Wake North Carolina Utilization by a REIT of partnership structures in financing five development projects

Description

How to fill out Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

Preparing documents for professional or personal purposes is always a significant responsibility.

When formulating a contract, a public service application, or a power of attorney, it is crucial to take into account all federal and state regulations of the particular area.

Nonetheless, smaller counties and even municipalities also have legislative processes that you must factor in.

To find the one that meets your needs, use the search tab in the page header. Ensure the template adheres to legal standards and click Buy Now. Select the subscription plan, then Log In or create an account with US Legal Forms. Use your credit card or PayPal account to pay for your subscription. Download the chosen document in your preferred format, print it, or complete it electronically. The remarkable feature of the US Legal Forms library is that all the documents you have ever obtained remain accessible - you can access them in your profile within the My documents tab at any time. Join the platform and conveniently acquire verified legal forms for any circumstance with just a few clicks!

- All these elements render it challenging and time-consuming to draft Wake Utilization by a REIT of partnership frameworks in funding five development initiatives without professional help.

- It's simple to bypass incurring expenses on attorneys drafting your paperwork and establish a legal Wake Utilization by a REIT of partnership structures in financing five development projects independently, utilizing the US Legal Forms web library.

- It is the largest online repository of state-specific legal documents that are professionally verified, so you can trust their legitimacy when selecting a sample for your locality.

- Prior subscribers just need to Log In to their accounts to retrieve the necessary document.

- If you are not yet subscribed, adhere to the step-by-step instructions below to obtain the Wake Utilization by a REIT of partnership structures in financing five development projects.

- Browse through the opened page and verify if it contains the sample you need.

- To do this, utilize the form description and preview if these options are available.

Form popularity

FAQ

6 Steps to Structuring an Investor Deal Figure Out Your Goal for the Project.Create a Property Level Financial Model for the Deal.Create a Model Based on Your Proposed Deal Structure With Your Investor.Adjust Your Proposed Structure So That the Deal Would Make Sense for You to Do.

If a REIT's dividend yield is above its long-term average, then the trust is undervalued; conversely, if a REIT's dividend yield is below its long-term average, the trust is overvalued.

When you're ready to invest in a REIT, look for growth in earnings, which stems from higher revenues (higher occupancy rates and increasing rents), lower costs, and new business opportunities. It's also imperative that you research the management team that oversees the REIT's properties.

Investors who want to estimate the value of a real estate investment trust (REIT) will find that traditional metrics such as earnings-per-share (EPS) and price-to-earnings(P/E) do not apply. For REITs, a more reliable method is a figure called funds from operations (FFO).

Finding REITs. You can use the free, easy-to-use screener at FINVIZ.com to find REITs. Start by going to the FINVIZ homepage (finviz.com) and then selecting Screener. FINVIZ calls its selection criteria filters. On the Filters bar, select All to display all of the available filters.

Rather than estimating future cash flows and discounting them to the present (as is the case with traditional valuation approaches), the NAV approach is a way to calculate a REITs value simply by assessing the fair market value of real estate assets As a result, the NAV is often favored in REIT valuation because it

Metrics to consider General considerations when investing in a REIT.Quality and Track Record of Management, Portfolio & Financials.Aggregate Leverage (Gearing ) Level.Price to Net Asset Value (NAV)Tenant Mix.Occupancy Rate.Weighted Average Lease Expiry (WALE)Lease Expiry Profile.

One of the simplest and most effective ways to analyze a REIT's debt is to look at its debt to EBITDA ratio. EBITDA stands for earnings before interest, taxes, depreciation and amortization. A higher ratio means higher leverage and more risk. A good rule of thumb is to look for a ratio between 4x and 6x.

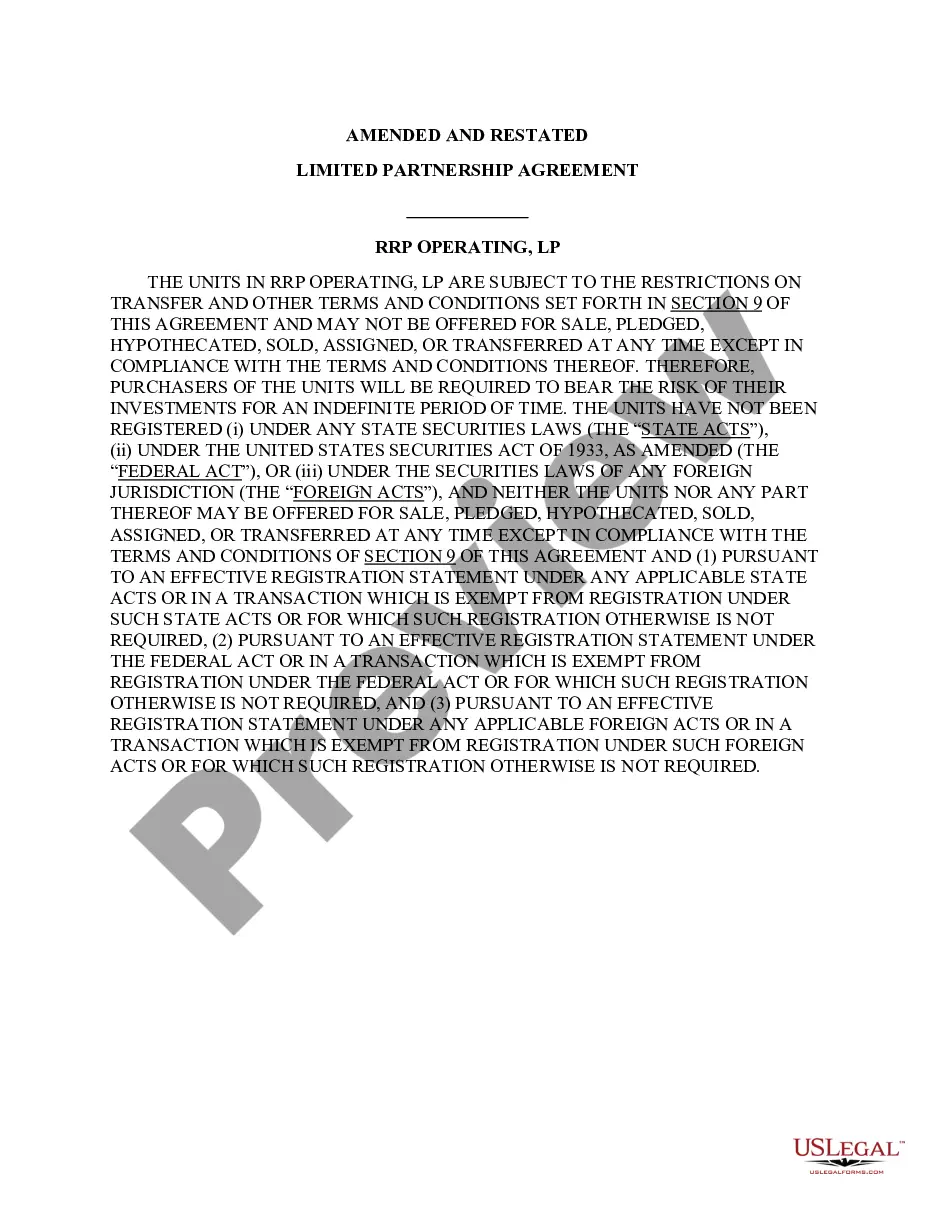

4. 2022 An UPREIT (short for umbrella partnership real estate investment trust) describes a structure in which a. REIT owns all of its properties and conducts all of its business through a limited partnership subsidiary. known as an operating partnership (the OP)