self-employment journey.

Yes, if your Texas LLC sells taxable goods or services, you are required to obtain a sales tax permit. This permit allows your business to collect sales tax from customers and remit it to the state. Platforms like USLegalForms can assist you with the process, ensuring your business complies with state laws while you focus on using contracts such as the Bexar Texas Storage Services Contract - Self-Employed.

Starting a self-employed business in Texas begins with a solid business plan outlining your goals and strategies. Next, you should choose a business structure, which can be easily created through USLegalForms. They provide resources and templates, like the Bexar Texas Storage Services Contract - Self-Employed, to help you get your business off the ground with legal protection.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

employed person does not work for a specific employer who pays them a consistent salary or wage. Selfemployed individuals, or independent contractors, earn income by contracting with a trade or business directly.

To be self-employed means one conducts business on their own, as a partner or owner, rather than working for employers. According to the instruction of IRS (on page 2), the person who will ?carry on a trade or business as a sole proprietor or an independent contractor? is a self-employed person.

Someone is probably self-employed if they're self-employed for tax purposes and most of the following are true: they put in bids or give quotes to get work. they're not under direct supervision when working. they submit invoices for the work they've done. they're responsible for paying their own National Insurance and tax.

You can be employed and self-employed at the same time. This would usually be the case if you were doing two jobs. For example, if you work for yourself as a hairdresser during the day but in the evenings you work as a receptionist in a hotel, you will be both self-employed and employed.