King Washington Shareholder Agreements: An Overview Introduction: A King Washington Shareholder Agreement is a legally binding contract that outlines the rights, responsibilities, and obligations of shareholders within a company. It serves as a framework to regulate the relationship between shareholders and ensures fair treatment, transparency, and smooth functioning of the organization. This article provides a detailed description of King Washington Shareholder Agreements, highlighting their importance and various types. Key Components of a Shareholder Agreement: 1. Ownership and Capital Structure: The agreement defines each shareholder's ownership percentage, the number of shares they hold, and the capital contributed to the company. 2. Voting Rights: It outlines the voting procedures for important decisions, such as electing directors, approving budgets, or mergers. Different classes of shares can have different voting powers. 3. Share Transfer and Sale: The agreement lays down rules for transferring or selling shares. This may include preemptive rights, drag-along and tag-along rights, and restrictions on share transfers to third parties. 4. Dividend Distribution: It specifies how dividends will be distributed among shareholders, considering factors like profits, financial commitments, and reinvestment needs. 5. Decision-Making Processes: The agreement outlines the decision-making processes, including board meetings, quorum requirements, and the need for unanimous or majority consent on certain matters. 6. Shareholders' Rights and Obligations: It clarifies the rights and obligations of each shareholder, ensuring fair treatment, protection against dilution, and the expectations regarding active involvement in the company's affairs. 7. Dispute Resolution: The agreement establishes mechanisms to resolve disputes between shareholders, such as mediation, arbitration, or litigation, to maintain cordial relations and prevent disruptions. Types of King Washington Shareholder Agreements: 1. Voting Shareholder Agreement: Focuses on outlining the voting rights and procedures, especially in situations where minority shareholders seek protection or control over significant decisions. 2. Buy-Sell Agreement: Also known as a "Buyout Agreement," this type of agreement allows shareholders to set the terms for buying or selling shares under specific conditions, such as death, disability, retirement, or departure from the company. 3. Share Subscription Agreement: It governs the issuance and subscription of new shares, including conditions, pricing, and any rights or restrictions associated with the newly issued shares. 4. Shareholders' Agreement for Startups: Designed specifically for startup companies, this agreement addresses concerns unique to early-stage businesses such as vesting schedules, founder obligations, and intellectual property rights. Conclusion: A King Washington Shareholder Agreement serves as a crucial tool for ensuring a fair and smooth operation of a company by clearly defining the rights, responsibilities, and obligations of shareholders. It offers a comprehensive framework that regulates the relationship between shareholders and provides mechanisms for dispute resolution and decision-making processes. Different types of Shareholder Agreements cater to specific needs, such as voting rights, share transfers, buyouts, or addressing concerns of startup companies.

King Washington Shareholder Agreements - An Overview

Description

How to fill out King Washington Shareholder Agreements - An Overview?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from the ground up, including King Shareholder Agreements - An Overview, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find information materials and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how you can purchase and download King Shareholder Agreements - An Overview.

