San Antonio Texas Motion to redeem

Category:

State:

Multi-State

City:

San Antonio

Control #:

US-BK-0013

Format:

Word

Instant download

Description

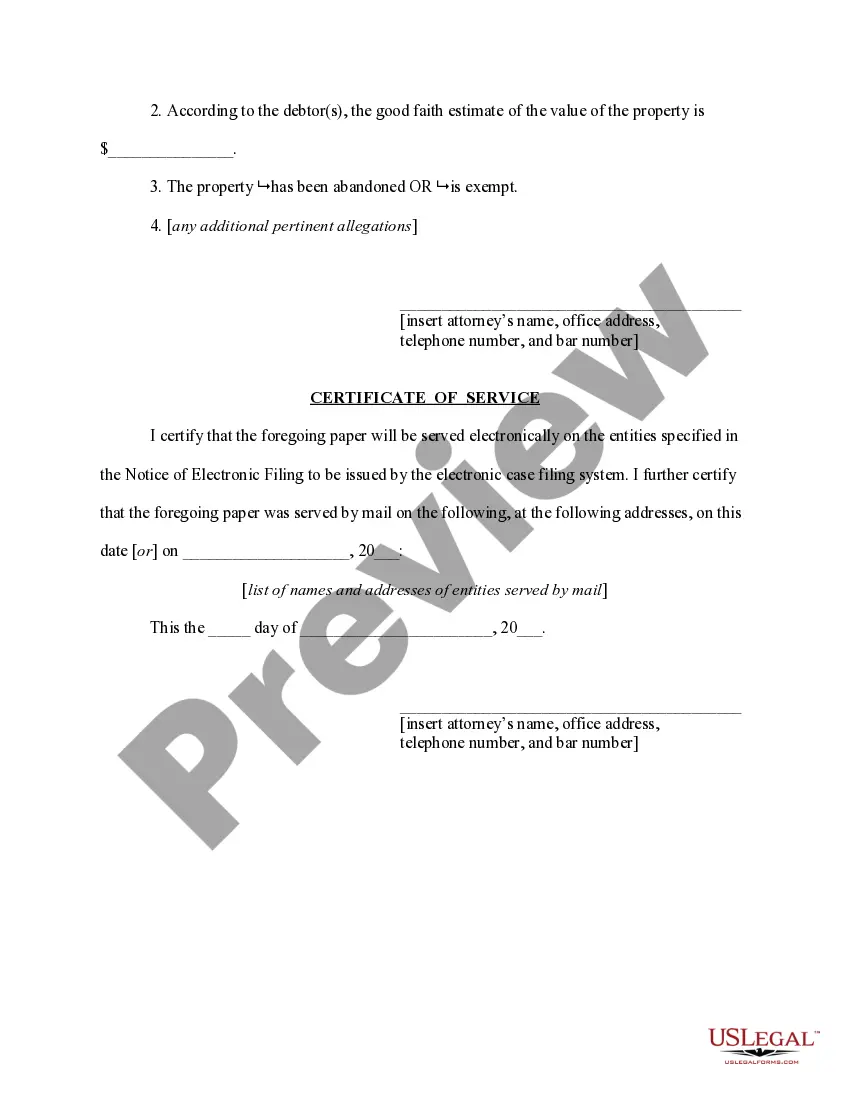

Motion to redeem

Free preview