Oakland Michigan Guaranty of Payment of Open Account

Description

How to fill out Guaranty Of Payment Of Open Account?

How long does it generally take for you to create a legal document.

Considering that every state has its own laws and regulations for every life situation, locating an Oakland Guarantee of Payment of Open Account that satisfies all local requirements can be exhausting, and obtaining it from a qualified attorney can often be costly.

Numerous online platforms provide the most frequently used state-specific documents for download, but utilizing the US Legal Forms collection is the most advantageous.

Choose the subscription plan that best fits your needs.

- US Legal Forms is the most comprehensive online directory of templates, categorized by states and areas of application.

- In addition to the Oakland Guarantee of Payment of Open Account, you can find any particular document necessary for your business or personal transactions, adhering to your local requirements.

- Experts verify all samples for their accuracy, ensuring you can prepare your documentation correctly.

- Using the service is quite simple.

- If you already have an account on the site and your subscription is active, you just need to Log In, pick the required form, and download it.

- You can access the document in your profile any time later.

- If you are new to the website, there will be additional steps to finish before you acquire your Oakland Guarantee of Payment of Open Account.

- Review the content of the page you’re currently on.

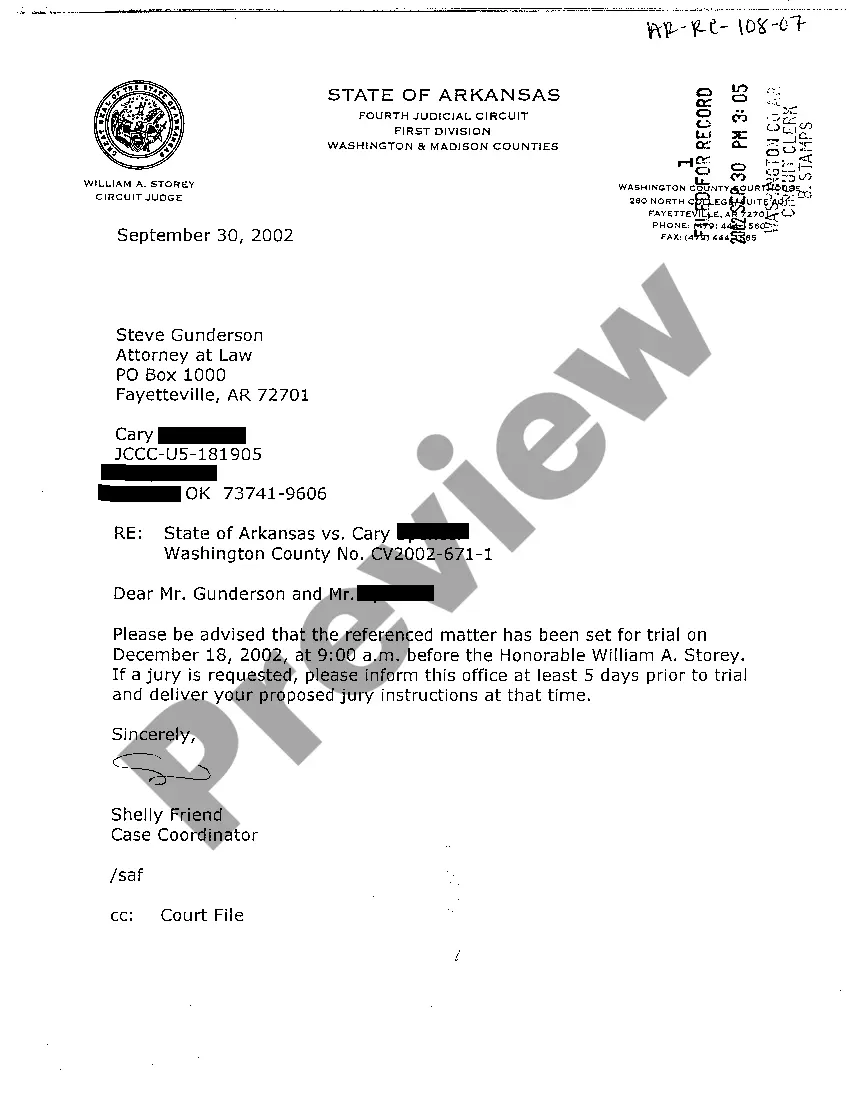

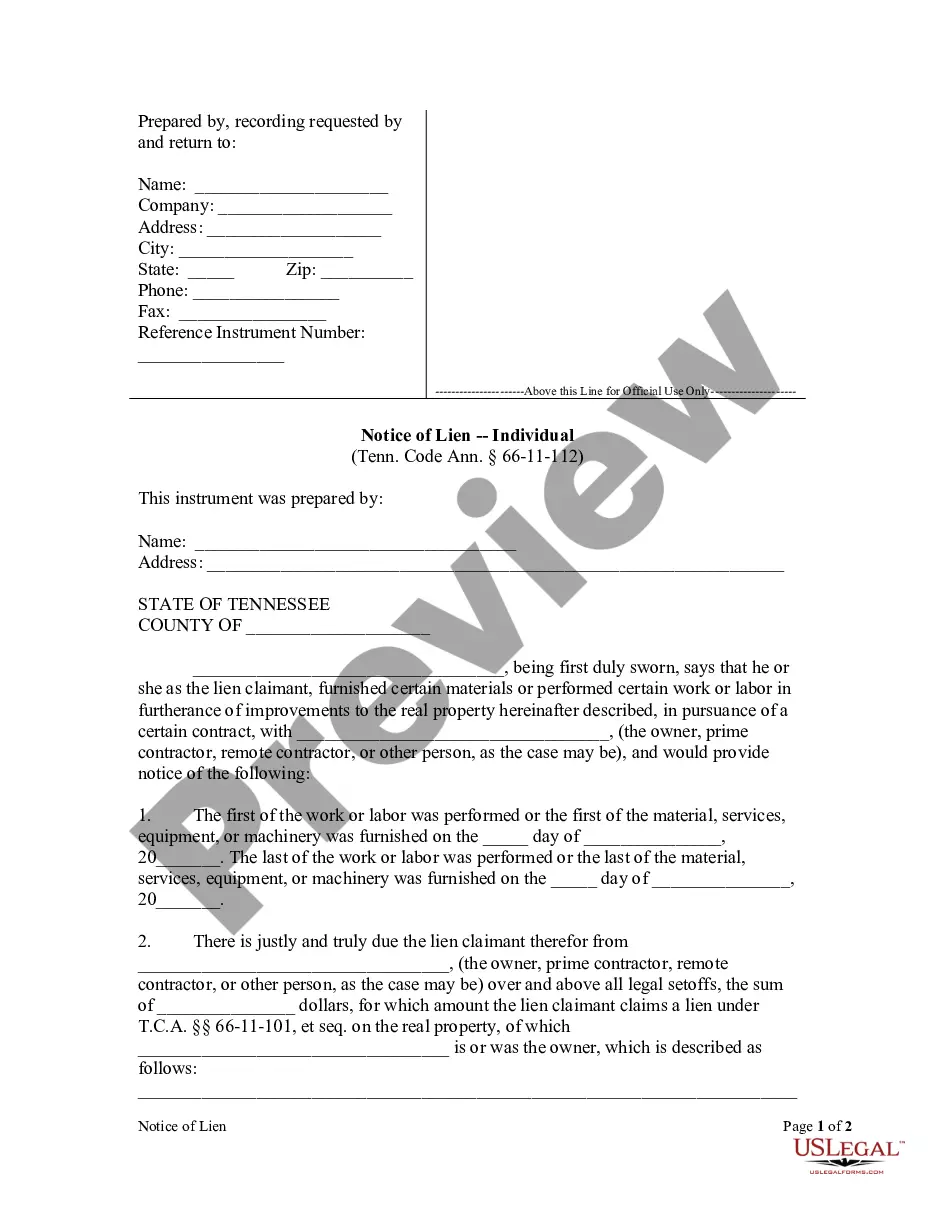

- Examine the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Press Buy Now once you are certain about your chosen document.

Form popularity

FAQ

Yes, you can e-file for divorce in Michigan through the Michigan Supreme Court's electronic filing system. This option simplifies the process and allows you to file documents from the comfort of your home. When dealing with complex issues such as the Oakland Michigan Guaranty of Payment of Open Account, online filing can save you time and effort. USLegalForms provides resources to ensure that your e-filing experience is smooth and efficient.