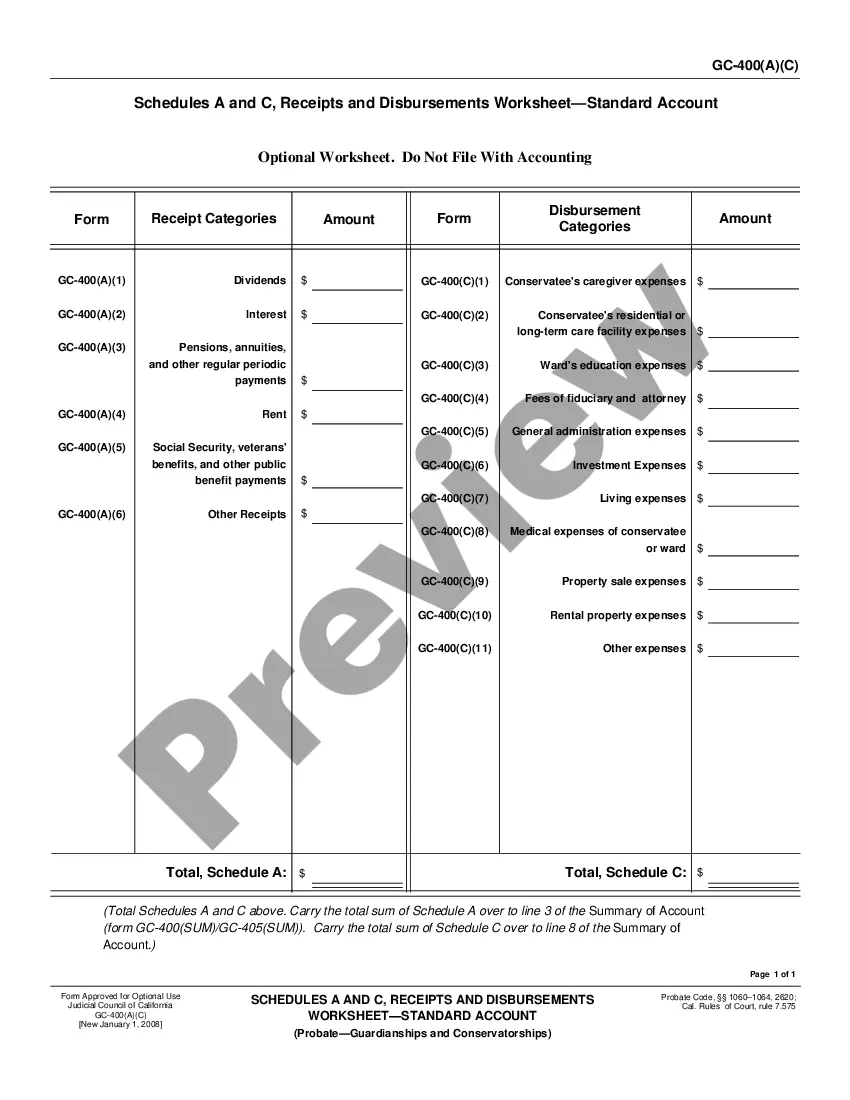

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Check the related document templates or start the search over to locate the appropriate document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase King Shareholder Agreements - An Overview.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate King Shareholder Agreements - An Overview, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you need to deal with an extremely challenging situation, we recommend using the services of an attorney to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-compliant documents with ease!

Form popularity

FAQ

You have to make it clear in writing what the legal obligations are of every person who signs the initial agreement. While it is not possible to completely rid the corporation of future disputes, a well-written shareholder agreement can be used to settle shareholder disputes in a civil manner.

Stock certificates and share ledgers are often used to prove business ownership. While stock certificates are commonly used in larger corporations, they are often not available in smaller corporations.

A shareholder is any person, company, or institution that owns shares in a company's stock. A company shareholder can hold as little as one share. Shareholders are subject to capital gains (or losses) and/or dividend payments as residual claimants on a firm's profits.

Between tax returns, business entity filings and stock logs, you should have all the documentation required to prove you are the sole owner of the business. Company financial statements may also show that no other parties are receiving profits from the company. Internal Revenue Service (IRS).

Corporate Bylaws (Corps only) Along with the articles of incorporation, corporate bylaws are the main organizational document for a corporation.

A shareholder agreement will include the rights and obligations of each shareholder, how the shares of the company are sold, how the company will run, and how decisions will be made.

A Partnership Agreement refers to an agreement between partners of a partnership. A Shareholders Agreement refers to an agreement between the shareholders of a company. The key difference between a partnership and a company is that a company is a separate legal entity.

Ownership certificates are issued to the owners of a company to formally document their ownership of the company. Types of ownership certificates include: Stock certificates. Stock certificates are issued to a corporation's shareholders to designate their ownership.

A company's constitutional documents are normally available for public inspection, whereas the terms of a shareholders' agreement, as a private law contract, are normally confidential between the parties.

What to Think about When You Begin Writing a Shareholder Agreement.Name Your Shareholders.Specify the Responsibilities of Shareholders.The Voting Rights of Your Shareholders.Decisions Your Corporation Might Face.Changing the Original Shareholder Agreement.Determine How Stock can be Sold or Transferred.