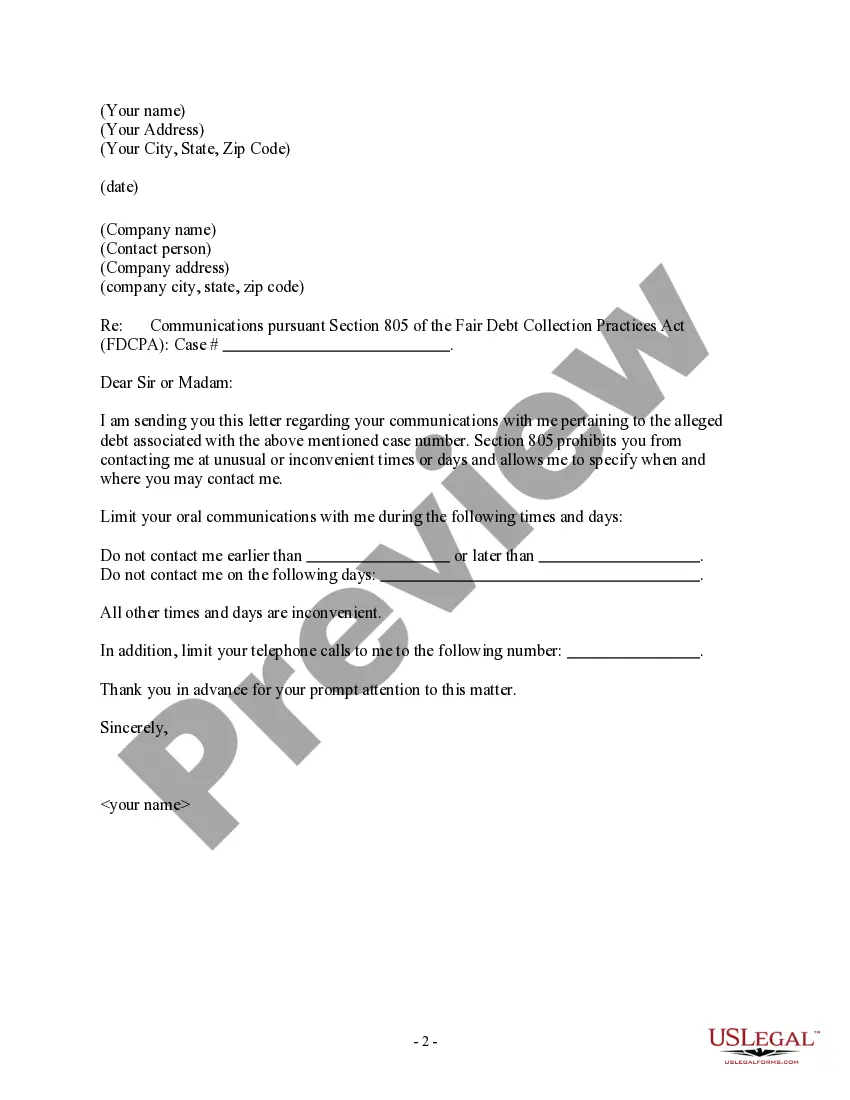

Santa Clara California Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

Drafting legal documents can be challenging. Furthermore, if you choose to hire an attorney to create a business agreement, ownership transfer papers, prenuptial contract, divorce documents, or the Santa Clara Letter to Debt Collector - Only contact me on the following days and times, it might cost you a significant amount.

So what is the most effective method to conserve time and money while creating valid documents in complete alignment with your state and local laws and regulations? US Legal Forms is a fantastic option, whether you are looking for templates for personal or commercial use.

Don't be concerned if the form doesn't meet your needs - look for the appropriate one in the header. Click Buy Now when you identify the necessary template and select the most appropriate subscription. Log In or register for an account to acquire your subscription. Process a payment using a credit card or via PayPal. Select the document format for your Santa Clara Letter to Debt Collector - Only contact me on the following days and times and download it. Afterward, you can print it and fill it out on paper or upload the template to an online editor for quicker and more convenient completion. US Legal Forms allows you to utilize all paperwork previously purchased multiple times - you can locate your templates in the My documents tab within your profile. Give it a go now!

