Cook Illinois Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp.

Description

How to fill out Agreement And Plan Of Merger By NFA Corp. And Casty Acquisition Corp.?

A paperwork process always accompanies any lawful action you undertake.

Starting a business, requesting or accepting a job proposal, transferring real estate, and numerous other life situations necessitate that you prepare official paperwork that differs from state to state.

This is why having everything consolidated in a single location is so advantageous.

US Legal Forms is the most extensive online repository of current federal and state-specific legal documents. Here, you can effortlessly find and obtain a form for any personal or business purpose required in your jurisdiction, including the Cook Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp.

This is the simplest and most trustworthy method to acquire legal documents. All the templates offered by our library are expertly crafted and verified for compliance with local laws and regulations. Organize your documentation and manage your legal matters effectively with US Legal Forms!

- Finding templates on the site is remarkably simple.

- If you possess a subscription to our service, Log In to your account, search for the sample using the search function, and click Download to save it onto your device.

- After that, the Cook Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp. will be accessible for future use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, adhere to these straightforward instructions to obtain the Cook Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp.

- Ensure you have navigated to the correct page with your regional form.

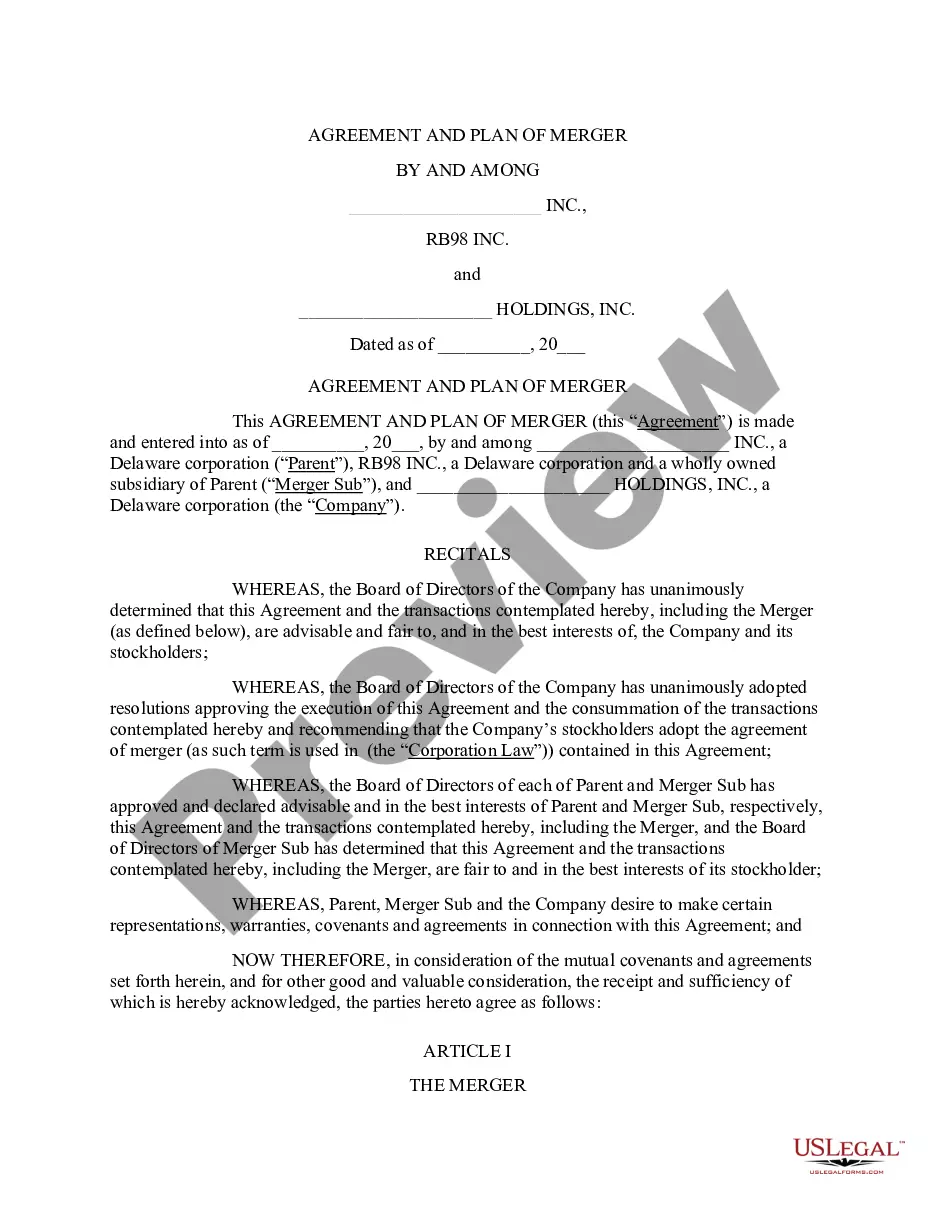

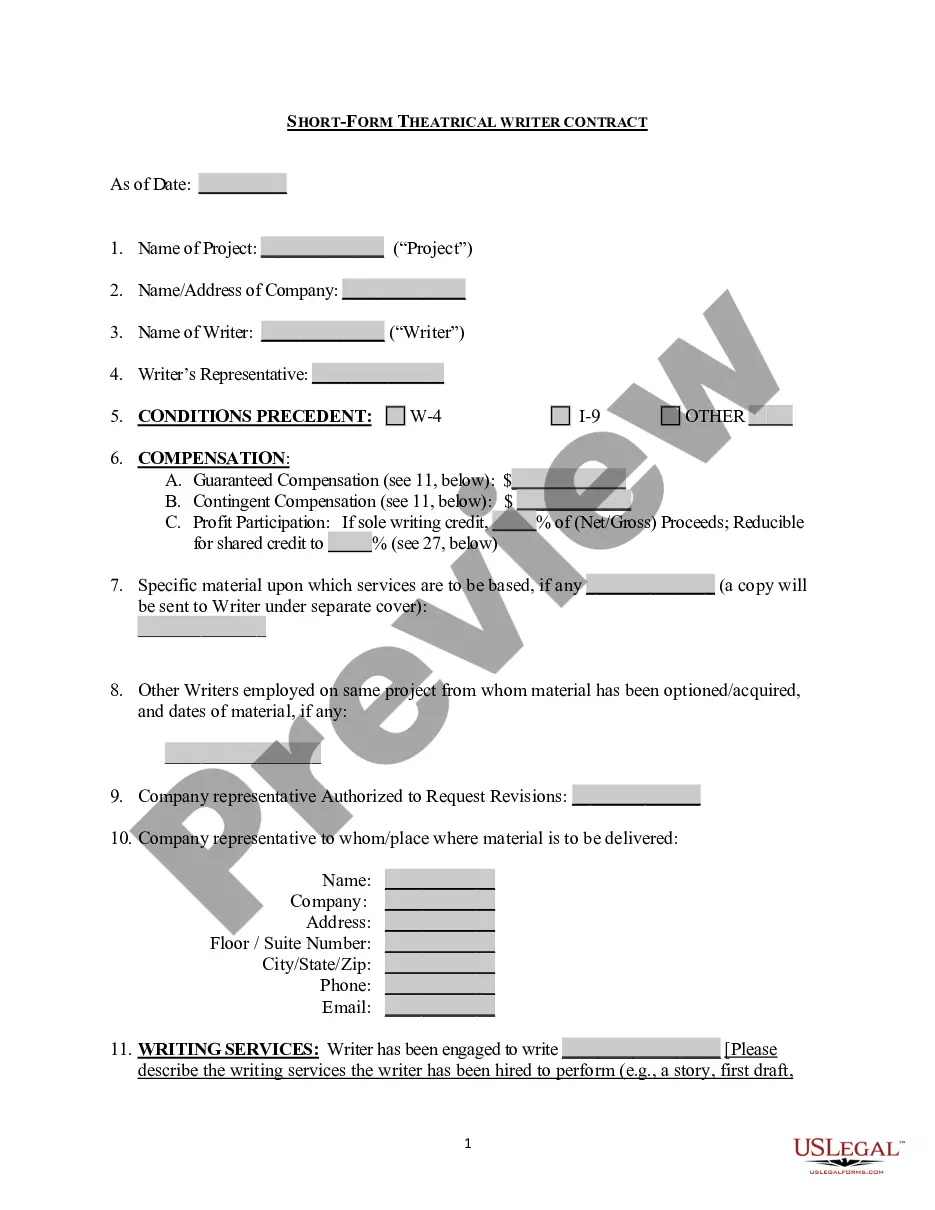

- Utilize the Preview mode (if available) and navigate through the template.

- Examine the description (if present) to confirm that the form meets your specifications.

- Look for another document through the search feature if the sample is unsuitable.

Form popularity

