Wayne Michigan Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

How long does it usually take you to create a legal document.

Considering that each state maintains its own laws and regulations for various life scenarios, locating a Wayne Door Contractor Agreement - Self-Employed that meets all local criteria can be tiring, and obtaining it from a qualified lawyer often incurs high costs.

Several online platforms provide frequent state-specific documents for download, but utilizing the US Legal Forms repository is the most advantageous.

Select the subscription plan that best fits your needs. Register for an account on the platform or Log In to proceed to payment methods. Pay via PayPal or with your credit card. Alter the file format if required. Press Download to save the Wayne Door Contractor Agreement - Self-Employed. Print the document or utilize any preferred online editor to finalize it electronically. Regardless of how many times you need to access the purchased document, you can locate all the files you’ve previously saved in your profile by selecting the My documents tab. Give it a try!

- US Legal Forms is the most extensive online compilation of templates, organized by states and fields of use.

- In addition to the Wayne Door Contractor Agreement - Self-Employed, you can discover any particular form necessary to operate your business or personal matters, adhering to your local regulations.

- Experts verify all samples for their relevance, so you can rest assured you're preparing your documentation accurately.

- Accessing the service is quite simple.

- If you already possess an account on the site and your subscription is active, you just need to Log In, choose the needed form, and download it.

- You can retrieve the file from your profile at any later time.

- If you are a newcomer to the platform, a few additional steps are needed before obtaining your Wayne Door Contractor Agreement - Self-Employed.

- Review the details on the page you're currently viewing.

