Queens New York Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

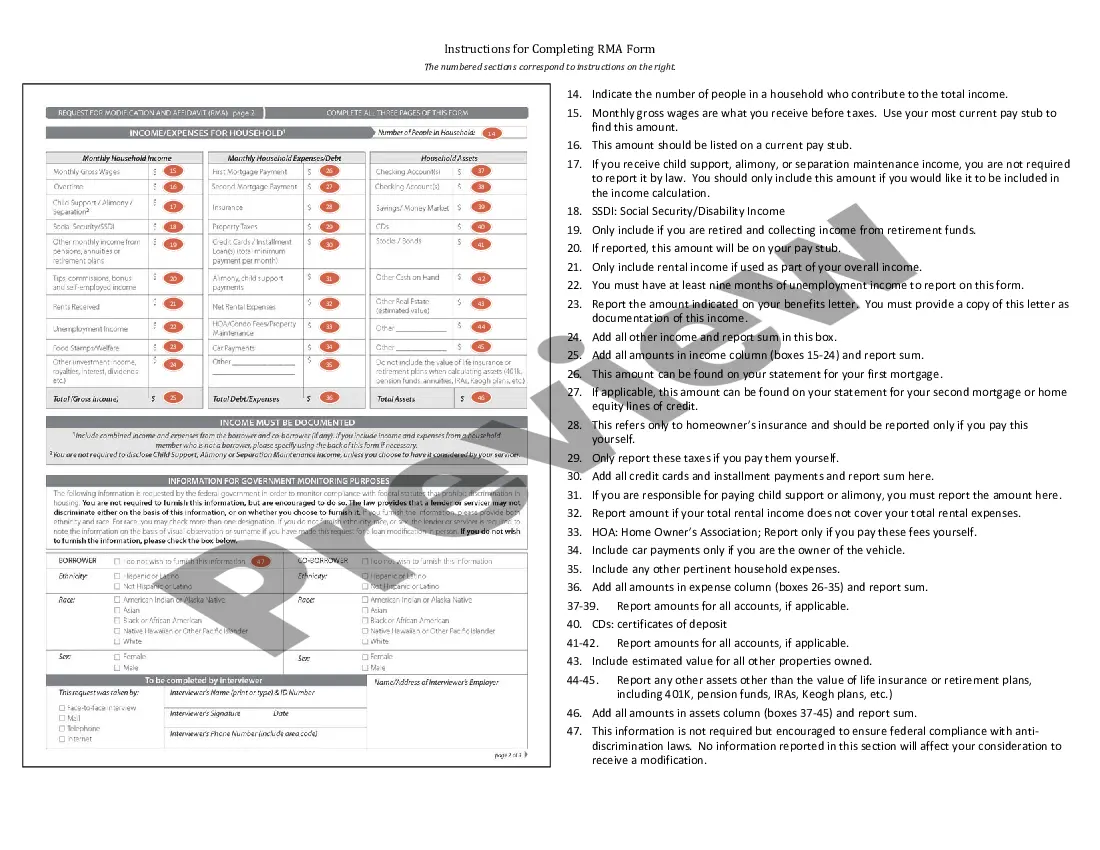

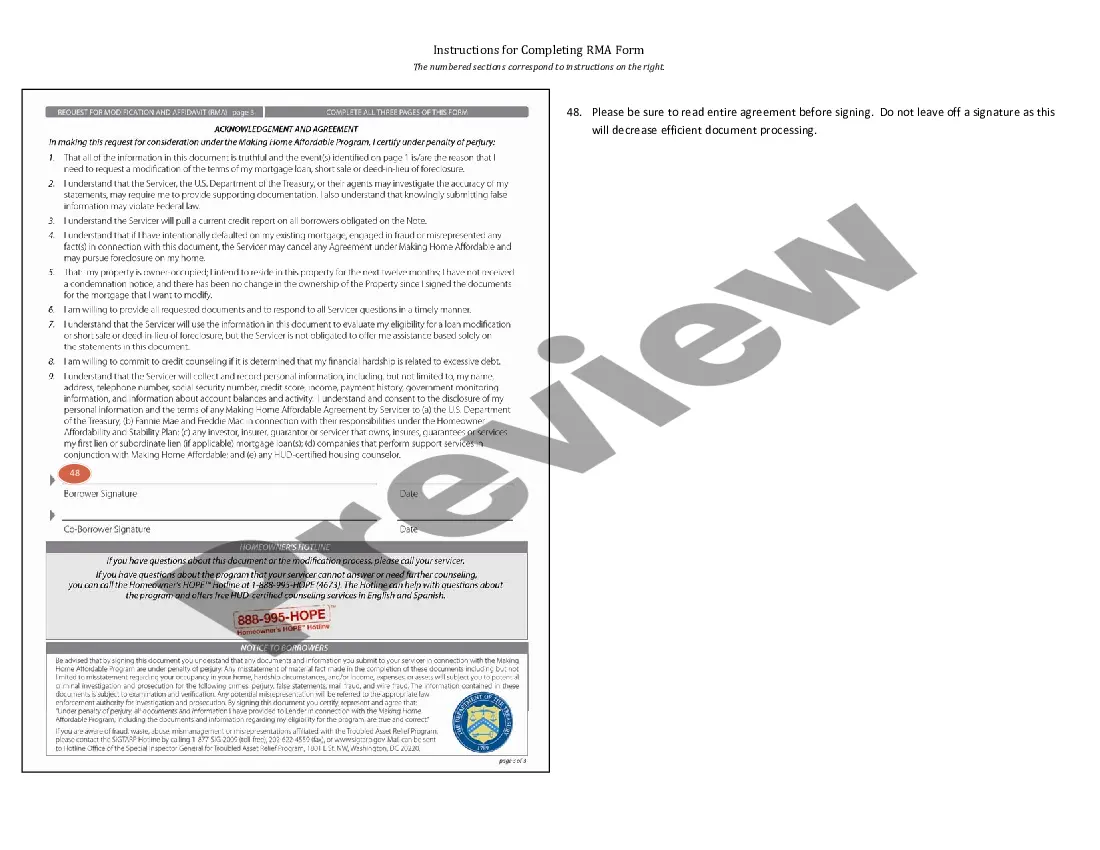

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

Navigating legal documents is essential in the modern era. Nevertheless, you don’t always have to seek expert assistance to generate some of them from scratch, including Queens Guidelines for Completing Request for Loan Modification and Affidavit RMA Form, utilizing a service like US Legal Forms.

US Legal Forms offers over 85,000 templates available for selection in various categories ranging from living wills to real estate documents to divorce forms. All templates are categorized by their corresponding state, streamlining the search process.

You can also access informational resources and guides on the website to facilitate any tasks related to document completion.

If you're already a subscriber to US Legal Forms, you can find the necessary Queens Guidelines for Completing Request for Loan Modification and Affidavit RMA Form, Log In to your account, and download it. It is important to note that our platform cannot fully substitute for an attorney. For highly complex cases, we suggest utilizing attorney services to review your form before finalizing and submitting it.

With over 25 years in the industry, US Legal Forms has established itself as a reliable platform for various legal forms for millions of users. Join today and acquire your state-compliant documents effortlessly!

- Review the document's preview and description (if accessible) to grasp a general understanding of what to expect post-download.

- Make sure that the template you select is tailored to your state/county/region as state laws can influence the validity of certain records.

- Check related forms or restart your search to locate the appropriate document.

- Click Buy now and create your account. If you possess an existing one, choose to Log In.

- Select the pricing {plan, then a desired payment method, and acquire Queens Guidelines for Completing Request for Loan Modification and Affidavit RMA Form.

- Opt to save the form template in any available format.

