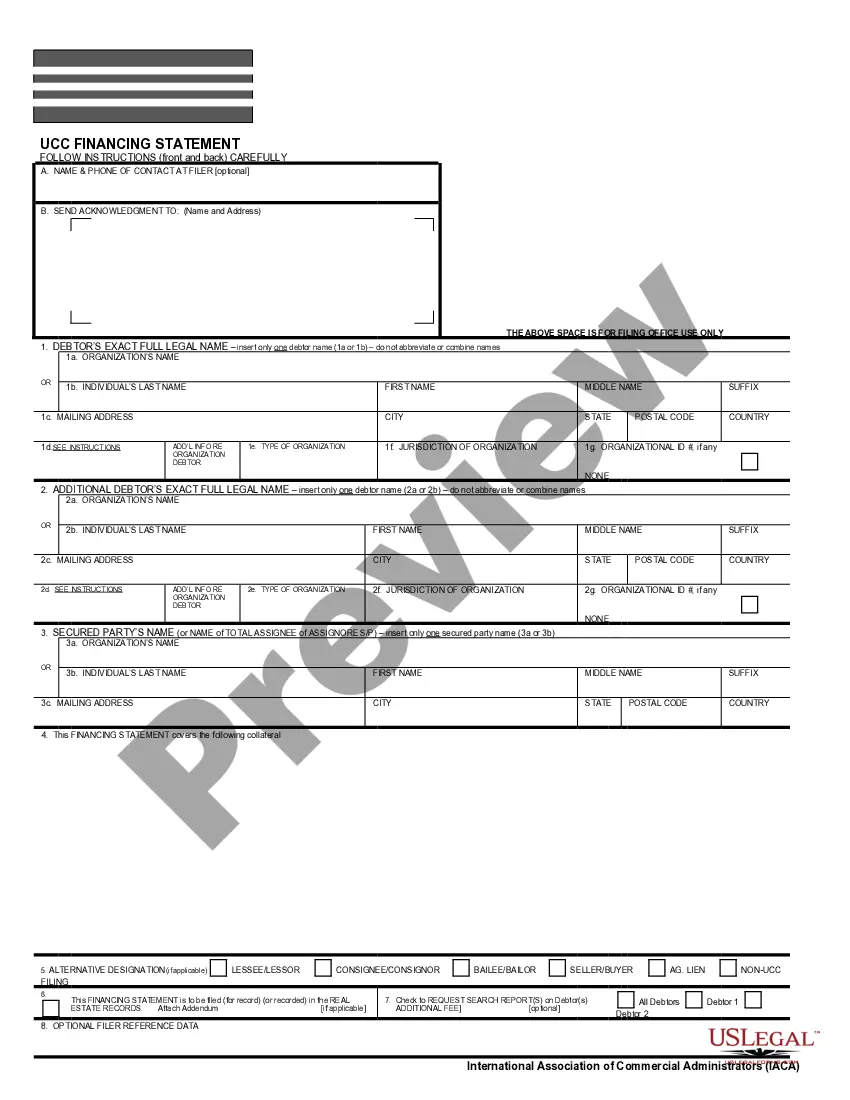

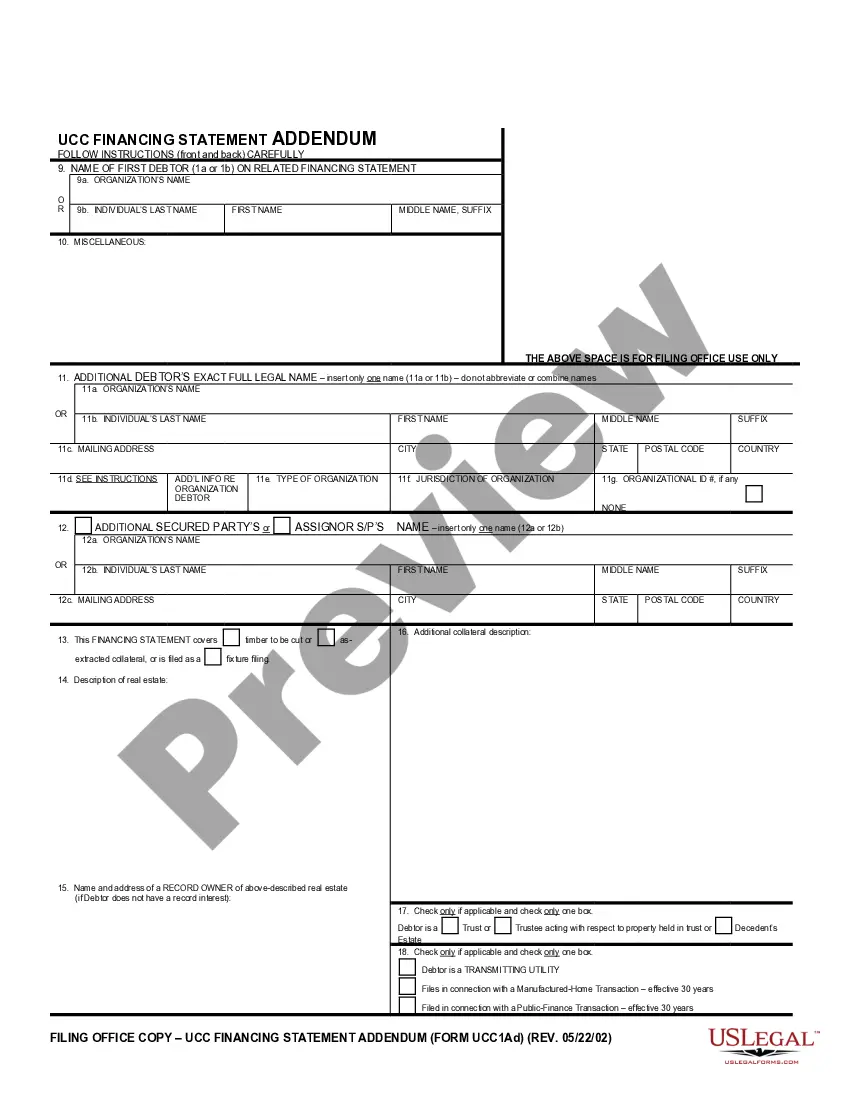

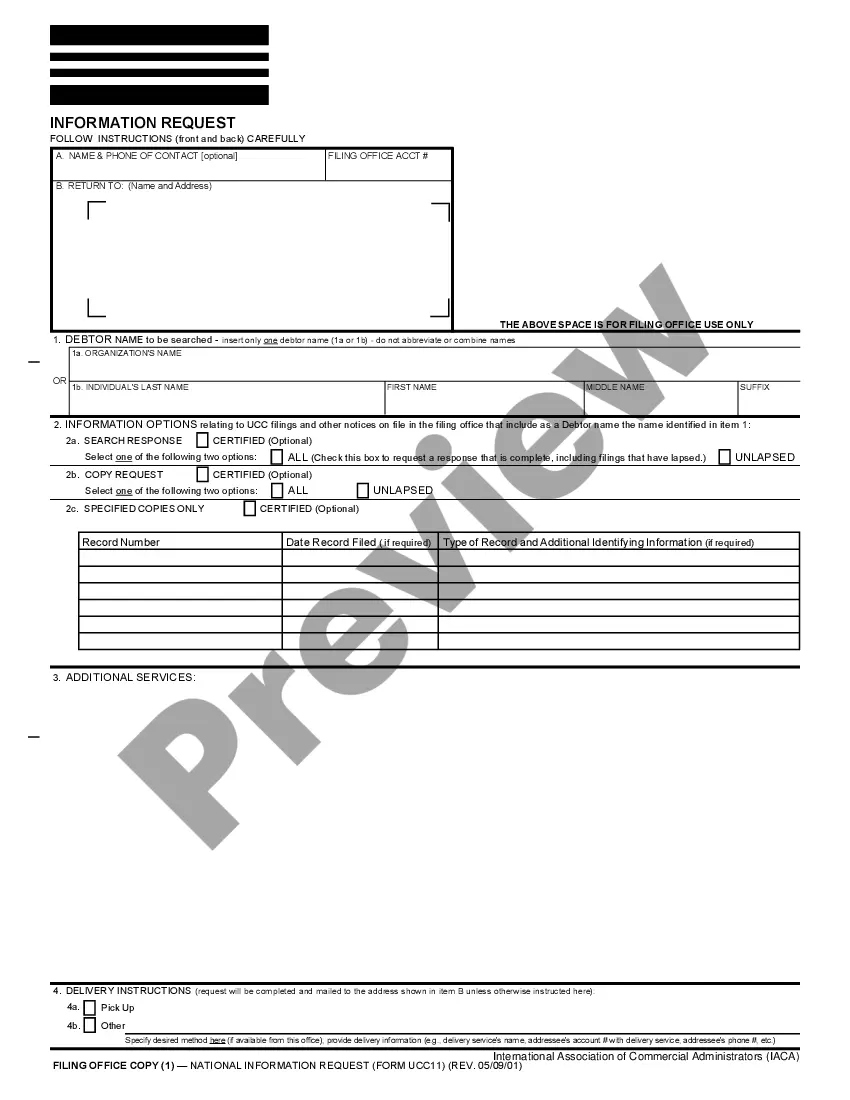

The Idaho Trustee Ch 7 Conversion Fee Waiver is a fee waiver available to individuals who convert from Chapter 7 bankruptcy into Chapter 13 bankruptcy in the state of Idaho. This fee waiver allows individuals to convert their case without having to pay the conversion fee that is usually associated with such a conversion. There are two types of Idaho Trustee Ch 7 Conversion Fee Waiver: a full fee waiver, which waives the entirety of the conversion fee, and a partial fee waiver, which waives a portion of the conversion fee. Both waivers are subject to certain eligibility requirements, such as having the necessary documentation, having a current income, and meeting other criteria.

Idaho Trustee Ch 7 Conversion Fee Waiver

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Trustee Ch 7 Conversion Fee Waiver?

How much duration and assets do you typically allocate towards creating official documentation.

There’s a larger chance to obtain such forms than recruiting legal professionals or squandering hours browsing the internet for a fitting template.

An additional benefit of our library is the ability to access previously acquired documents that you securely keep in your profile under the My documents tab. Retrieve them at any time and redo your paperwork whenever necessary.