FAQ

A DPA is sometimes known as a Stock Purchase Agreement or Definitive Merger Agreement. A Definitive Purchase Agreement is used as a document to transfer the ownership of a company.

Mergers are transactions involving the combination of generally two or more companies into a single entity. The need for shareholder approval of a merger is governed by state law. Typically, a merger must be approved by the holders of a majority of the outstanding shares of the target company.

The merger process varies from state-to-state. However, there are some rules that all states have in common. First, you can expect every state to require board approval from the target firm (the one that will not survive for a merger).

Market estimates place a merger's timeframe for completion between six months to several years. In some instances, it may take only a few months to finalize the entire merger process. However, if there is a broad range of variables and approval hurdles, the merger process can be elongated to a much longer period.

Merger transactions typically require approval of the boards of directors of the constituent companies and a vote of the shareholders of the constituent companies.

The investor should get to know the nature of the merger, key information concerning the other company involved, the types of benefits that shareholders are receiving, which company is in control of the deal, and any other relevant financial and non-financial considerations.

In a stock sale, the agreement is often called the merger agreement, while in an asset sale, it's often called an asset purchase agreement. The agreement lays out the terms of the deal in more detail. For example, the LinkedIn merger agreement details: Conditions that would trigger the break-up fee.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

A merger agreement definition is a legal contract governing the combination of two companies into a single business entity. Negotiating a Merger Agreement. Price and Consideration. Holdback or Escrow. Representations and Warranties.