This due diligence checklist identifies the guidelines and general overview of a corporation by providing information and supportive materials regarding business transactions.

Middlesex Massachusetts Short Form Checklist and Guidelines for Basic Corporate Entity Overview

Description

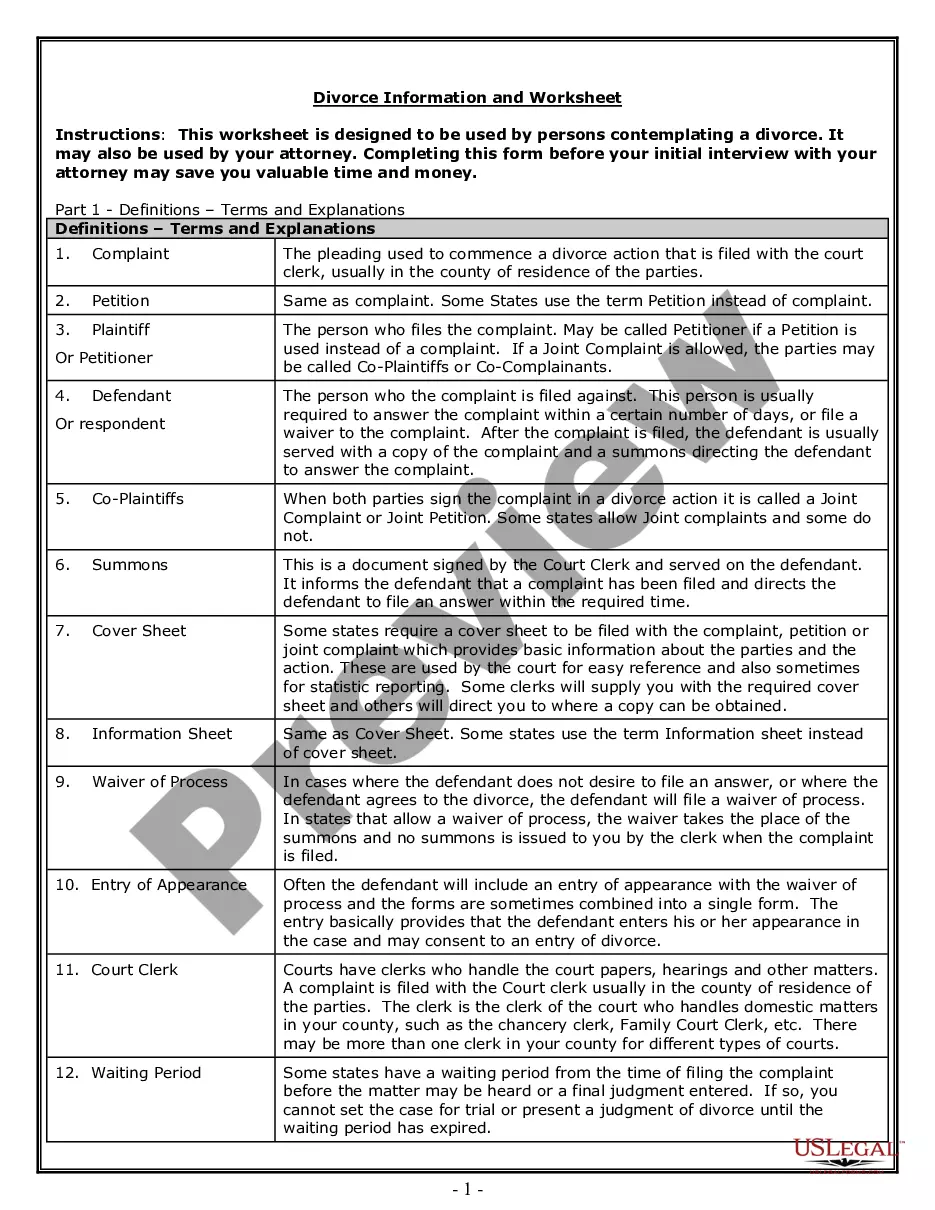

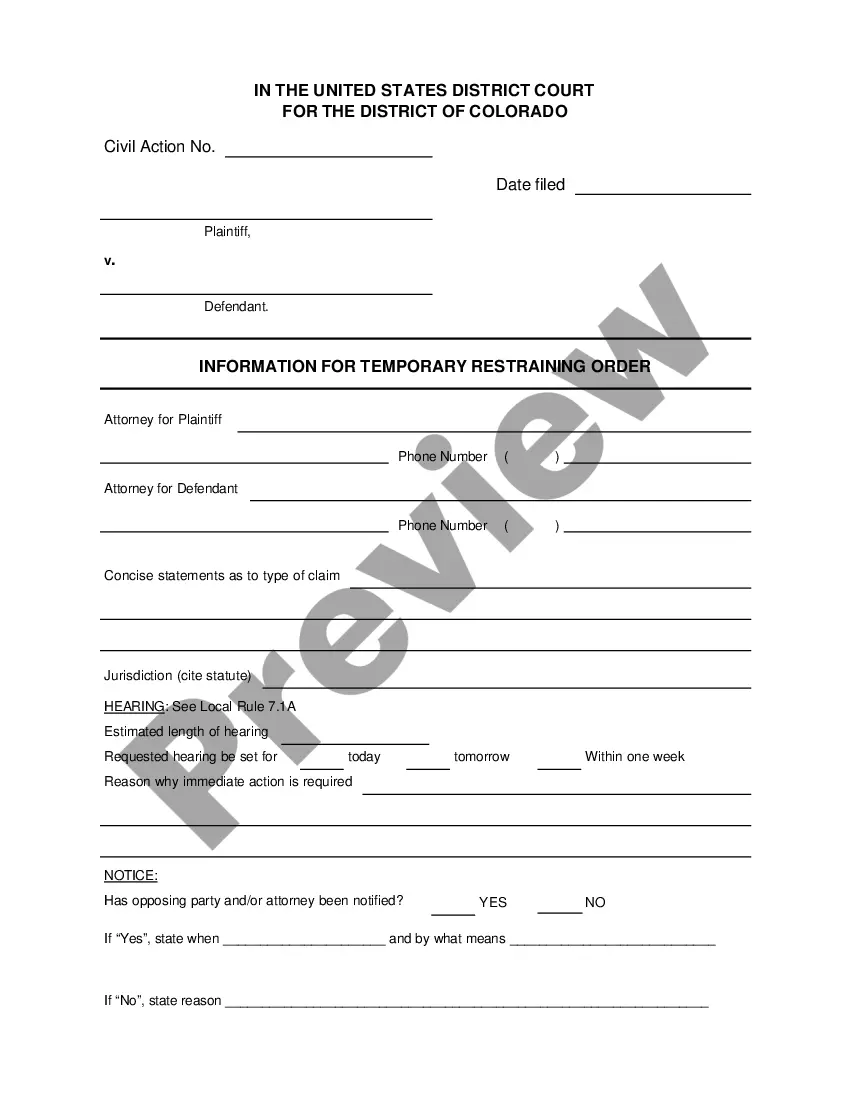

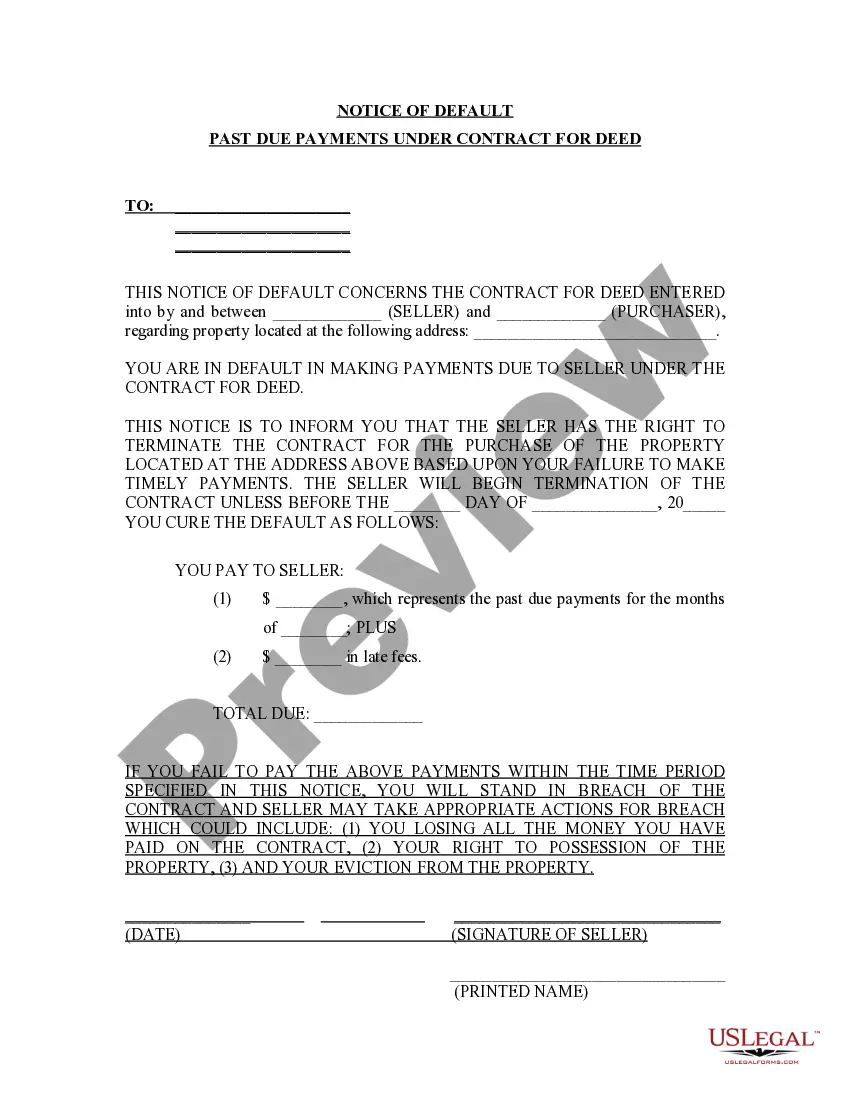

How to fill out Short Form Checklist And Guidelines For Basic Corporate Entity Overview?

Legislation and rules in every domain differ across the nation.

If you're not a legal professional, it can be challenging to navigate various standards when it comes to creating legal documents.

To sidestep costly legal fees when preparing the Middlesex Short Form Checklist and Guidelines for Basic Corporate Entity Overview, you require a verified template valid for your area.

That's the simplest and most economical approach to obtain current templates for any legal purposes. Find them all with a few clicks and keep your documents organized with US Legal Forms!

- This is where utilizing the US Legal Forms platform proves to be beneficial.

- US Legal Forms is relied upon by millions and features a web library of over 85,000 region-specific legal templates.

- It's an excellent resource for professionals and individuals in search of DIY templates for different personal and business scenarios.

- All forms can be utilized repeatedly: once you acquire a sample, it remains accessible in your profile for future use.

