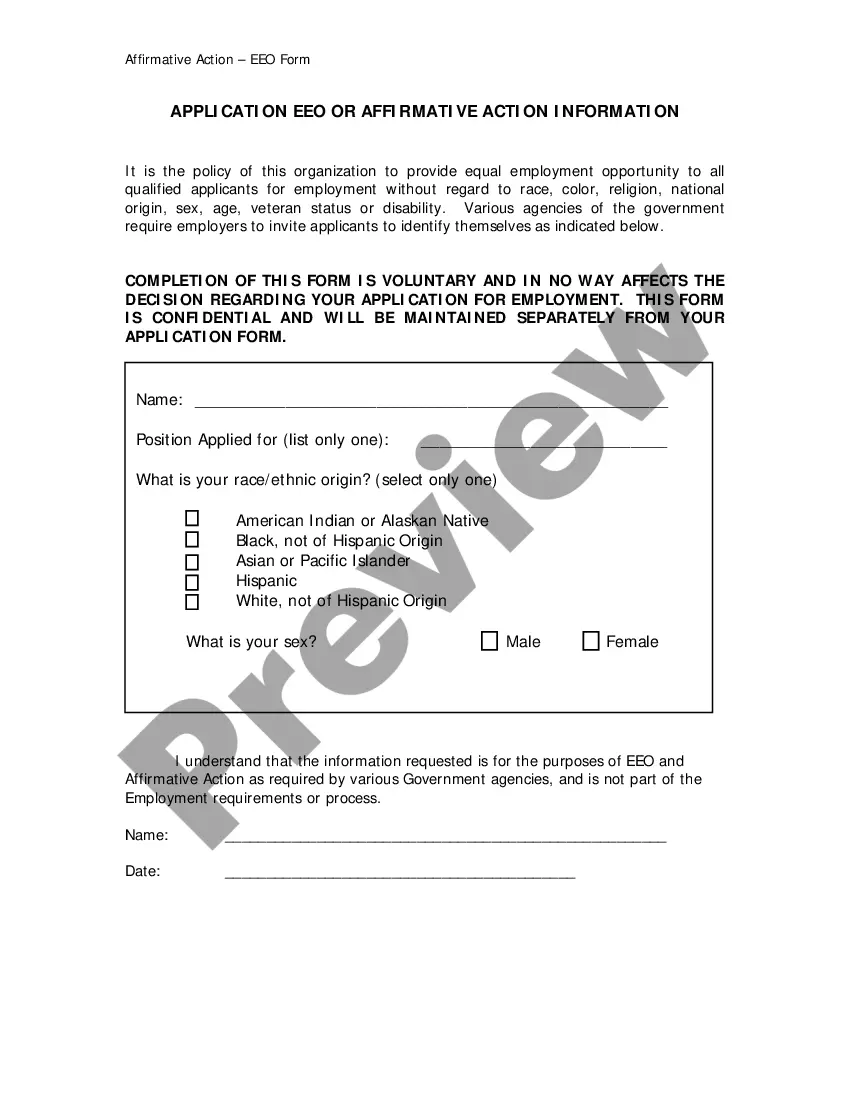

Bexar Texas Affirmative Action Information Form

Description

How to fill out Affirmative Action Information Form?

Do you require to swiftly compose a legally-binding Bexar Affirmative Action Information Form or perhaps any other document to handle your personal or business affairs.

You can choose from two alternatives: reach out to a specialist to create a legal document for you or create it completely by yourself. Fortunately, there's a third option - US Legal Forms.

If the document contains a description, be sure to verify what it is appropriate for.

If the document isn’t what you were seeking, restart the search using the search bar at the top. Select the plan that best meets your needs and proceed to payment. Choose the file format you wish to receive your document in and download it. Print it, fill it out, and sign where indicated. If you have already created an account, you can effortlessly Log In to it, find the Bexar Affirmative Action Information Form template, and download it. To re-download the document, simply navigate to the My documents tab.

- It will assist you in obtaining well-crafted legal documents without incurring exorbitant charges for legal assistance.

- US Legal Forms offers an extensive assortment of over 85,000 state-compliant form templates, including the Bexar Affirmative Action Information Form and document packages.

- We provide documents for a wide range of life situations: from divorce papers to real estate form templates.

- We have been in the industry for over 25 years and maintain an impeccable reputation among our clients.

- Here's how you can join them and obtain the required template without unnecessary complications.

- To begin, make sure the Bexar Affirmative Action Information Form is customized to your state's or county's requirements.

Form popularity

FAQ

Do you have your Residential Homestead Exemption? To find out, visit our website by clicking the green box here ? application and then mail to BCAD, P.O. Box 830248, San Antonio, TX 78283. For more information, please call 210-335-2251.

The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. This service includes filing an exemption on your residential homestead property, submitting a Notice of Protest, and receiving important notices and other information online.

2022 Document Fee Schedule Document TitleService FeeFiling FeeSmall Claim Petition (small claims petition form)$85.00$54.00Small Counter/Cross/3rd Party Claim$85.00$54.00Subpoena (subpoena form)$85.00 + $10 cashN/ASummons$85.00N/A21 more rows

For Pro Se filers, a Petition for Non-Disclosure can be filed with the County Clerk's Criminal Filing Department located in the basement of the Bexar County Courthouse. The filing fee for a Petition of Non-disclosure is $260.00.

To apply for an exemption, call the Bexar Appraisal District at 210-224-2432. You may also contact their agency directly by email or visit their website to obtain the necessary forms. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records.

The Tarrant Appraisal District has launched their new online website feature that will allow homeowners to apply for the Residence Homestead exemption online. There is no fee for filing a Residence Homestead exemption application.

Choose an electronic filing service provider (EFSP) at eFileTexas.gov. An electronic filing service provider (EFSP) is required to help you file your documents and act as the intermediary between you and the eFileTexas.gov system. For eFiling questions you may call 210-335-2496 or 855-839-3453.

The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. This service includes filing an exemption on your residential homestead property, submitting a Notice of Protest, and receiving important notices and other information online.

Residence Homestead Exemption Applications must be postmarked between January 1 and April 30 of the tax year.