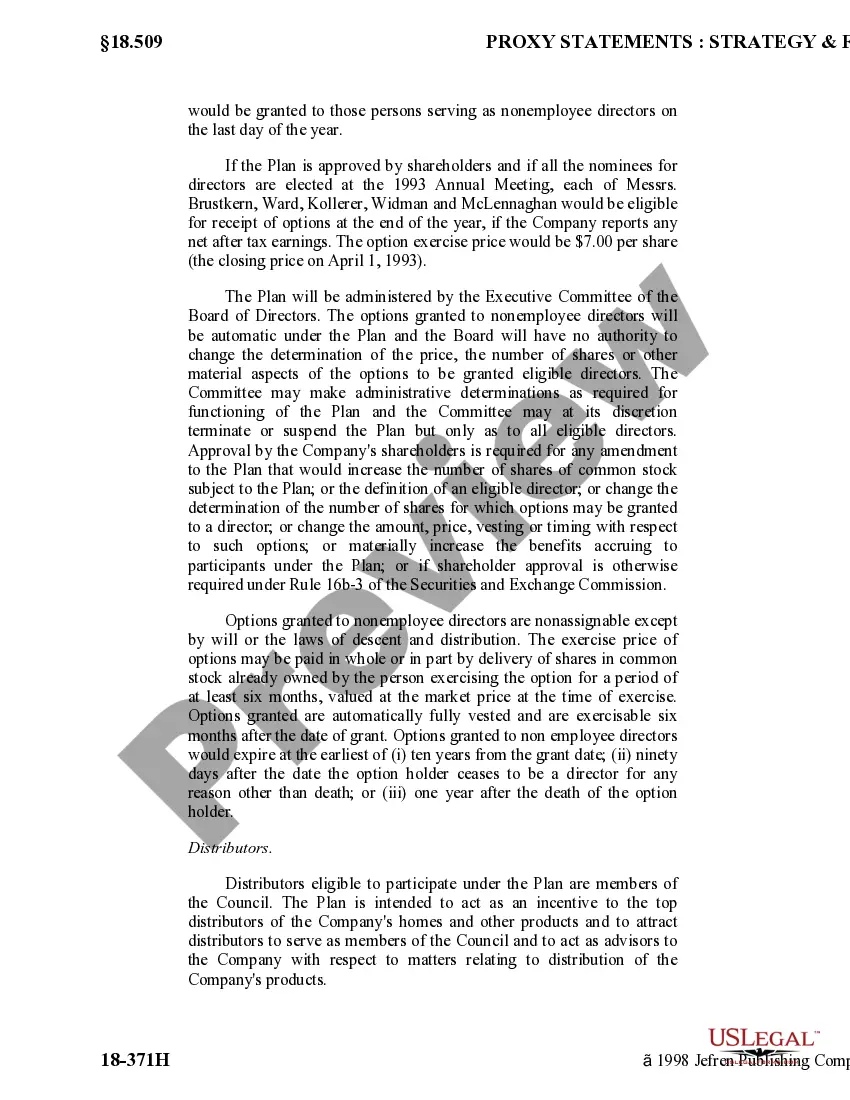

Suffolk New York Directors and Distributors Stock Option Plan

Description

How to fill out Directors And Distributors Stock Option Plan?

If you require a dependable supplier of legal documents to obtain the Suffolk Directors and Distributors Stock Option Plan, look no further than US Legal Forms. Whether you aim to initiate your LLC enterprise or manage the distribution of your assets, we have you covered. You do not need to be an expert in law to find and download the correct form.

Simply select to search for or browse the Suffolk Directors and Distributors Stock Option Plan, either by a keyword or by the state/county for which the form is intended.

After locating the required form, you can Log In and download it or save it in the My documents tab.

Don't have an account? It's easy to get started! Just find the Suffolk Directors and Distributors Stock Option Plan template and review the form's preview and description (if available). If you’re confident about the template’s legal terminology, go ahead and click Buy now. Register for an account and select a subscription plan. The template will be ready for download as soon as the payment is finalized.

Managing your legal-related affairs doesn’t need to be costly or time-intensive. US Legal Forms is here to demonstrate that. Our extensive collection of legal forms makes these tasks less expensive and more affordable. Establish your first business, organize your advance care planning, draft a real estate agreement, or complete the Suffolk Directors and Distributors Stock Option Plan - all from the convenience of your home. Sign up for US Legal Forms today!

- You can choose from over 85,000 forms categorized by state/county and case.

- The user-friendly interface, numerous learning resources, and committed support team make it simple to obtain and complete various documents.

- US Legal Forms is a reputable service providing legal forms to millions since 1997.

Form popularity

FAQ

Essentially, this is an agreement which grants the employee eligibility to purchase a limited amount of stock at a predetermined price. The resulting shares that are granted are typically restricted stock. There is no obligation for the employee to exercise the option, in which case the option will lapse.

On June 30, the SEC approved rules requiring shareholder approval of equity compensation plans, including stock option plans. The new rules will also require approval for repricings and material plan changes.

The core elements of an Employee Stock Option Plan include: Definitions, Option Commitment Certificate, Grant of Options, Conditions of Options, Vesting, and Exercise of Option, Termination of Participation, Payment.

The three main types of employee stock plans are: stock bonus plans, stock purchase plans, and stock option plans.

Therefore, under the present status of the law on stock options, directors of corporations, unless they are also employees thereof, are not eligible to receive the favorable tax treatment of restricted or non-restricted stock options.

Basically, as the company profits, employees profit as well. Thus, stock options are a way to create a loyal partnership with employees. Stock options are a way for companies to motivate employees to be more productive. Through stock options, employees receive a percentage of ownership in the company.

Aligning Interests By paying executives in stock options, executives receive a direct and personal financial incentive to better the company's performance. Executives also have a disincentive to mess up, because if share prices prices drop as a result of bad performance, executives lose lucrative options.

While private companies may have shareholders, stock issues by private companies are not traded on the public exchanges. Private stock options are commonly associated with startup companies, especially in technology where the goal is to create a highly valued company that will eventually go public.

Setting Up Your Employee Stock Option Plan Your company's mission and values should be a major factor in your stock option's plan design. Determine how much of the company you plan to share with early employees and employees that will join your company later. Regular stock grants are sold in shares of 100.

Granting someone options gives them the right to buy shares in the future, but they don't become a shareholder or get any rights associated with the shares until they actually own the shares.