Conserve time and effort in preparing legal documentation with US Legal Forms, a highly regarded online service. Register with us today!

- Review the document content to confirm it aligns with your state requirements. To do this, read the document description or utilize the Preview option.

- If your legal form does not fulfill your needs, find an alternative using the search bar located at the top of the page.

- If you already possess an account with us, Log In and retrieve the Idaho Trustee Ch 7 Conversion Fee Waiver. If not, move on to the next steps.

- Click Buy now after you identify the correct form. Select the subscription plan that best fits you in order to take advantage of our library’s complete offerings.

- Register for an account and settle your subscription fee. You may complete the payment via credit card or PayPal - our service guarantees full safety for that.

- Download your Idaho Trustee Ch 7 Conversion Fee Waiver onto your device and complete it on a printed version or electronically.

Form popularity

FAQ

The main cons to Chapter 7 bankruptcy are that most unsecured debts won't be erased, you may lose nonexempt property, and your credit score will likely take a temporary hit. While a successful bankruptcy filing can give you a fresh start, it's important to do your research before deciding what's right for you.

Chapter 7 is your better bet if you are hopelessly awash in debt from credit cards, medical bills, personal loans, and/or car loans and your income simply cannot keep up. As noted above, you're most likely going to get to keep most of your assets while erasing your unsecured debt.

In a Chapter 7 bankruptcy, assets are liquidated to pay creditors, with secured debts having priority over unsecured debts. In a Chapter 11 bankruptcy, a company is restructured under the supervision of a trustee appointed by the court. The company continues to operate, paying its debts back with future earnings.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

Chapter 11's disadvantages include: Not shielding sole proprietors from creditors seeking repayment. It's expensive, thanks to the need for legal and other professional advice. Cases can take a long time. The business may not be able to sell assets, borrow or make other decisions without court approval.

Under Chapter 11 bankruptcy, a business or person generally gets to keep most of their assets, though the debtor could propose to sell many of their assets as part of the reorganization plan.

Chapter 7 cases are typically only filed voluntarily by the debtor. The primary purpose of a Chapter 11 bankruptcy is to give business entities and individuals with large amounts of debt an opportunity to reorganize their financial affairs.

Bankruptcy is a legal process where you're declared unable to pay your debts. It can release you from most debts, provide relief and allow you to make a fresh start. You can enter into voluntary bankruptcy. To do this you need to complete and submit a Bankruptcy Form.