Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Wayne Michigan Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt

Description

How to fill out Letter Denying That Alleged Debtor Owes Any Part Of Debt And Requesting A Collection Agency To Validate That Alleged Debtor Owes Such A Debt?

Preparing documents, such as the Wayne Letter Refuting that the Claimed Debtor Has Any Liability for Debt and Requesting a Collection Agency to Confirm that the Claimed Debtor Is Responsible for such a Debt, to oversee your legal matters is a challenging and protracted endeavor.

Numerous situations necessitate an attorney’s participation, which also renders this endeavor rather costly.

Nonetheless, you can take control of your legal matters and manage them independently. US Legal Forms is here to assist.

The onboarding process for new users is quite simple! Here’s what you need to complete before downloading the Wayne Letter Refuting that the Claimed Debtor Has Any Liability for Debt and Requesting a Collection Agency to Confirm that the Claimed Debtor Is Responsible for such a Debt: Ensure that your document is tailored to your state/county, given that legal document requirements may vary significantly between states.

- Our platform offers over 85,000 legal documents designed for various circumstances and life scenarios.

- We ensure that each form complies with state regulations, so you need not worry about potential legal compliance issues.

- If you are already familiar with our offerings and hold a subscription with US, you understand the ease of acquiring the Wayne Letter Refuting that the Claimed Debtor Has Any Liability for Debt and Requesting a Collection Agency to Confirm that the Claimed Debtor Is Responsible for such a Debt template.

- Feel free to Log In to your account, download the template, and adapt it to your preferences.

- Have you misplaced your document? No problem. You can retrieve it in the My documents section in your account - available on both desktop and mobile.

Form popularity

FAQ

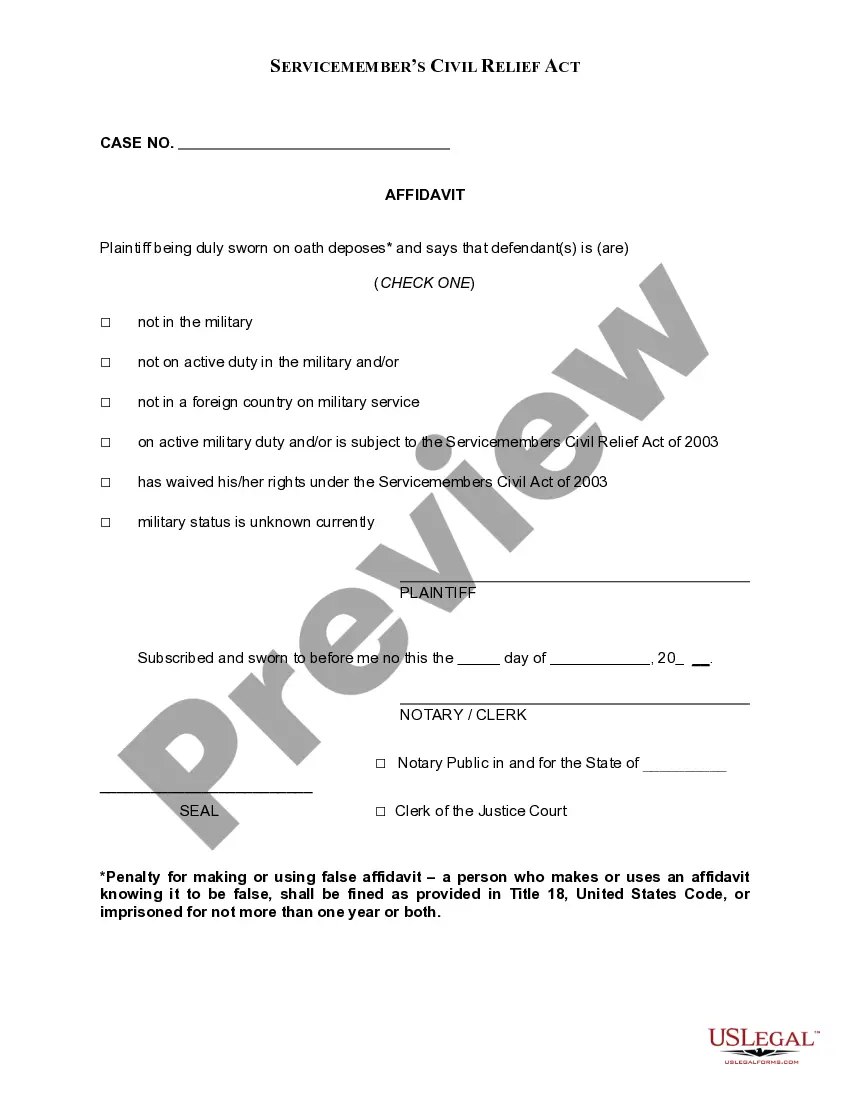

If a debt collector cannot validate the debt, the Fair Debt Collection Practices Act makes it clear that they must cease all collection efforts. This means that the collection agency will no longer have the legal right to pursue you for that debt. You can use a Wayne Michigan Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt to formally assert your position. This document serves as your protective measure and maintains your rights throughout the process.