- Go to the My documents section to re-download the document.

Form popularity

FAQ

Some lenders and servicers offer their own loan modification programs, and the changes they make to your terms may be either temporary or permanent.

How to Write an Effective Hardship Letter Part 1: Explain what happened and why you are applying.Part 2: Specifically illustrate the time and severity of the hardship.Part 3: Back up the reasons traditional remedies won't work.Part 4: Detail why you are stable enough to succeed with a modification.

A Request for Mortgage Assistance (RMA) is the application you have to fill out to be considered for a mortgage loan modification.

To qualify for a modification, you'll have to submit a complete "loss mitigation" application to your loan servicer. It's best to submit your application as soon as you know you'll have trouble making your payments or shortly after you fall behind.

No matter how focused your attention to detail, your credit score almost certainly will take a hit with a home loan modification. Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments. Those missed payments hurt your credit score.

Required Paperwork Application. The first thing you'll need to complete a loan modification is your mortgage lenders application.Paystubs.Signed IRS form 4506-T or 4506-EZ.Two Most Recent Bank Statements.Investment Statements.Monthly Bills.Divorce Decree or Separation Agreement (if applicable)Hardship Letter.

How to get a loan modification Gather information about your financial situation. You'll need to give your lender or servicer everything from tax returns to pay stubs to demonstrate you're experiencing financial hardship and are unable to make your monthly mortgage payments.Plan out your case.Contact your servicer.

To qualify for a loan modification, a borrower usually must have missed at least three mortgage payments and be in default. Sometimes, a borrower who has experienced financial setbacks, which makes a default imminent, can qualify for a loan modification.

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount.

A Request for Mortgage Assistance (RMA) is the application you have to fill out to be considered for a mortgage loan modification.