- US Legal Forms is the largest online repository of state-specific legal documents, offering users the latest and professionally validated forms for any situation compiled all in one location.

- Consequently, if you require the latest version of the Santa Clara Letter to Debt Collector - Only contact me on the following days and times, you can easily find it on our platform.

- Acquiring the documents needs minimal time.

- Individuals who already possess an account should verify that their subscription is active, Log In, and select the template using the Download button.

- If you haven't subscribed yet, here's how to obtain the Santa Clara Letter to Debt Collector - Only contact me on the following days and times.

- Browse the page and confirm there is a template for your area.

- Review the form description and utilize the Preview option, if accessible, to ensure it's the document you require.

Form popularity

FAQ

Unfortunately, a debt collection agency can take as long as they want to respond to your request to validate an existing debt. I would say, generally, the usual range is between 130 days or they never respond. Here's a video with more info on Debt Validation Letters.

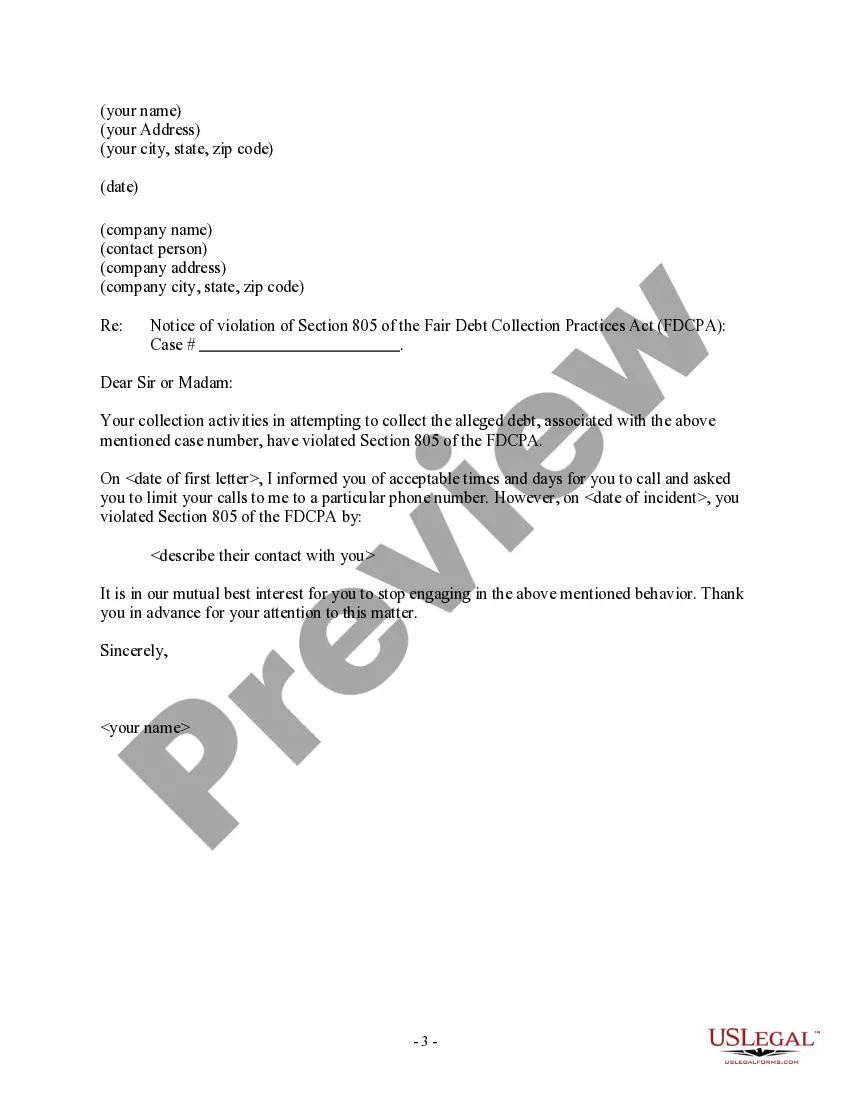

Generally, debt collectors cannot call you at an unusual time or place, or at a time or place they know is inconvenient to you and they are prohibited from contacting you before 8 a.m. or after 9 p.m.

