Middlesex Massachusetts Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Educator Agreement - Self-Employed Independent Contractor?

A document procedure consistently accompanies any legal undertaking you initiate.

Launching a business, submitting or accepting a job proposal, transferring property, and numerous other life circumstances necessitate that you prepare formal documentation that varies across the nation. This is why having everything consolidated in one location is extremely advantageous.

US Legal Forms is the most comprehensive online repository of current federal and state-specific legal documents.

On this site, you can effortlessly find and download a document for any personal or commercial purpose used in your locale, including the Middlesex Educator Agreement - Self-Employed Independent Contractor.

Click Buy Now once you find the required template.

- Finding templates on the site is incredibly straightforward.

- If you already possess a subscription to our service, Log In to your account, locate the example using the search bar, and click Download to save it to your device.

- Subsequently, the Middlesex Educator Agreement - Self-Employed Independent Contractor will be accessible for future use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, adhere to this straightforward guide to acquire the Middlesex Educator Agreement - Self-Employed Independent Contractor.

- Ensure you have navigated to the correct page containing your local form.

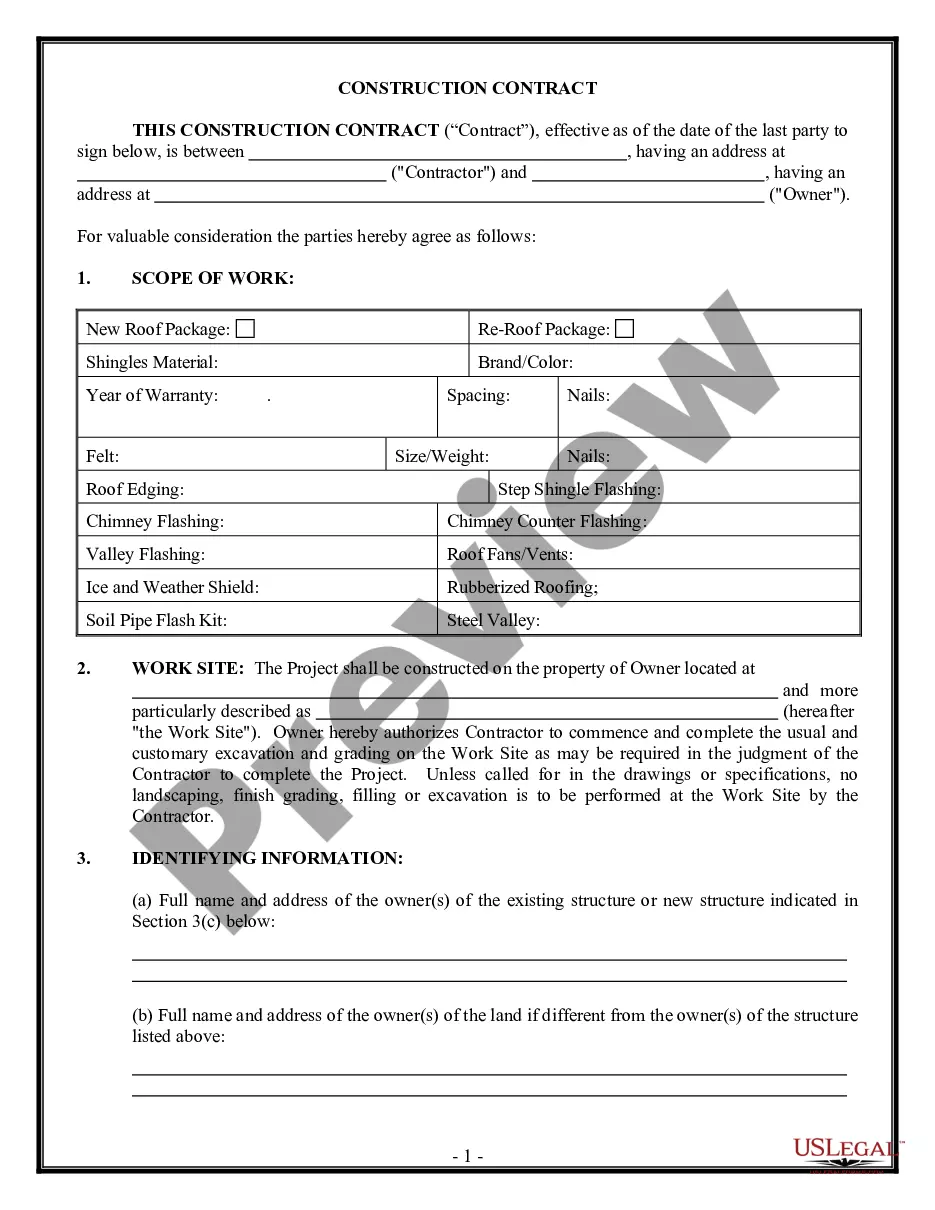

- Utilize the Preview mode (if applicable) and peruse through the example.

- Examine the description (if present) to confirm that the template meets your needs.

- Search for an alternative document using the search tab if the example does not suit you.

Form popularity

FAQ

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Minimum rates of pay 2022 rights under working time and whistleblowing legislation 2022 protection from discrimination. Self-employed individuals generally only have contractual rights, but they may also be protected: from discrimination 2022 under data protection legislation as 'data subjects'.

A worker, personal trainer, or fitness instructor can be classified as an independent contractor if: (a) the worker is free from control and direction in the performance of services; and. (b) the worker is performing work outside the usual course of the business of the hiring company; and.

What information do I need for an Independent Contractor Agreement? What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

How to become an independent contractor understand your tax obligations. visit Self-Employed Australia for information about super, insurance and workers compensation. register a business name (this is optional if you're trading under your personal name)

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.

Most clubs currently classify their coaches as independent contractors and do not pay employment taxes on payments to coaches.

Because nearly all online English teachers are classified as Independent Contractors and therefor get no taxes taken out of our paychecks as employees would, we're in charge of making payments to the IRS ourselves, usually quarterly.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

It's rare that you will find a Pilates Studio which hires instructors as employees. For the most part, you will be working as a Pilates Instructor as an Independent Contractor. There are pros and cons to working as either an employee or an independent contractor.