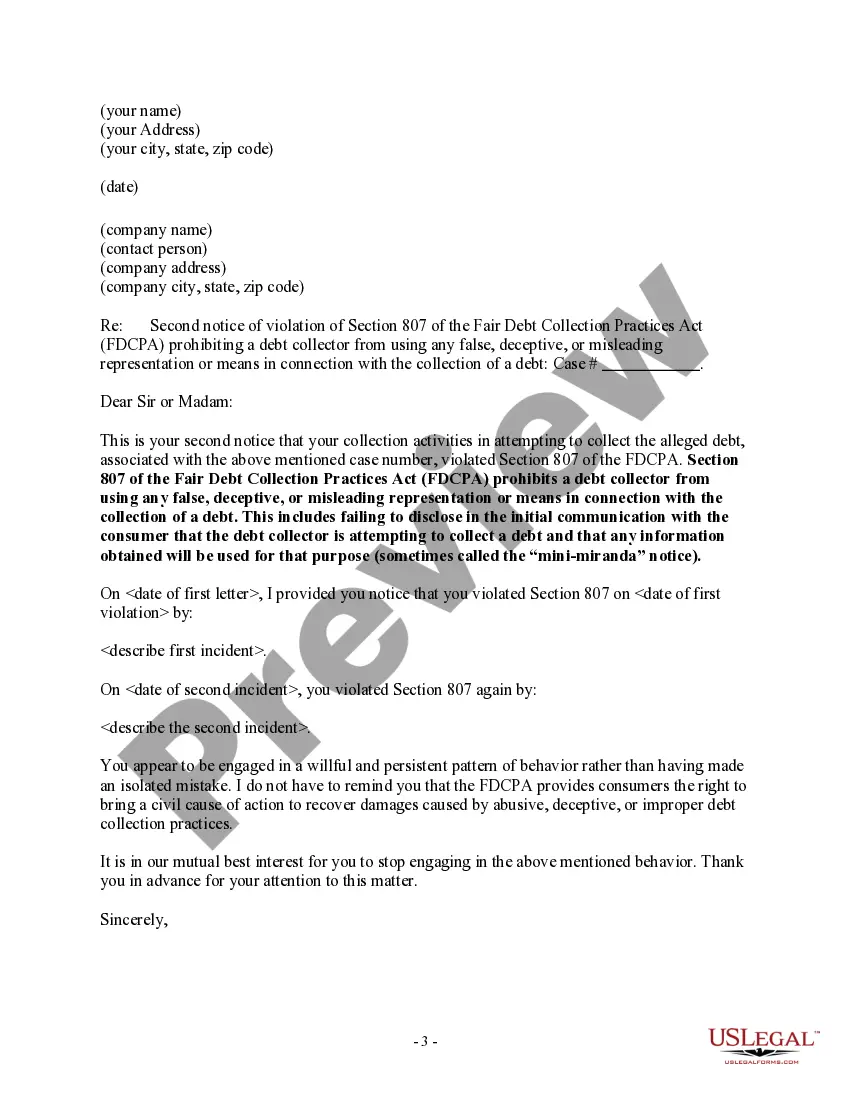

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

Dallas Texas Notice to Debt Collector - Failure to Provide Mini-Miranda

Description

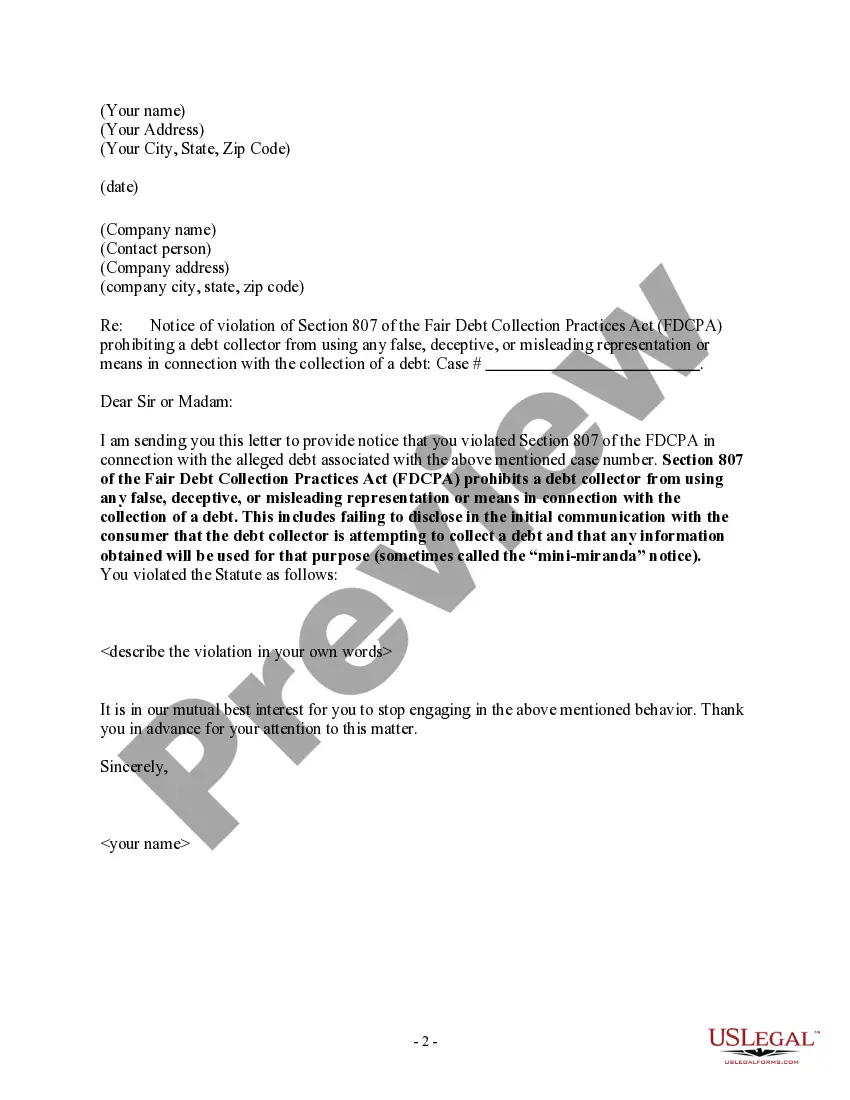

How to fill out Notice To Debt Collector - Failure To Provide Mini-Miranda?

Developing legal documents is essential in contemporary society. However, you don't necessarily have to seek professional help to construct certain forms from scratch, such as the Dallas Notice to Debt Collector - Failure to Provide Mini-Miranda, by using a service like US Legal Forms.

US Legal Forms boasts over 85,000 templates available in various categories from advance directives to property agreements to separation papers. All documents are categorized based on their applicable state, making the search process less aggravating. You can also access informational resources and guides on the site to streamline any tasks related to completing documents.

Here's how you can locate and download the Dallas Notice to Debt Collector - Failure to Provide Mini-Miranda.

If you are already a member of US Legal Forms, you can locate the necessary Dallas Notice to Debt Collector - Failure to Provide Mini-Miranda, Log In to your account, and download it. Naturally, our website cannot entirely substitute for a legal expert. If you encounter a particularly complex issue, we advise consulting a lawyer to review your document before signing and filing it.

With over 25 years in the business, US Legal Forms has become a preferred source for various legal templates for millions of users. Join them today and obtain your state-specific documents effortlessly!

- Review the document's preview and description (if available) to understand what you’ll receive after downloading it.

- Make sure that the template you select is specific to your state/county/region because local regulations might influence the legitimacy of certain documents.

- Examine related forms or restart the search to find the correct document.