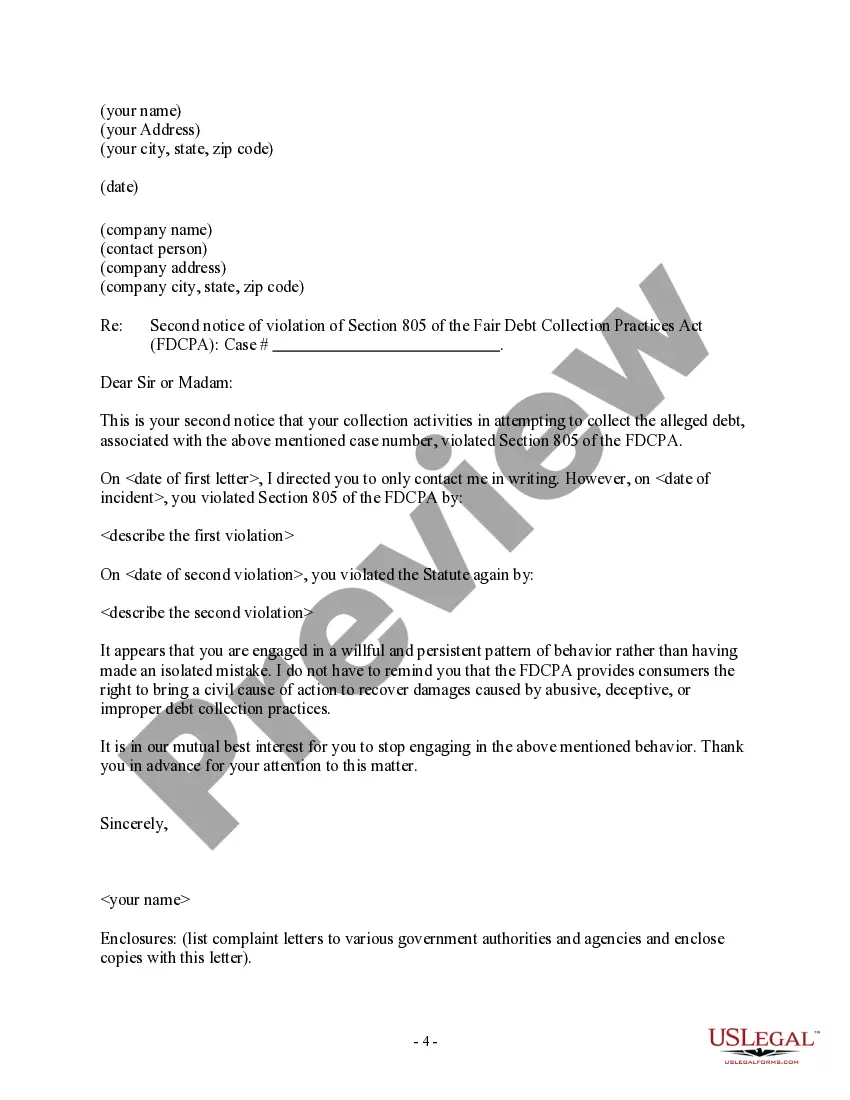

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).

The new rule specifies that third-party debt collectors can call you once daily, but if they actually speak to you, they cannot call again for at least seven days. In addition, you can ask them to stop calling you and they must comply.

Generally, the earliest phases of the debt collection process begin to kick in about 30 days after a payment's due date has passed and payment has not been made the point at which the debt is marked as delinquent.

Generally, debt collectors cannot call you at an unusual time or place, or at a time or place they know is inconvenient to you and they are prohibited from contacting you before 8 a.m. or after 9 p.m.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

According to the FDCPA, a debt collector cannot call a debtor more than once per day for each debt. This means that if you only have one outstanding debt, then your debt collector is only allowed to call you one time per day.

According to the FDCPA, a debt collector cannot call a debtor more than once per day for each debt. This means that if you only have one outstanding debt, then your debt collector is only allowed to call you one time per day.