Harris Texas Fixed Asset Removal Form

Description

How to fill out Fixed Asset Removal Form?

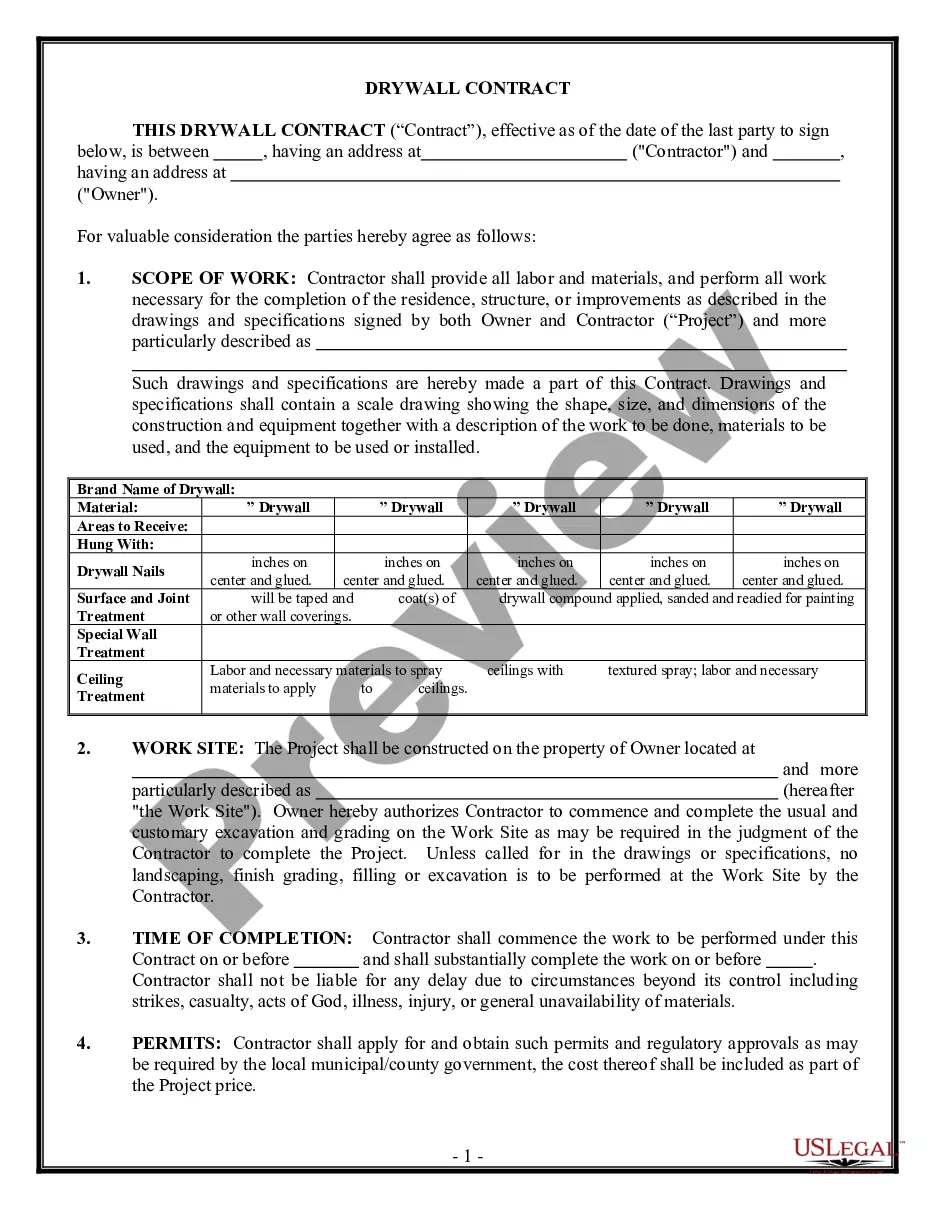

Do you require to swiftly compose a legally-binding Harris Fixed Asset Removal Form or possibly any other document to oversee your personal or business matters.

You can choose between two alternatives: employ a professional to create a legal document for you or draft it entirely by yourself. The good news is, there's an additional option - US Legal Forms.

If the document includes a description, ensure to verify its intended purpose.

Start the search anew if the template isn’t what you were looking for by utilizing the search box in the header.

- It will assist you in obtaining professionally drafted legal documents without exorbitant fees for legal services.

- US Legal Forms provides a vast catalog of over 85,000 state-compliant form templates, including the Harris Fixed Asset Removal Form and form packages.

- We offer documents for a diverse range of life situations: from divorce paperwork to real estate documents.

- We have been established for more than 25 years and have built a strong reputation among our clients.

- Here's how you can join them and acquire the required template without added complications.

- To begin, thoroughly check if the Harris Fixed Asset Removal Form is customized to your state's or county's laws.

