Montgomery Maryland Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

Form popularity

FAQ

To transfer property after the death of a parent with a will in Maryland, you will typically need to go through the probate process. This process validates the will and ensures that the property is distributed according to the wishes outlined in the document. Utilizing the Montgomery Maryland Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property may further streamline this process by clarifying rights to the specific property.

An heir may renounce an estate for various reasons, including to avoid inheritance tax consequences or to decline ownership of property that is carrying debt. You must renounce the estate before you take legal possession of your inherited property. Visit the office of the probate court handling the estate.

Renunciation means giving up, or renouncing, your right to something. It is not uncommon for someone named in a last will and testament to renounce rights or property given to him in the will. Reasons might range from financial to personal. State laws are set up to allow this.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

When someone who has beengranted something or has accepted somethinglater gives it up or rejects it; as when an agent withdraws from the agency relationship. Compare: Revocation.

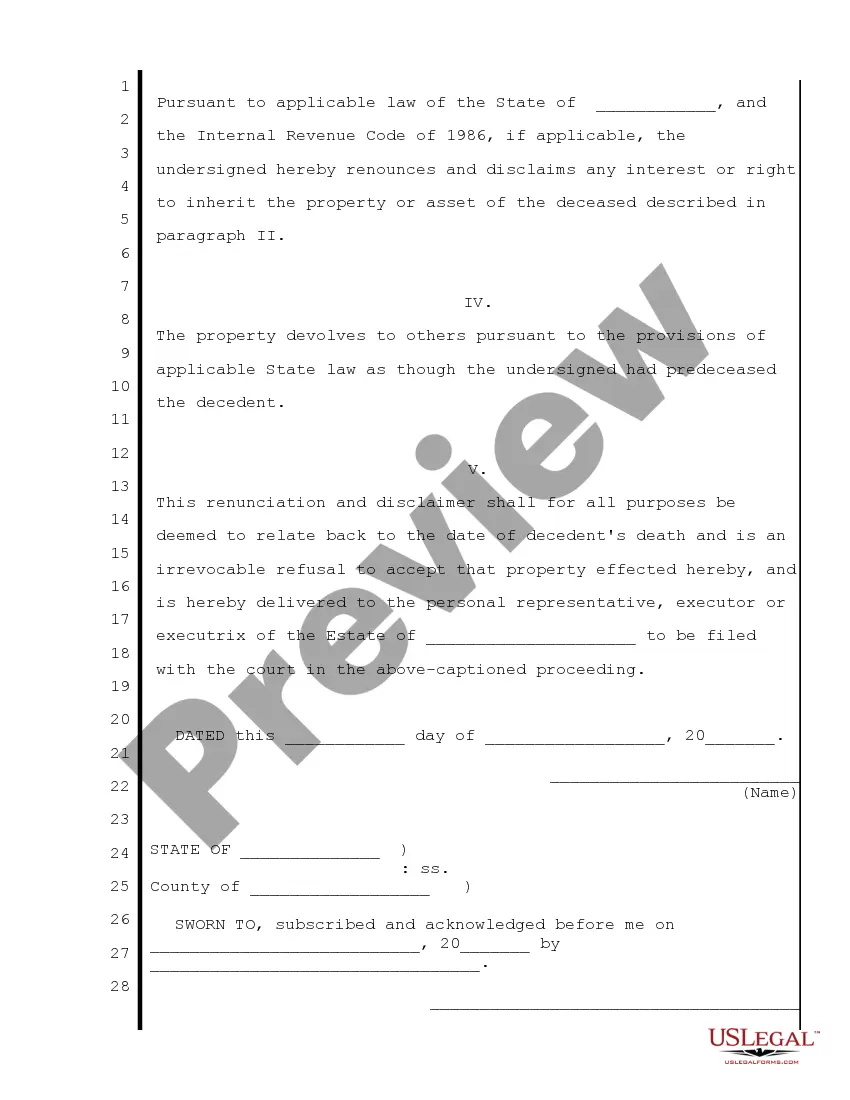

Renouncing or Disclaiming an Inheritance Be in writing; Describe the specific property being disclaimed; Be dated within nine months of the death of the decedent, or once the beneficiary attains the age of 21; And filed with the Executor and/or Court.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

How long do you have to disclaim your inheritance? If you choose to disclaim your inheritance for any reason, you will need to do so within nine months of the deceased's passing.

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.