This due diligence checklist identifies the guidelines and general overview of a corporation by providing information and supportive materials regarding business transactions.

San Diego California Short Form Checklist and Guidelines for Basic Corporate Entity Overview

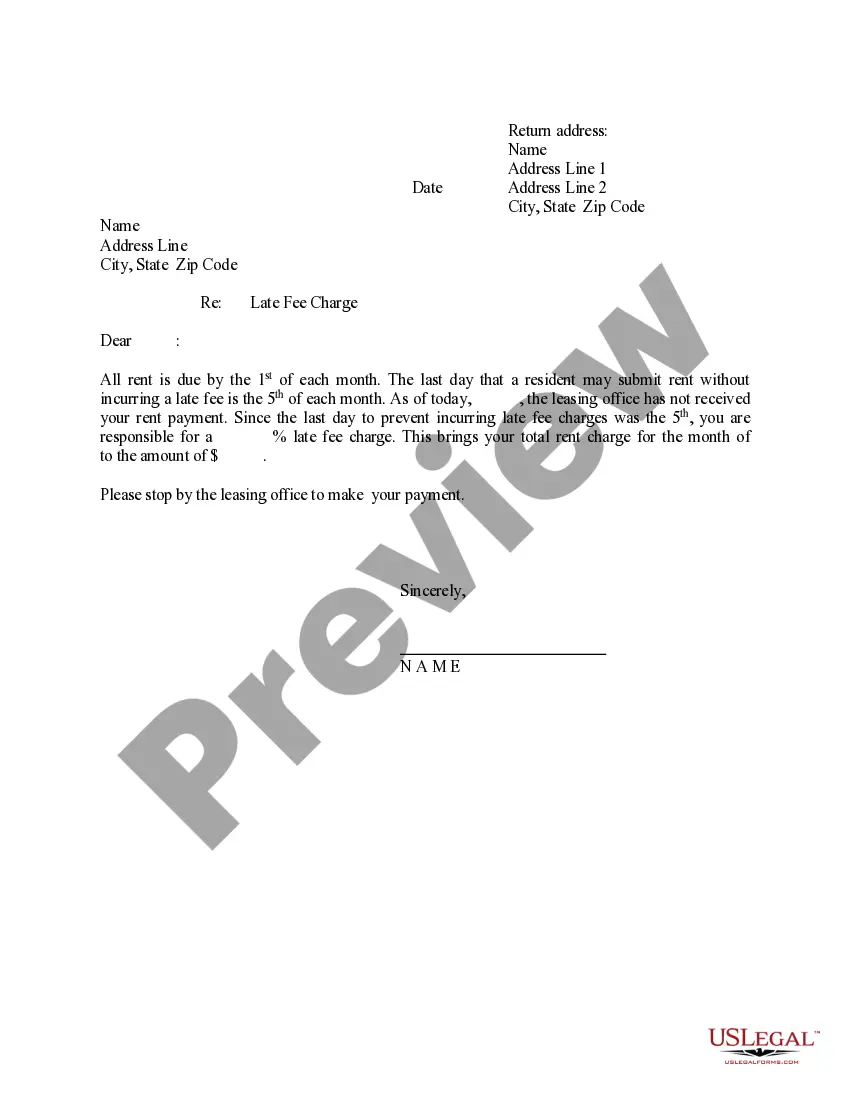

Description

How to fill out Short Form Checklist And Guidelines For Basic Corporate Entity Overview?

Organizing documentation for business or personal needs is always a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it's crucial to consider all federal and state regulations of the particular area.

Nevertheless, smaller counties and even municipalities also have legislative provisions that you must take into account.

Reaffirm that the template adheres to legal standards and click Buy Now.

- All these factors contribute to the pressure and duration involved in composing the San Diego Short Form Checklist and Guidelines for Basic Corporate Entity Overview without expert assistance.

- It's straightforward to avoid spending excessively on attorneys for drafting your paperwork and to create a legally binding San Diego Short Form Checklist and Guidelines for Basic Corporate Entity Overview independently by utilizing the US Legal Forms online repository.

- It represents the largest online compilation of state-specific legal documents that are professionally verified, ensuring you can trust their validity when selecting a sample for your county.

- Previous subscribers only need to Log In to their accounts to access the required form.

- If you don't possess a subscription yet, follow the step-by-step instructions below to secure the San Diego Short Form Checklist and Guidelines for Basic Corporate Entity Overview.

- Review the page you've accessed and confirm it contains the sample you require.

- To do this, utilize the form description and preview if these features are available.

Form popularity

FAQ

To set up a corporation in California, you need to choose a unique name, file the Articles of Incorporation, and designate a registered agent. Additionally, consider drafting bylaws and obtaining any necessary business licenses. These steps collectively form the foundation for compliance with the San Diego California Short Form Checklist and Guidelines for Basic Corporate Entity Overview.

Every company that is established in India needs to quote its Corporate Identification Number on various documents which include: On invoices, bills and receipts. On notice. On memos. On letterheads. Annual Reports and audits. Every e-form submission on the MCA portal. Company's official publications.

Corporations registered in California are required to file an initial Statement of Information using form SI-550 and then file again every year during a specific six-month filing window that is based on the corporation's original registration date.

California Form SI-550 may only be used by stock cooperatives, agricultural cooperatives, or registered foreign corporations. If a domestic stock or agricultural cooperative corporation needs to file a Statement of Information, they must use Form SI-200, Statement of Information that was developed especially for them.

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

2. File Articles of Incorporation. Your corporation is legally created by filing Articles of Incorporation-General Stock (Form ARTS-GS) with the California Secretary of State.

Entity Number: The identification number assigned to a business entity by the California Secretary of State at the time of registration. A corporation entity number is a 7 digit number with a C at the beginning.

California Secretary of State File Numbers are assigned to all entities in the state of California by the Secretary of State. This can be found in the LLC form that was submitted when applying for a limited liability corporation. The business will either have a seven-digit corporation number or a 12 digit file number.

1 attorney answer. Its my understanding that the 7 digit Entity Number is for Corporations and the 12 digit SOS Number is for LLCs. If you list only the 7 digit number you should be fine...

In essence, the California form SI-550 is a document that must be filed by stock corporations, foreign corporations, or agricultural cooperatives to ensure that they declare the mandatory information required by the State of California.