Palm Beach Florida Monthly Cash Flow Plan

Description

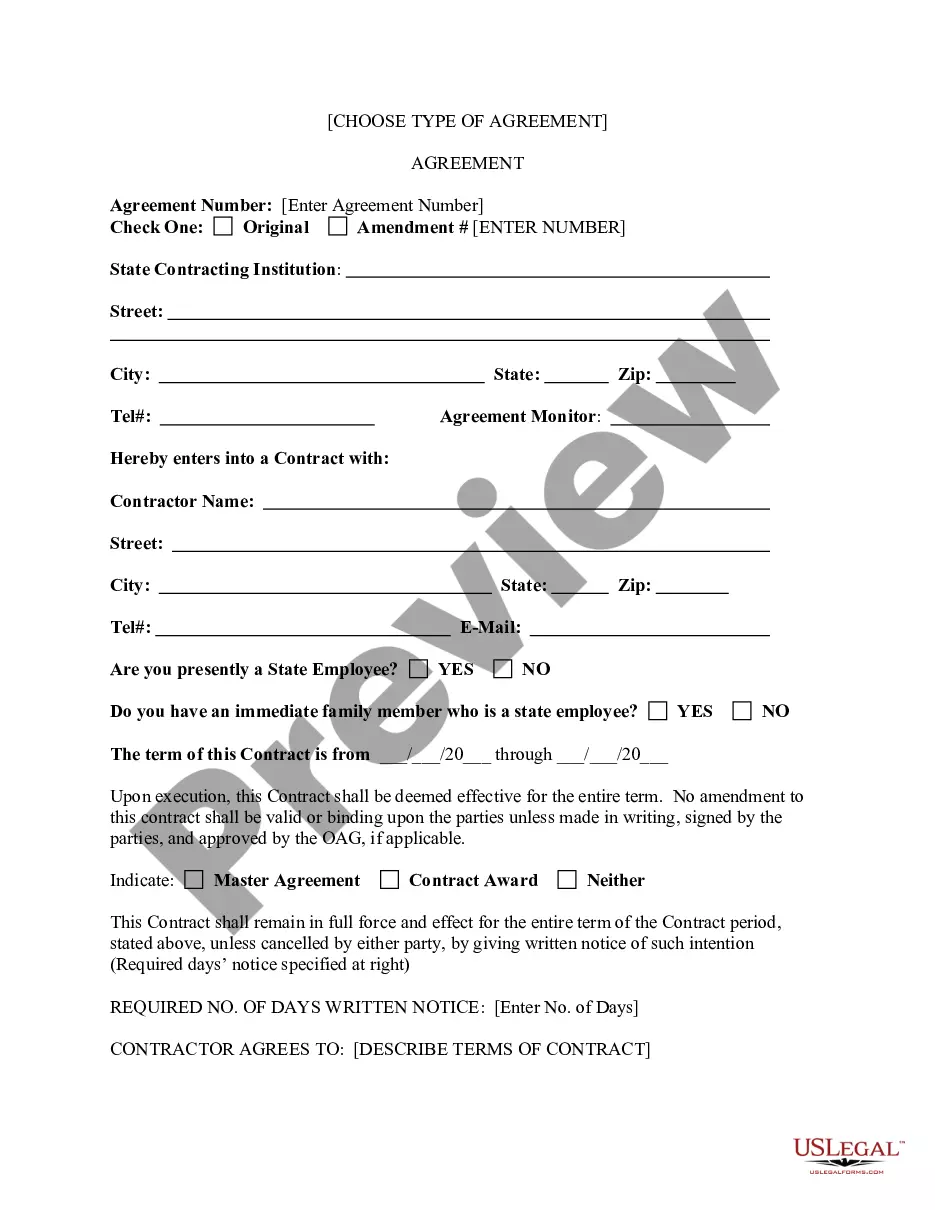

How to fill out Monthly Cash Flow Plan?

Drafting legal documents is essential in the contemporary world.

Nevertheless, you don't always have to seek expert assistance to create some of them from the ground up, including the Palm Beach Monthly Cash Flow Plan, utilizing a service like US Legal Forms.

US Legal Forms boasts over 85,000 documents to choose from across diverse categories such as living trusts, real estate contracts, and divorce forms. All documents are organized by their applicable state, enhancing the search experience.

If you are already a subscriber of US Legal Forms, you can find the appropriate Palm Beach Monthly Cash Flow Plan, Log In to your account, and download it. Naturally, our platform cannot replace an attorney completely. If you face a particularly complex issue, we recommend utilizing the services of an attorney to review your document before finalizing and filing it.

With more than 25 years in the industry, US Legal Forms has established itself as a reliable platform for a variety of legal documents for millions of clients. Join them today and easily obtain your state-compliant paperwork!

- Review the preview and outline of the document (if available) to obtain general insight into what you'll receive after downloading the form.

- Make sure that the template you select is suited to your state/county/region, as state laws can influence the validity of certain documents.

- Examine the associated document templates or restart your search to find the correct file.

- Click Buy now and set up your account. If you already possess an account, choose to Log In.

- Select your option, pick a suitable payment platform, and acquire the Palm Beach Monthly Cash Flow Plan.

- Choose to save the form template in any available file format.

- Navigate to the My documents section to re-download the file.

Form popularity

FAQ

How to calculate projected cash flow Find your business's cash for the beginning of the period.Estimate incoming cash for next period.Estimate expenses for next period.Subtract estimated expenses from income.Add cash flow to opening balance.

byStep Guide on How to Create a Cash Budget Determine the cash inflow to the company in a month.Determine the cash outflow from the company in a month.Ensure that your cash inflow must be greater than the outflow.The ending balance for the first month must be the beginning balance for the second month.

The Statement of Cash Flows (also referred to as the cash flow statement) is one of the three key financial statements that report the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Monthly Cash Flow reports are considered essential month-end financial statements and are often used by CFOs and Analysts to review the cash inflows and outflows of the business. Key functionality in this type of report is parameter driven so the figures are presented automatically when the user runs the report.

, follow these steps to prepare an emergency management cash flow budget. Step 1: Determine the time frame.Step 2: Estimate sales units.Step 3: Estimate sales income.Step 4: Estimate timing of income.Step 5: Itemise and add expenditure.Step 6: Work out surplus or deficit.Step 7: Review sales units.

Accounting experts recommend using three categories to organize cash flow data: operating activities, investing activities, and financing activities. However, there are two possible approaches to reporting cash flow from operating activities: the direct method and the indirect method.

Four steps to a simple cash flow forecast Decide how far out you want to plan for. Cash flow planning can cover anything from a few weeks to many months.List all your income. For each week or month in your cash flow forecast, list all the cash you've got coming in.List all your outgoings.Work out your running cash flow.

In practical terms, a cash flow projection chart includes 12 months laid out across the top of a graph, and a column on the left-hand side with a list of both payables and receivables.

Monthly Cash Flow reports are considered essential month-end financial statements and are often used by CFOs and Analysts to review the cash inflows and outflows of the business. Key functionality in this type of report is parameter driven so the figures are presented automatically when the user runs the report.

Do one month at a time. Enter Your Beginning Balance. For the first month, start your projection with the actual amount of cash your business will have in your bank account. Estimate Cash Coming In. Fill in all amounts you expect to take in during the month.Estimate Cash Going Out.Subtract Outlays From Income.