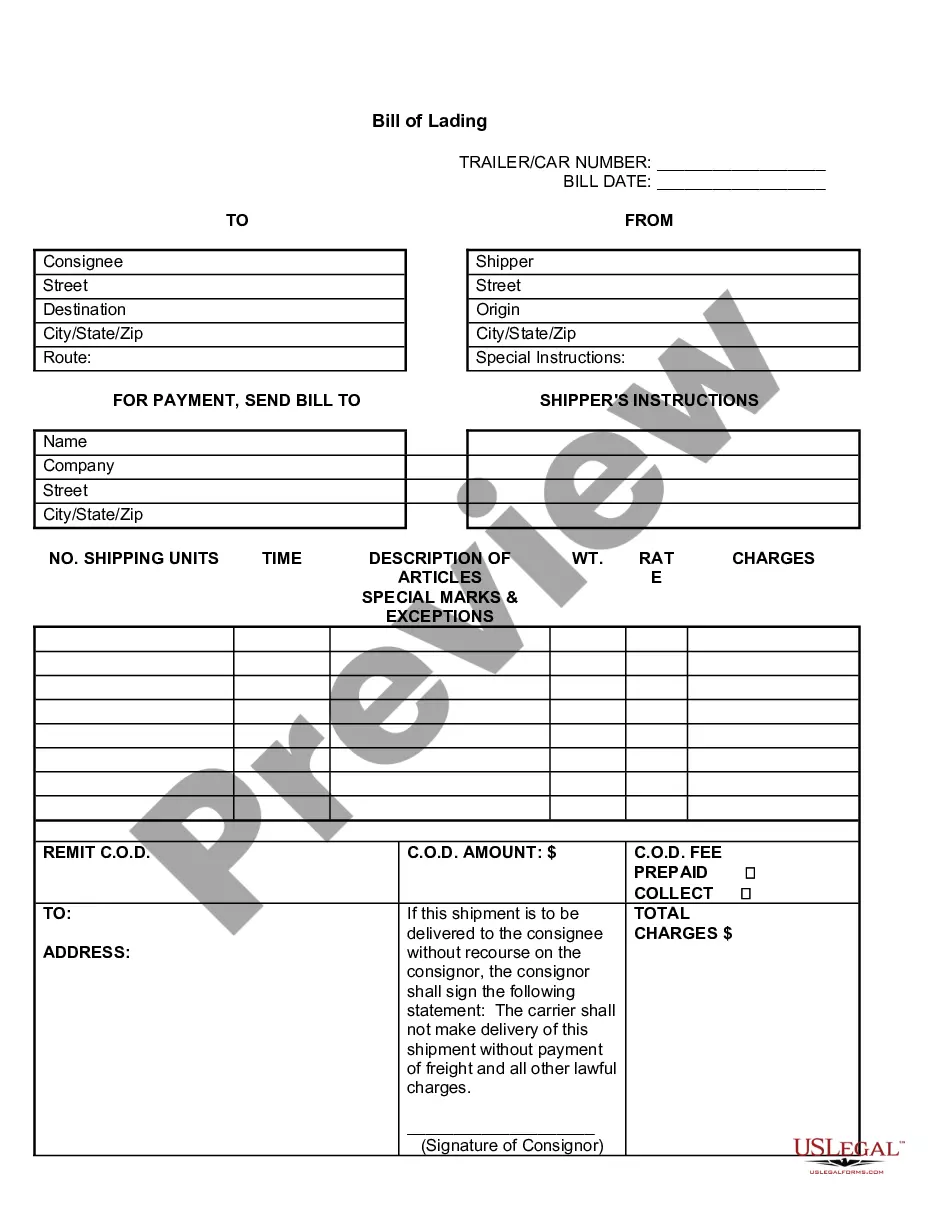

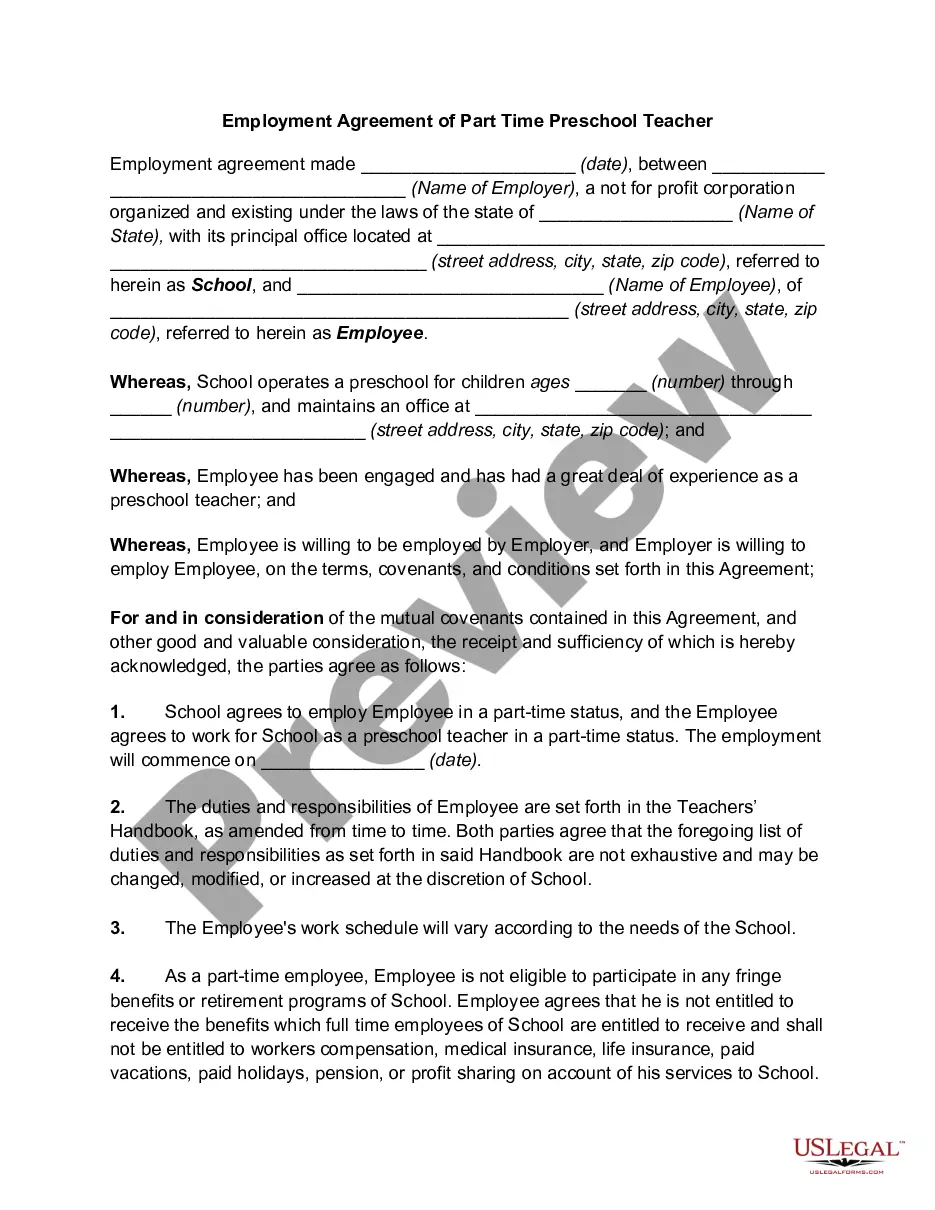

- Examine the description of the sample or Preview it (if accessible).

- Seek another form using the related option in the header.

- Press Buy Now when you are confident in your selected file.

Form popularity

FAQ

You become a self-employed contractor when you provide services independently without the control of an employer. Self-employed individuals set their schedules, manage their finances, and often maintain multiple contracts. By using a Wayne Michigan Door Contractor Agreement - Self-Employed, you formalize your independent status while protecting your interests.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

What to Include in a Contract The date the contract begins and when it expires. The names of all parties involved in the transaction. Any key terms and definitions. The products and services included in the transaction. Any payment amounts, project schedules, terms, and billing dates.

employed person refers to any person who earns their living from any independent pursuit of economic activity, as opposed to earning a living working for a company or another individual (an employer).

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The 5 personality traits that make a successful contractor Confidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.