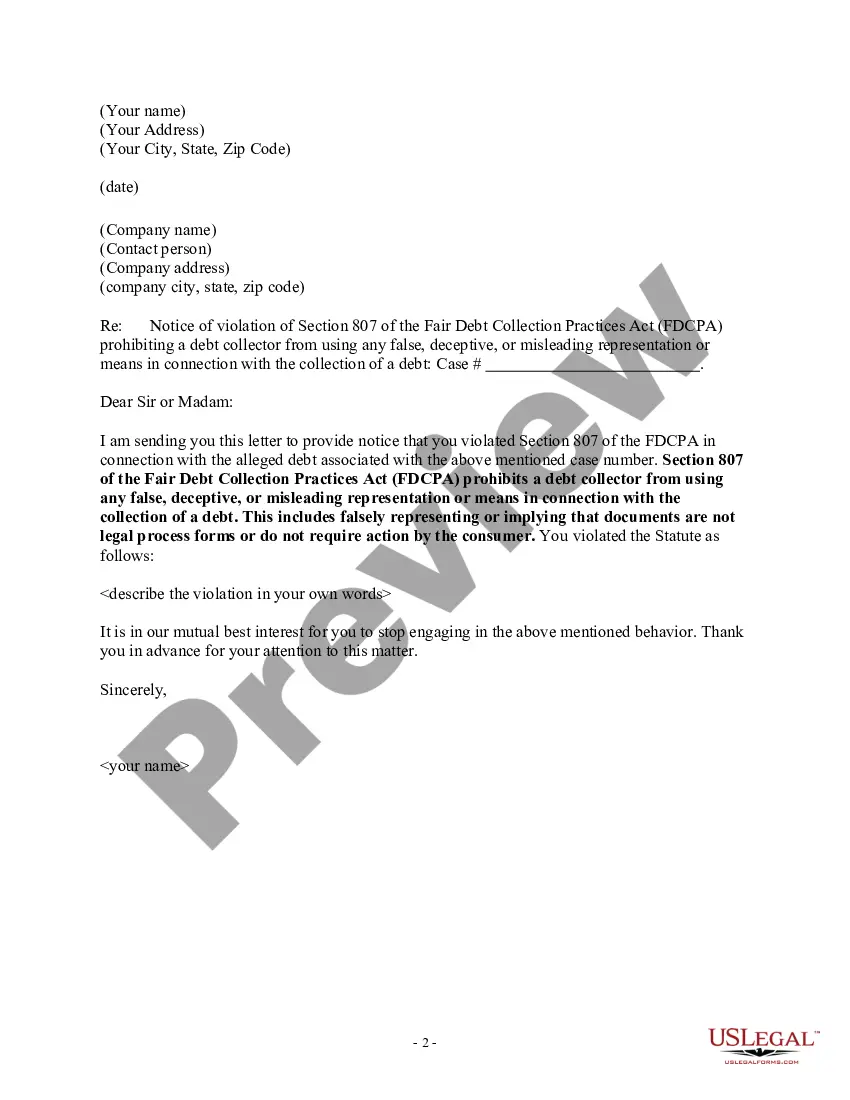

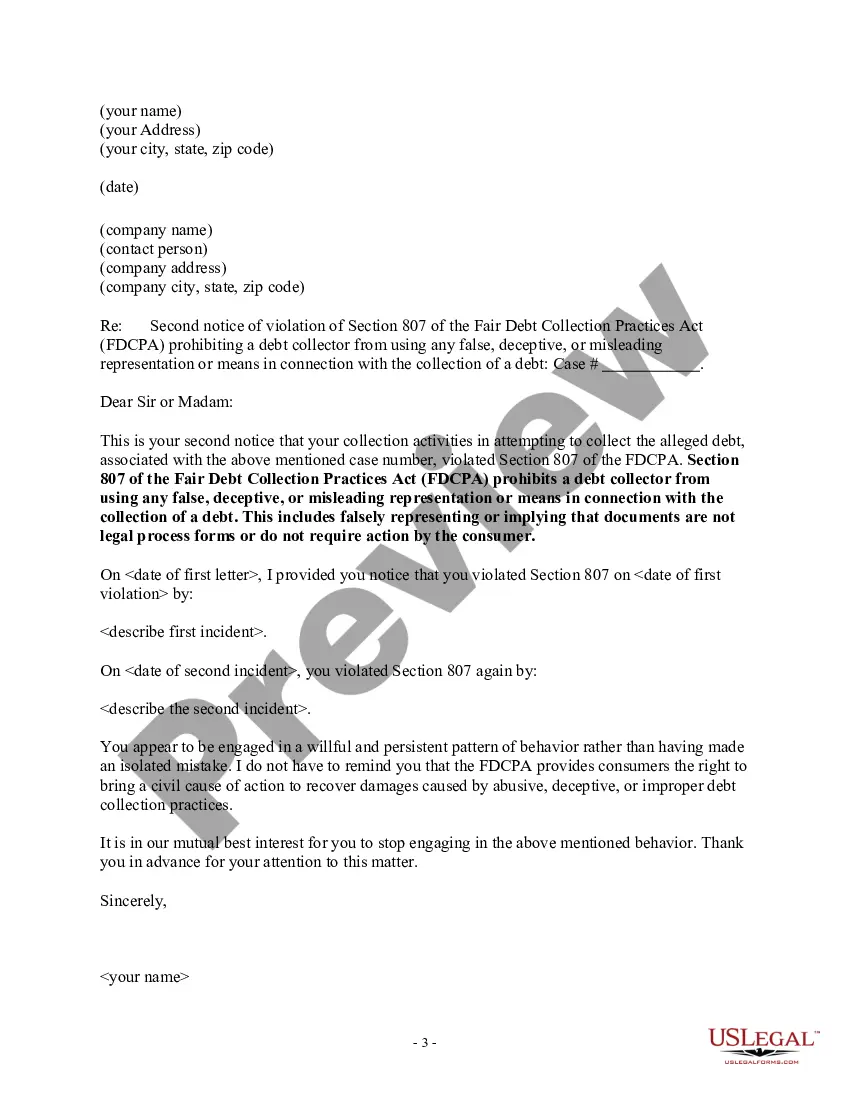

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Collin Texas Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

Laws and regulations in every domain vary from state to state.

If you are not an attorney, it is simple to become bewildered by the multitude of standards regarding the preparation of legal documents.

To circumvent costly legal guidance when drafting the Collin Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action, you require a confirmed template applicable for your jurisdiction.

That’s the simplest and most economical method to acquire current templates for any legal situations. Find them all in just a few clicks and keep your documentation organized with US Legal Forms!

- This is where employing the US Legal Forms platform proves to be beneficial.

- US Legal Forms is a reliable online catalog with over 85,000 state-specific legal documents.

- It is an excellent option for professionals and individuals searching for DIY templates for various personal and business circumstances.

- All documents can be reused: once you acquire a template, it stays accessible in your profile for future reference.

- Therefore, if you possess an account with an active subscription, you can simply Log In and re-download the Collin Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action from the My documents section.

- For newcomers, a few additional steps are required to obtain the Collin Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- Review the page content to confirm you have located the correct sample.

- Use the Preview feature or read the form description if one is provided.

Form popularity

FAQ

A common violation of the Fair Debt Collection Practices Act is when collectors use false or misleading representations about the debt. They may falsely claim they are attorneys or threaten actions that cannot legally be taken. Knowing the specifics within the Collin Texas Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action can help you identify and report violations effectively.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

6 YEAR LIMITATION PERIOD For most debts, a creditor must begin court action to recover the debt within 6 years of the date: that you last made a payment; or. that you admitted in writing that you owed the debt.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

Creditor harassment is any type of unsolicited and repeated contact from the creditor or a debt collection agency that disturbs you, frightens you, or makes you feel threatened.

Here are a few suggestions that might work in your favor: Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.

State Debt Recovery Act 2018 No 11 - NSW Legislation.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

The Australian Collectors & Debt Buyers Association Code of Practice (Code) is the industry code of the Australian Collectors & Debt Buyers Association (ACDBA). Compliance with this Code is a compulsory obligation for ACDBA members.

Legal rights when dealing with debt collectors Under the Australian Consumer Law, a debt collector must not: use physical force or coercion (forcing or compelling you to do something) harass or hassle you to an unreasonable extent. mislead or deceive you (or try to do so)