Queens New York Credit Application

Description

How to fill out Credit Application?

Drafting legal paperwork can be burdensome. Furthermore, if you opt to engage a legal expert to create a business contract, documents for property transfer, prenuptial agreement, dissolution papers or the Queens Credit Application, it could entail significant expenses.

So what is the most sensible approach to conserve both time and finances while producing valid forms that fully adhere to your state and local regulations? US Legal Forms presents a superb option, whether you're in search of templates for individual or commercial purposes.

Don't fret if the form does not meet your specifications - search for the appropriate one in the header.

- US Legal Forms is the largest online repository of state-specific legal documents, offering users access to current and professionally verified forms for any scenario, all compiled in one location.

- As a result, if you require the most recent version of the Queens Credit Application, you can effortlessly find it on our platform.

- Acquiring the documents takes minimal time.

- Those who already hold an account should verify their subscription status to ensure it's valid, Log In, and select the template with the Download button.

- If you have not yet subscribed, here’s how you can obtain the Queens Credit Application.

- Browse through the page and confirm there is a sample available for your area.

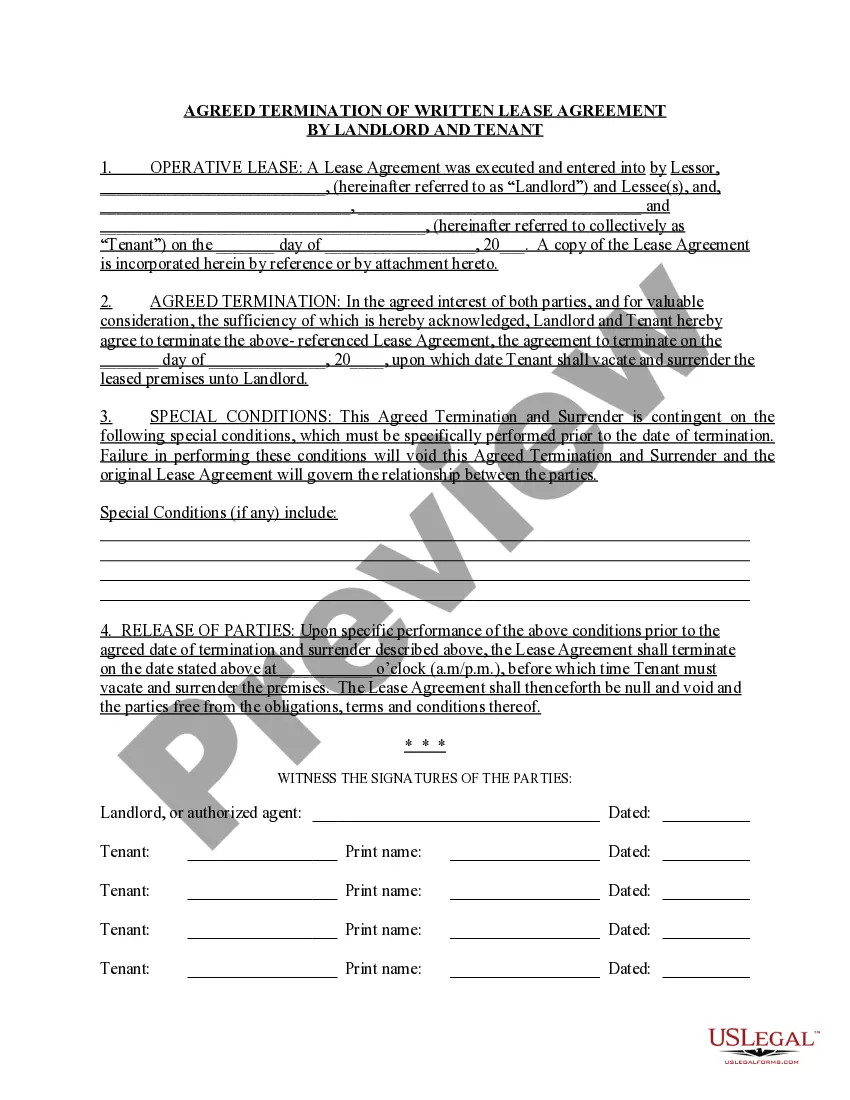

- Review the form description and utilize the Preview option, if available, to ensure it’s the form you seek.

Form popularity

FAQ

To apply for the Enhanced STAR exemption, submit the following to your assessor: Form RP-425-IVP, Supplement to Form RP-425-E , and. Form RP-425-E, Application for Enhanced STAR Exemption (include the Social Security numbers of all owners of the property and any of their spouses who reside at the property).

The Maximum Enhanced STAR exemption savings on our website is $1,000. The total amount of school taxes owed prior to the STAR exemption is $400. The Enhanced STAR exemption amount is $74,900 and the school tax rate is $21.123456 per thousand.

Summary star ratings are an average of a provider's question level star ratings. Patient star ratings are calculated by dividing the patient's aggregate mean score by 20. For clients using only one question in the patient star rating, the star rating would simply be the individual question score, divided by 20.

Follow these steps to calculate the STAR savings amount: Multiply the Enhanced STAR exemption amount by the school tax rate (excluding any library levy portion) divided by 1000. The lesser of Steps 1, 2, or 3 is the Enhanced STAR savings amount.

If you have not received your refund within 30 days of this date, call 518-457-5149.

The STAR exemption program is closed to all new applicants. If you're a new homeowner or you weren't receiving the STAR exemption on your current home in 2015, you can Register for the STAR credit to receive a check directly from New York State.

The Maximum Enhanced STAR exemption savings on our website is $1,000. The total amount of school taxes owed prior to the STAR exemption is $4,000. The Enhanced STAR exemption amount is $74,900 and the school tax rate is $21.123456 per thousand.

More information is available at or by calling (518) 457-2036. You may apply for the Basic STAR or Enhanced STAR tax exemption with the NYC Department of Finance if: You owned your property and received STAR in 2015-16 but later lost the benefit and would like to apply to have it restored.

Residents everywhere in NY who have basic STAR who make between $75,000 and $150,000 would get a credit worth 115% of the STAR amount. Residents in Upstate NY who have basic STAR who make between $150,000 and $250,000 would get a credit worth 66% of the STAR amount. The amount is 105% in New York City.