- Thus, if you have an account with a current subscription, you can merely Log In and re-download the Middlesex Short Form Checklist and Guidelines for Basic Corporate Entity Overview from the My documents section.

- For newcomers, a few additional steps are required to acquire the Middlesex Short Form Checklist and Guidelines for Basic Corporate Entity Overview.

- Review the page content to confirm you've found the correct sample.

- Use the Preview feature or read the form description if available.

Form popularity

FAQ

Businesses registered as corporations or limited liability companies in Massachusetts are required to file an annual report. This report allows the state to keep updated records of your business's activities and current status. Failing to submit the report can result in penalties or loss of good standing. For detailed steps, reference the Middlesex Massachusetts Short Form Checklist and Guidelines for Basic Corporate Entity Overview.

Articles of organization are part of a formal legal document used to establish a limited liability company (LLC) at the state level. The materials are used to create the rights, powers, duties, liabilities, and other obligations between each member of an LLC and also between the LLC and its members.

Remember, you are required to register a DBA name in every town or city in which you conduct business in Massachusetts. This means that if you conduct business in multiple towns, you will need to complete and file your DBA name certificate in each of the cities or towns you operate.

A Massachusetts DBA (doing business as) is called a business certificate name. Massachusetts business certificate name registration allows a business to operate under a name that's different from its legal name.

The costs to start an LLC in Massachusetts are significant. LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year. Massachusetts registered agent and resident agent are synonymous.

Step 1: Get Your Certificate of Organization Forms. You can download and mail in your Massachusetts Certificate of Organization, OR you can file online.Step 2: Fill Out the Certificate of Organization.Step 3: File the Certificate of Organization.

A certificate of organization form, known in other states as an articles of organization, is the document that one must complete and submit to the commonwealth to establish the creation of an LLC within Massachusetts.

How to File Your Massachusetts Annual Report Determine your business's due date and filing fees. Download a paper form OR complete the report online. LLPs foreign and domestic must create their own Massachusetts Annual Report. Submit your report and filing fee.

How to Form a Massachusetts Professional Corporation (in 11 Steps) Step One) Choose a Name.Step Two) Select a Registered Agent.Step Three) Complete Your Articles of Organization.Step Four) Establish a Corporate Record.Step Five) Designate a Board of Directors.Step Six) Create Corporate Bylaws.

You can get the Certificate of Organization form directly from the secretary of commonwealth website for Massachusetts. If you opt to file by mail, the applicable filing fee is $500. Make sure you complete all the steps if opting to file this way: Fill in the form by hand with black or blue ink, or on your computer.