Form popularity

FAQ

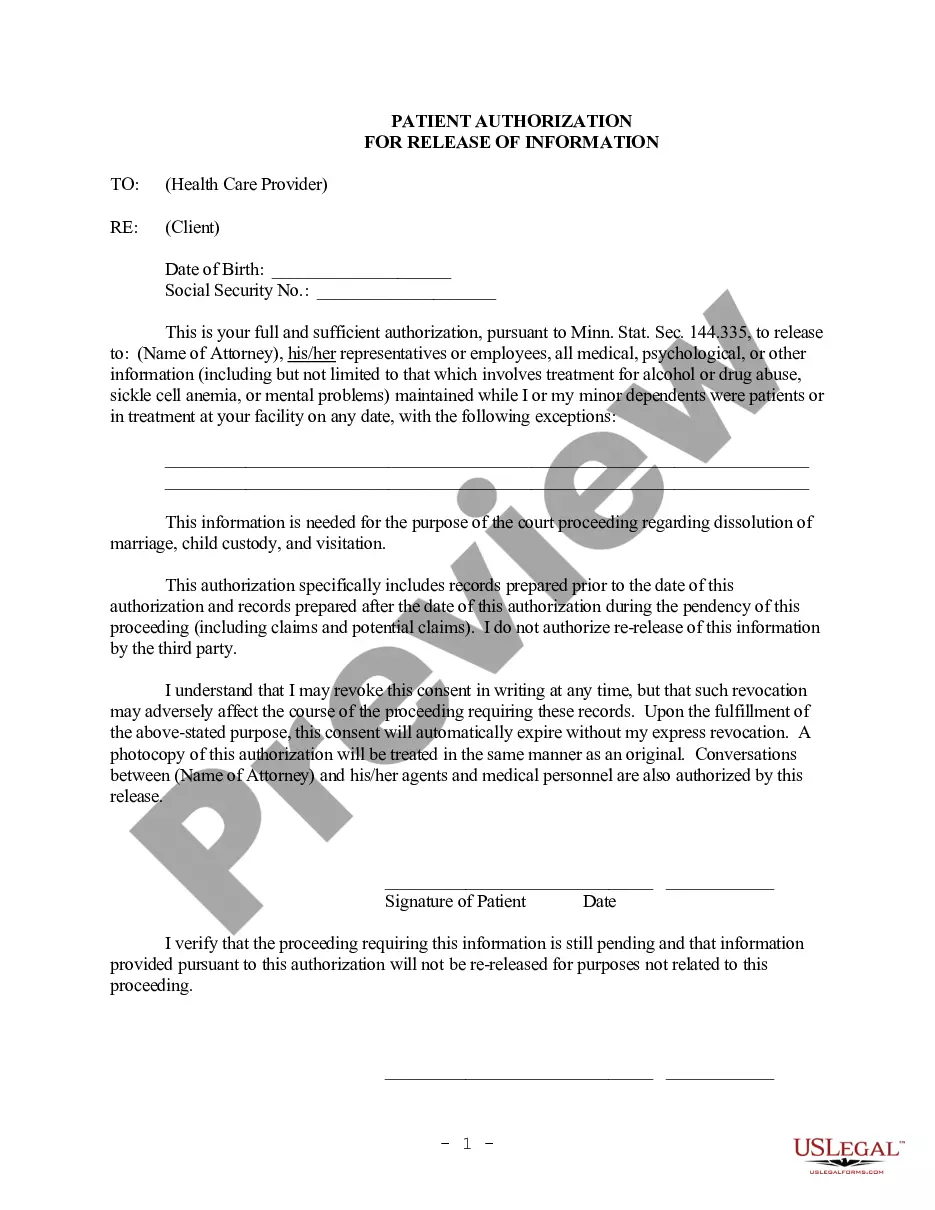

The fixed assets' disposal is defined as the removal of a fixed asset from the assets of a company. The disposal of a fixed asset is an extraordinary transaction, that is to say an unusual one. The disposal price is therefore an exceptional product.

2) If the Asset has been Sold Suppose the fully depreciated asset has been sold. In that case, the total accumulated depreciation will be written off. read more against the asset, and no impact will be given in the p&l statement since the total depreciation has already been recorded.

Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance sheet, recording receipt of cash and recognizing any resulting gain or loss in income statement.

Fully depreciated asset: With zero proceeds from the disposal, debit accumulated depreciation and credit the fixed asset account. Gain on asset sale: Debit cash for the amount received, debit all accumulated depreciation, credit the fixed asset, and credit the gain on sale of the asset account.

Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance sheet, recording receipt of cash and recognizing any resulting gain or loss in income statement.

The Fixed Asset Disposal Form Template is used to document the disposal of old or faulty equipment. Include information such as the name of the person who authorized the disposal, the method of disposal as well as details about costs in case the asset was sold.

When an asset is being sold, a new account in the name of Asset Disposal Account is created in the ledger. This account is primarily created to ascertain profit on sale of fixed assets or loss on the sale of fixed assets.

If the fully depreciated car is sold or scrapped, the following accounting entry is needed: Debit to Cash for the amount received. Debit Accumulated Depreciation for the car's accumulated depreciation. Credit the asset account containing the car's cost.

An asset disposal form is a form used to document the disposal process of assets. It is used by banks, state agencies, and other businesses to keep track of their assets. It is also used to record the items that are being disposed of.

ASSET DISPOSAL FORM. Page 1. FORM FD14.0906. THIS FORM IS USED TO DOCUMENT THE DISPOSAL OF BOTH MAJOR ASSETS AND MINOR EQUIPMENT.