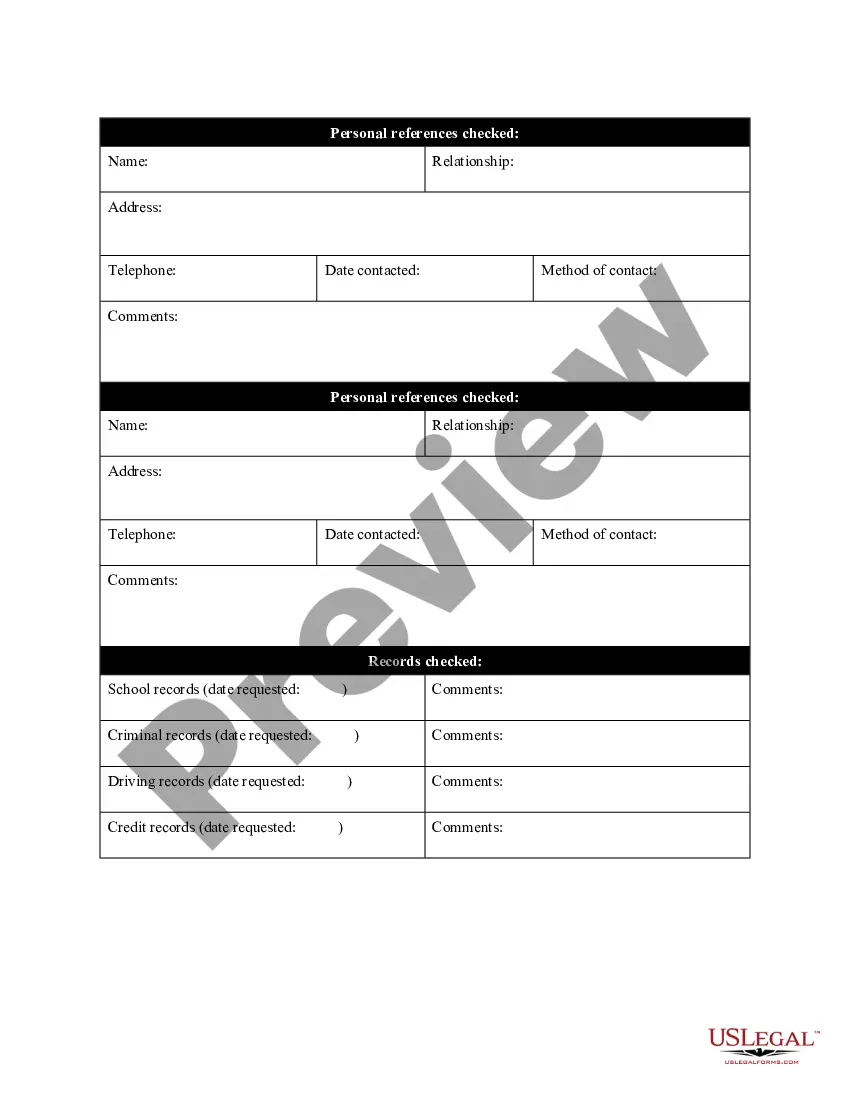

Bexar Texas Reference Check Control Form

Description

How to fill out Reference Check Control Form?

Laws and regulations in every domain differ across the nation.

If you aren't a lawyer, it can be challenging to navigate through diverse standards when it comes to crafting legal documents.

To sidestep costly legal support while preparing the Bexar Reference Check Control Form, you require a certified template valid for your locality.

This is the simplest and most affordable method to obtain current templates for any legal requirements. Find them all in just a few clicks and keep your documents organized with US Legal Forms!

- Assess the page content to confirm you have located the appropriate sample.

- Utilize the Preview option or refer to the form description if it's accessible.

- Look for another document if there are discrepancies with any of your requirements.

- Click on the Buy Now button to acquire the template once you find the suitable one.

- Select one of the subscription options and Log In or create a new account.

- Decide how you wish to pay for your subscription (via credit card or PayPal).

- Choose the format you want to save the file as and click Download.

- Fill out and sign the template in writing after printing or complete it electronically.

Form popularity

FAQ

The Texas Constitution sets out five basic rules for property taxes in our state: Taxation must be equal and uniform. No single property or type of property should pay more than its fair share. The property taxes you pay are based on the value of property you own.

There is no fee for eService and all Optional Services are priced by the Court.

The appraised home value for a homeowner who qualifies his or her homestead for exemptions in the preceding and current year may not increase more than 10 percent per year.

How To eFile. Choose an electronic filing service provider (EFSP) at eFileTexas.gov. An electronic filing service provider (EFSP) is required to help you file your documents and act as the intermediary between you and the eFileTexas.gov system. For eFiling questions you may call 210-335-2496 or 855-839-3453.

You must sign the petition in the presence of a Texas notary and confirm that all statements in the document are true. After witnessing your signature and reviewing your identification, the notary must also sign the document. File the petition and order with the Bexar County District Clerk.

Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices. PROPERTY SEARCH. Search property by name, address, or property ID.

The Bexar County Appraisal District is responsible for accurately valuing the houses in Bexar County. Overall, the average, or an ideal fair market value, should be extremely close to 100%. This is also called the median. The median is what defines the middle value.

Take the Petition and the copies to the District Clerk's Civil Filing Department. The Civil Filing Department is in the Paul Elizondo Tower at 101 W Nueva, Suite 216. The phone number is 210-335-2621. Turn in your Petition and copies.

EFileTexas.Gov Official E-Filing System for Texas. applying technology that enables everyone access to our justice system. e-Filing is now mandatory for all attorneys filing civil, family, probate, or criminal cases in the Supreme Court, Court of Criminal Appeals, Courts of Appeals, and all district and county courts

Fee Schedule FAMILY2022 FEERemoval of disabilities of minority (emancipation)$350.00Enforcement of a foreign decree or support order$350.00Change of name (minor or adult)$350.00Application for writ of habeas corpus (Child)$350.0011 more rows