How to Write a Debt Verification Letter Determine the exact amounts you owe. Gather documents that verify your debt. Get information on who you owe. Determine how old the debt is. Place a pause on the collection proceedings.

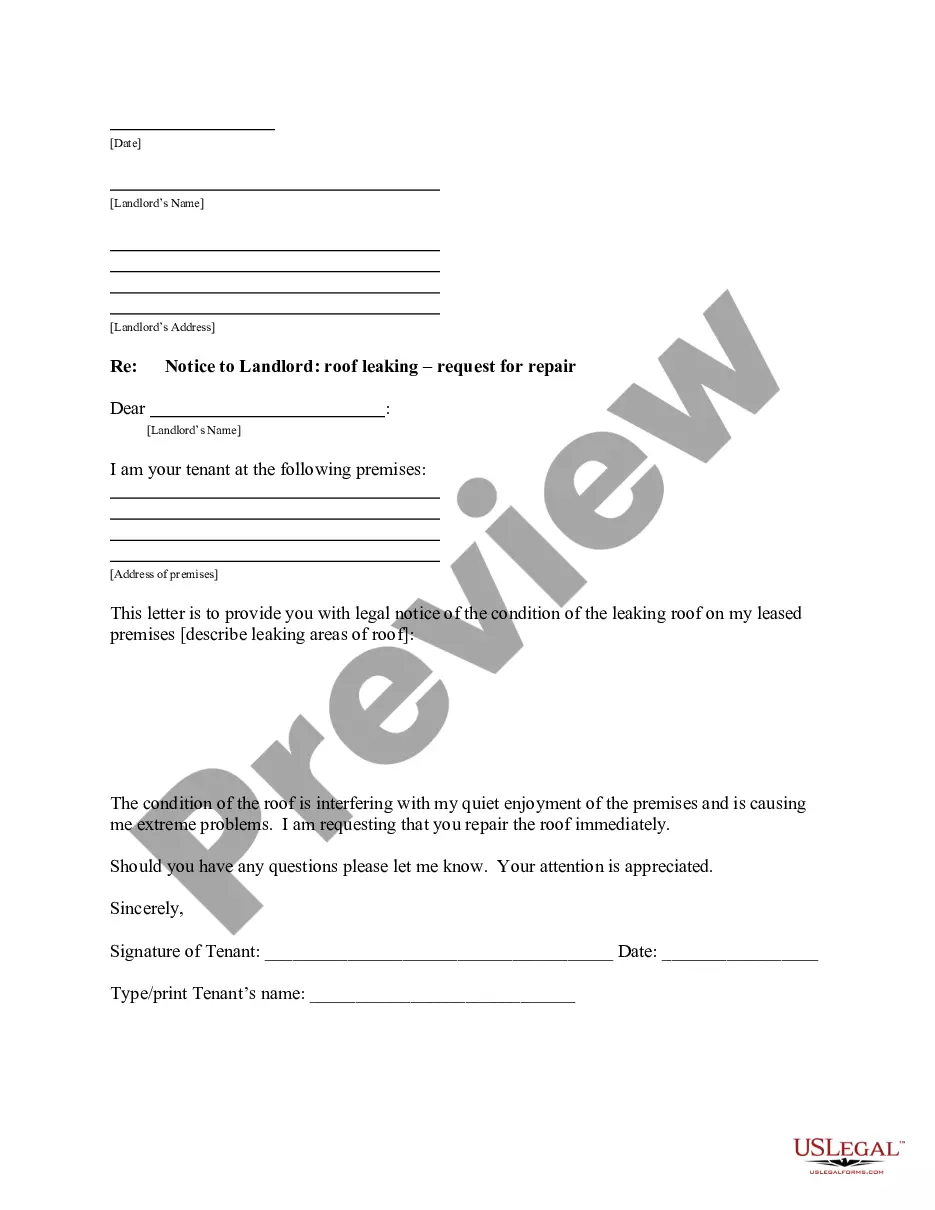

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Once a debt collector receives written notice from a consumer that he or she refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease any further communication with the consumer except "(1) to advise the consumer that the debt collector's further efforts are being

Even if the debt collector can't contact you, it can still take legal steps to collect the debt, like filing a lawsuit. By stopping all communications with the collector, you limit the amount of information you get regarding the debt and what the debt collector is doing.

3. Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.