A debt collector may not use obscene or profane language or language likely to abuse the hearer or reader. This includes abusive language includes religious slurs, profanity, obscenity, calling the consumer a liar or a deadbeat, and the use of racial or sexual epithets.

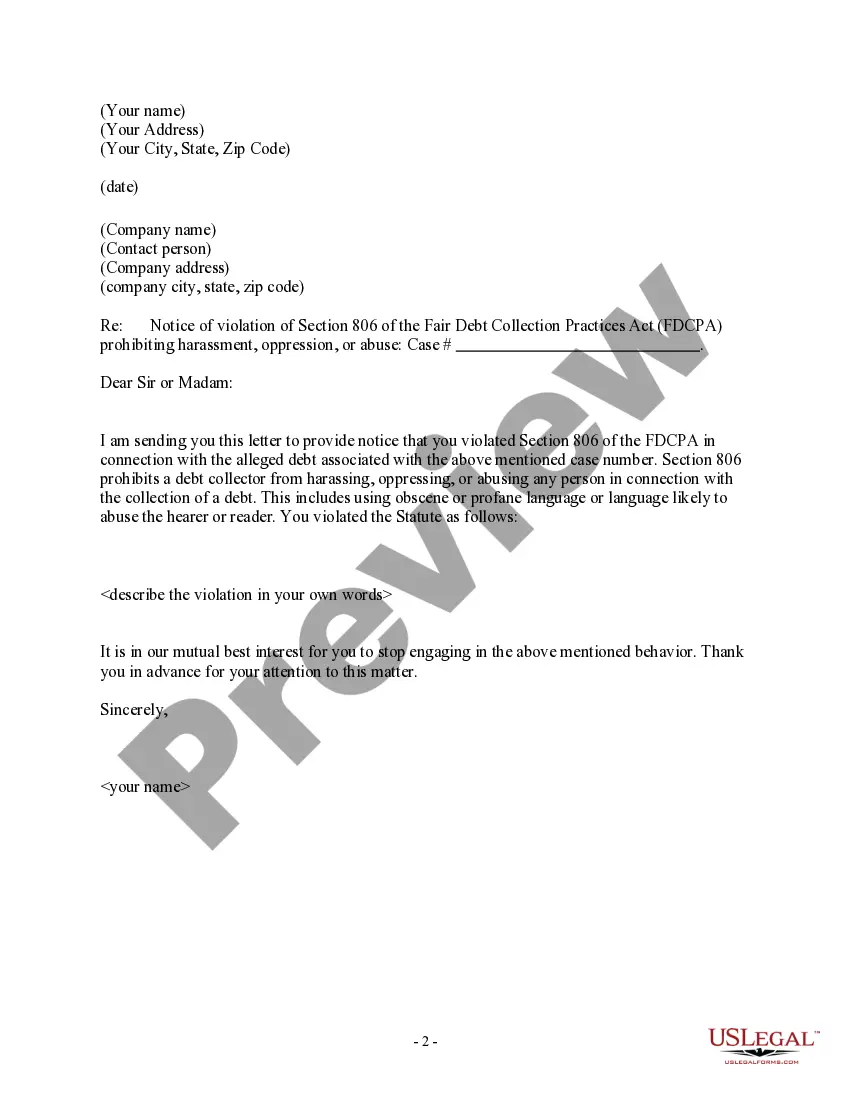

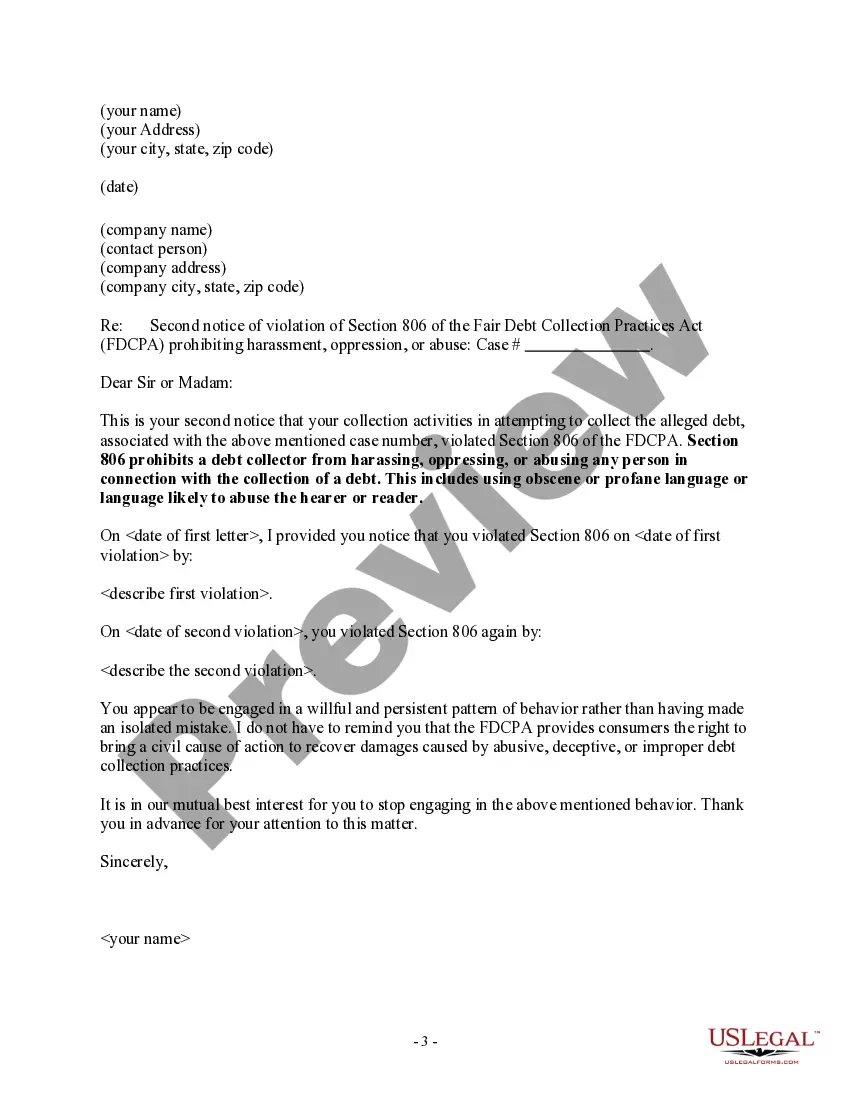

Maricopa, Arizona Notice to Debt Collector — Use of Abusive Language: Exploring the Legal Ramifications In the town of Maricopa, Arizona, debt collectors are governed by specific rules and regulations outlined by both federal and state laws. These laws aim to protect consumers from abusive, harassment, or threatening practices by debt collectors. One common issue that may arise in debt collection cases is the use of abusive language, which can have serious legal consequences for debt collectors involved. It is important to understand the various aspects of this notice to debt collectors concerning the use of abusive language. Definition and Consequences: Using abusive language refers to the act of employing profanity, derogatory, or offensive remarks when communicating with a debtor. Debt collectors are strictly prohibited from using such language under the Fair Debt Collection Practices Act (FD CPA). The FD CPA ensures that debtors are treated fairly and respectfully during the collection process. Failure to comply with these regulations can lead to severe penalties, lawsuits, and damage to the reputation of debt collection agencies. Types of Maricopa, Arizona Notice to Debt Collector — Use of Abusive Language: 1. Formal Notice: This initial type of notice serves as a written warning to debt collectors who have been found using abusive language while attempting to communicate with debtors. The formal notice outlines the specific language used and the details of the incident. Debt collectors receiving