Harris Texas Gutter Services Contract - Self-Employed

Description

How to fill out Gutter Services Contract - Self-Employed?

Handling legal documents is essential in the modern era.

However, you don't always have to seek expert assistance to draft some of them from the ground up, including the Harris Gutter Services Contract - Self-Employed, using a service like US Legal Forms.

US Legal Forms boasts over 85,000 templates available across a variety of categories, from living wills to real estate forms to divorce papers.

Choose the appropriate option along with a convenient payment method, and purchase the Harris Gutter Services Contract - Self-Employed.

Decide to save the form template in any available format.

- All papers are organized according to their applicable state, simplifying the search process.

- You can also discover comprehensive materials and guides on the website to facilitate any tasks related to document processing.

- Here’s how you can locate and obtain the Harris Gutter Services Contract - Self-Employed.

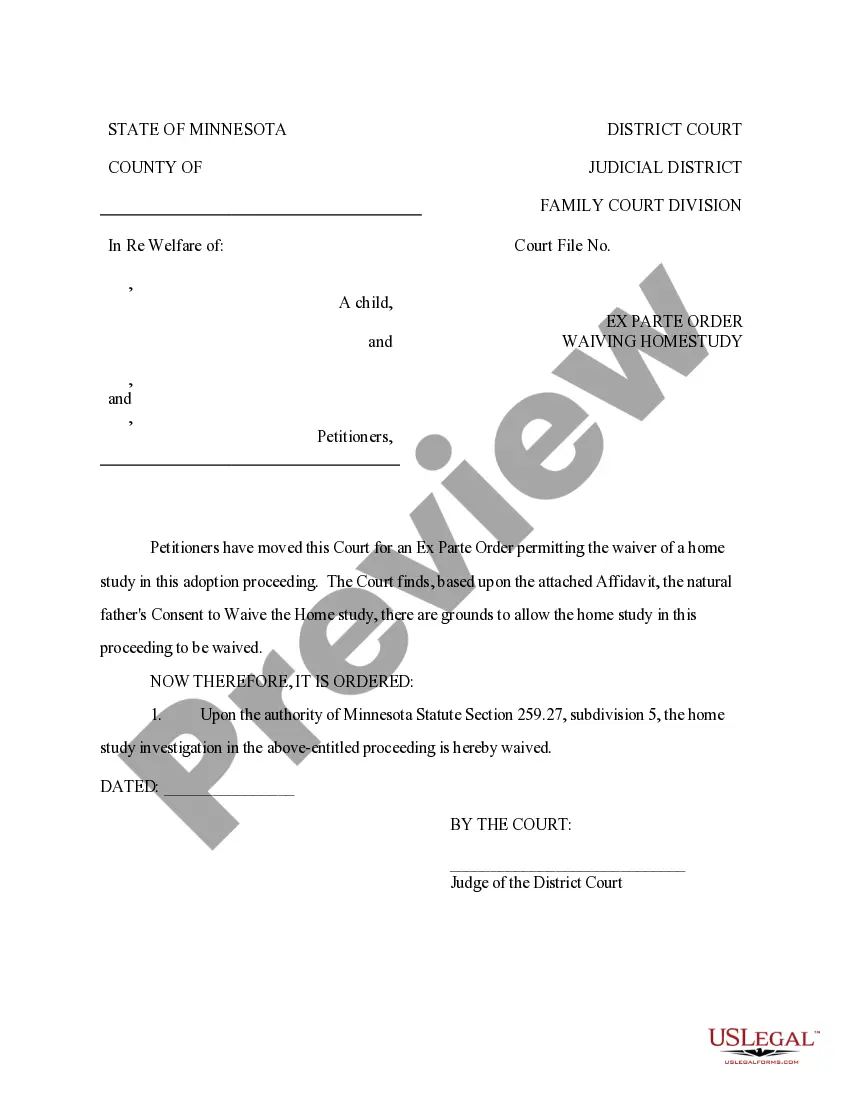

- Review the document’s preview and outline (if available) to obtain basic details about what you will receive after downloading the form.

- Make sure that the template you select complies with your state/county/area as state laws can affect the validity of certain documents.

- Examine similar forms or restart your search to find the accurate file.

- Click Buy now and set up your account. If you already have an account, opt to Log In.

Form popularity

FAQ

An attorney or accountant who has his or her own office, advertises in the yellow pages of the phone book under Attorneys or Accountants, bills clients by the hour, is engaged by the job or paid an annual retainer, and can hire a substitute to do the work is an example of an independent contractor.

A contractor must accrue and remit use tax on the sales price of equipment purchased, leased, or rented for use in Texas from an out-of-state seller unless the out-of-state seller collected Texas use tax.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your Services Protect your social security number. Have a clearly defined scope of work and contract in place with clients. Get general/professional liability insurance. Consider incorporating or creating a limited liability company (LLC).

Known as poaching, having contractors contact your own clients is a risk every business takes when bringing on contractors. Poaching can happen either while the worker is on contract with you or afterward. Either way, though, you can lose the ability to do business with that client.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Therefore, an independent contractor must keep track of their business expense information and receipts in a dedicated folder on their electronic devices for their perusal. A few small business owners also suggest maintaining a physical folder to file and record paper receipts for calculating employment tax.

This agreement should clearly state what tasks the contractor is to perform. The agreement will also include what tasks will be performed and how much the contractor will be paid for his or her work. A contractor agreement can also help demonstrate that the person is truly an independent contractor and not an employee.

Elements of a Construction Contract Name of contractor and contact information.Name of homeowner and contact information.Describe property in legal terms.List attachments to the contract.The cost.Failure of homeowner to obtain financing.Description of the work and the completion date.Right to stop the project.

To ensure you're protected from start to finish, always follow these protocols before you hire. Get Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.

Written agreements can avoid disputes and protect IP ownership rights. Engagement of an independent contractor or freelance worker that will include creation of intellectual property should include a contract drafted by an attorney whose practice focuses on IP, copyrights and contract law.