You can file a Personal Protection Order in Michigan at your local circuit court. It is essential to visit the court where you reside or where the incident occurred. For individuals facing issues surrounding the Oakland Michigan Guaranty of Payment of Open Account, understanding the right court jurisdiction is crucial for successful legal proceedings. USLegalForms offers resources to guide you through this process.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A limited guaranty is a written undertaking to fulfill a specific obligation. Ordinarily, a limited guaranty is restricted in its application to a single transaction. A limited guarantee is limited to the amount, time, or type of loss.

Purpose of Guaranty The guarantor agrees to pay the obligations of the borrower under the loan agreement in the event that the borrower does not pay. In addition to being an alternate source of repayment, guaranties provide evidence that the guarantor intends to stand behind the borrower.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

A loan guaranty is a legal document that is essentially an insurance policy that protects the lender in case the borrower defaults on their loan. The company will insure your company's debt to protect you from loss if they are unable to repay your loans, but it will come at a cost.

Guaranty Documents means those certain documents, if any, entered into between the Guarantor and any Lender to evidence the guaranty for the repayment of any Loan which may be requested by the Lender to be provided by the Guarantor.

It's easy Zelle® is already available within Guaranty Bank & Trust's mobile banking app and online banking! Check our app or sign in online and follow a few simple steps to enroll with Zelle® today.

A guaranteed loan is a loan that a third party guaranteesor assumes the debt obligation forin the event that the borrower defaults. Sometimes, a guaranteed loan is guaranteed by a government agency, which will purchase the debt from the lending financial institution and take on responsibility for the loan.