- Click Buy now and create your account. If you already possess an account, opt to Log In.

- Choose the pricing {plan, then the required payment method, and purchase the Dallas Notice to Debt Collector - Failure to Provide Mini-Miranda.

- Decide to save the form template in any provided file format.

- Access the My documents section to re-download the document.

Form popularity

FAQ

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

At the beginning of a collection call, a debt collector must recite wording that has come to be called the mini-Miranda disclosure. It informs the consumer that the call is from a debt collector, that they are calling to collect a debt, and that any information revealed in the call will be used to collect that debt.

The mini Miranda exists to help you understand what you shouldn't say to a debt collector so you don't incriminate yourself. Anything and everything you say to the debt collector during your correspondence can be used against you to build a case.

The federal FDCPA says that the collector must disclose in the initial communication that they're attempting to collect a debt and that any information obtained will be used for that purpose.

1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included. The disclaimer keeps debt collectors from tricking you into giving up information that can be used against you.

Legal rights when dealing with debt collectors Under the Australian Consumer Law, a debt collector must not: use physical force or coercion (forcing or compelling you to do something) harass or hassle you to an unreasonable extent. mislead or deceive you (or try to do so)

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

The key is to be thorough in your request for debt verification. In your letter, ask for details on: Why the collector thinks you owe the debt: Ask who the original creditor is and request documentation that verifies you owe the debt, such as a copy of the original contract.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.