this notice must take immediate steps to rectify their conduct, ensuring compliance with the law. 2. Cease and Desist Order: In more serious cases, debtors may choose to issue a cease and desist order to debt collectors who persist in using abusive language. This formal document demands that the debt collector stops all communication with the debtor immediately. Failure to comply with a cease and desist order can result in legal action and further penalties against the debt collector. 3. Legal Action: If a debt collector continues to engage in abusive language after receiving a formal notice or cease and desist order, debtors may have grounds to pursue legal action against the debt collector. In Maricopa, Arizona, debt collectors found guilty of using abusive language can face fines, damages, potential loss of license, and other legal consequences. 4. Reporting to Regulatory Agencies: In addition to taking legal action, debtors have the option to report abusive language incidents to relevant regulatory agencies, such as the Consumer Financial Protection Bureau (CFPB). Agencies like the CFPB actively monitor debt collection practices and can take administrative actions against debt collectors found in violation of the FD CPA. Conclusion: Maricopa, Arizona Notice to Debt Collector — Use of Abusive Language is of significant importance for both debt collectors and consumers. Debt collectors must conduct themselves professionally when communicating with debtors, avoiding any use of abusive language. Debtors, on the other hand, should be aware of their rights and pursue necessary actions if they experience abusive language during the debt collection process. By promoting fair and respectful behaviors, the Maricopa community can ensure that debt collection practices are conducted within the boundaries of the law, respecting the rights of both parties involved.