Clark Nevada Notice of Qualifying Event from Employer to Plan Administrator

Description

How to fill out Clark Nevada Notice Of Qualifying Event From Employer To Plan Administrator?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Clark Notice of Qualifying Event from Employer to Plan Administrator, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Clark Notice of Qualifying Event from Employer to Plan Administrator from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Clark Notice of Qualifying Event from Employer to Plan Administrator:

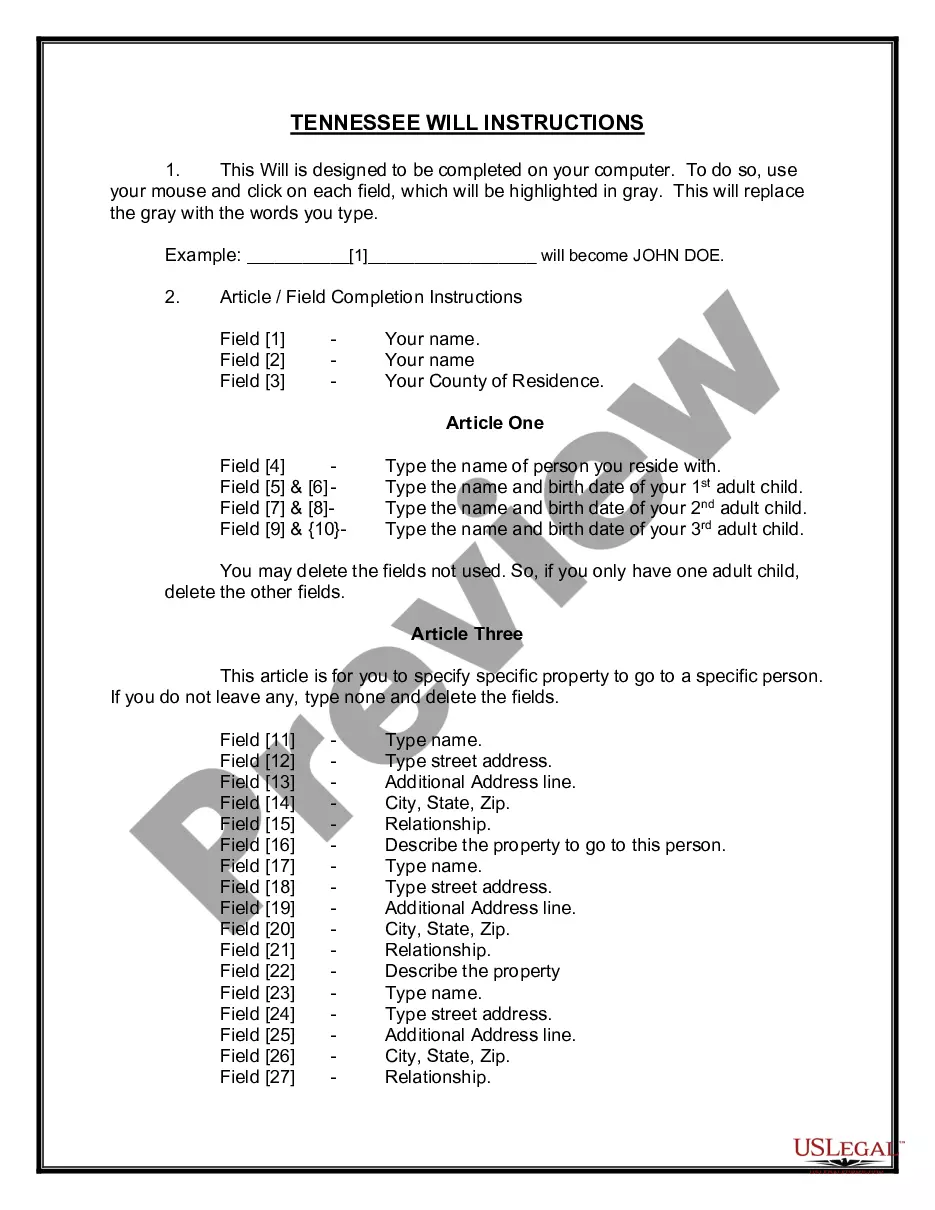

- Analyze the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

The following are qualifying events: the death of the covered employee; a covered employee's termination of employment or reduction of the hours of employment; the covered employee becoming entitled to Medicare; divorce or legal separation from the covered employee; or a dependent child ceasing to be a dependent under

With all paperwork properly submitted, your COBRA coverage should begin on the first day of your qualifying event (for example, the first day you are no longer with your employer), ensuring no gaps in your coverage.

A waiting period is the amount of time an insured must wait before some or all of their coverage comes into effect. The insured may not receive benefits for claims filed during the waiting period. Waiting periods may also be known as elimination periods and qualifying periods.

COBRA is always retroactive to the day after your previous coverage ends, and you'll need to pay your premiums for that period too.

If you enroll in COBRA before the 60 days are up, your coverage is then retroactive, as long as you pay the retroactive premiums. This means that if you incur medical bills during your election period, you can retroactively and legally elect COBRA and have those bills covered.

This term may also be used to describe the total number of enrollees in a health insurance plan. Enrollment Period: The period of time during which an eligible employee or eligible person may sign up for a group health insurance plan.

COBRA continuation coverage may be terminated if we don't receive timely payment of the premium. What is the grace period for monthly COBRA premiums? After election and initial payment, qualified beneficiaries have a 30-day grace period to make monthly payments (that is, 30 days from the due date).

A COBRA administrator manages the requirements of a program, which include notifying eligible participants about their rights, collecting premiums, providing notice of eligibility and other forms (enrollment), along with how long the coverage period is. Administrators also must provide notice when coverage ends.

Which of the following is considered a qualifying event under cobra? Divorce. Other qualifying events include the voluntary termination of employment; an employee's change from full time to part time; or the death of the employee.

COBRA allows you to continue coverage typically for up to 18 months after you leave your employer. You can buy an Affordable Care Act (ACA) plan through a public exchange on the health insurance marketplace. Or you can switch to your spouse or partner's plan, if possible.