Maricopa Arizona Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

Laws and regulations in various domains differ across the nation.

If you are not a lawyer, it is simple to become confused amidst numerous standards when it comes to creating legal documents.

To prevent expensive legal fees when drafting the Maricopa Shareholders' Agreement with Unique Allocation of Dividends among Shareholders in a Private Corporation, you require an authenticated template applicable to your region.

That's the easiest and most cost-effective method to obtain current templates for any legal situations. Find them all in just a few clicks and manage your documentation efficiently with US Legal Forms!

- That's when leveraging the US Legal Forms platform becomes advantageous.

- US Legal Forms is a reliable online repository trusted by millions, offering over 85,000 state-specific legal documents.

- It serves as an ideal solution for both professionals and individuals seeking do-it-yourself templates for diverse personal and business needs.

- All the documents can be reused multiple times: once you select a template, it remains accessible in your profile for future use.

- Therefore, if you have an account with a valid subscription, you can easily Log In and re-download the Maricopa Shareholders' Agreement with Unique Allocation of Dividends among Shareholders in a Private Corporation from the My documents section.

- For newcomers, several additional steps are necessary to acquire the Maricopa Shareholders' Agreement with Unique Allocation of Dividends among Shareholders in a Private Corporation.

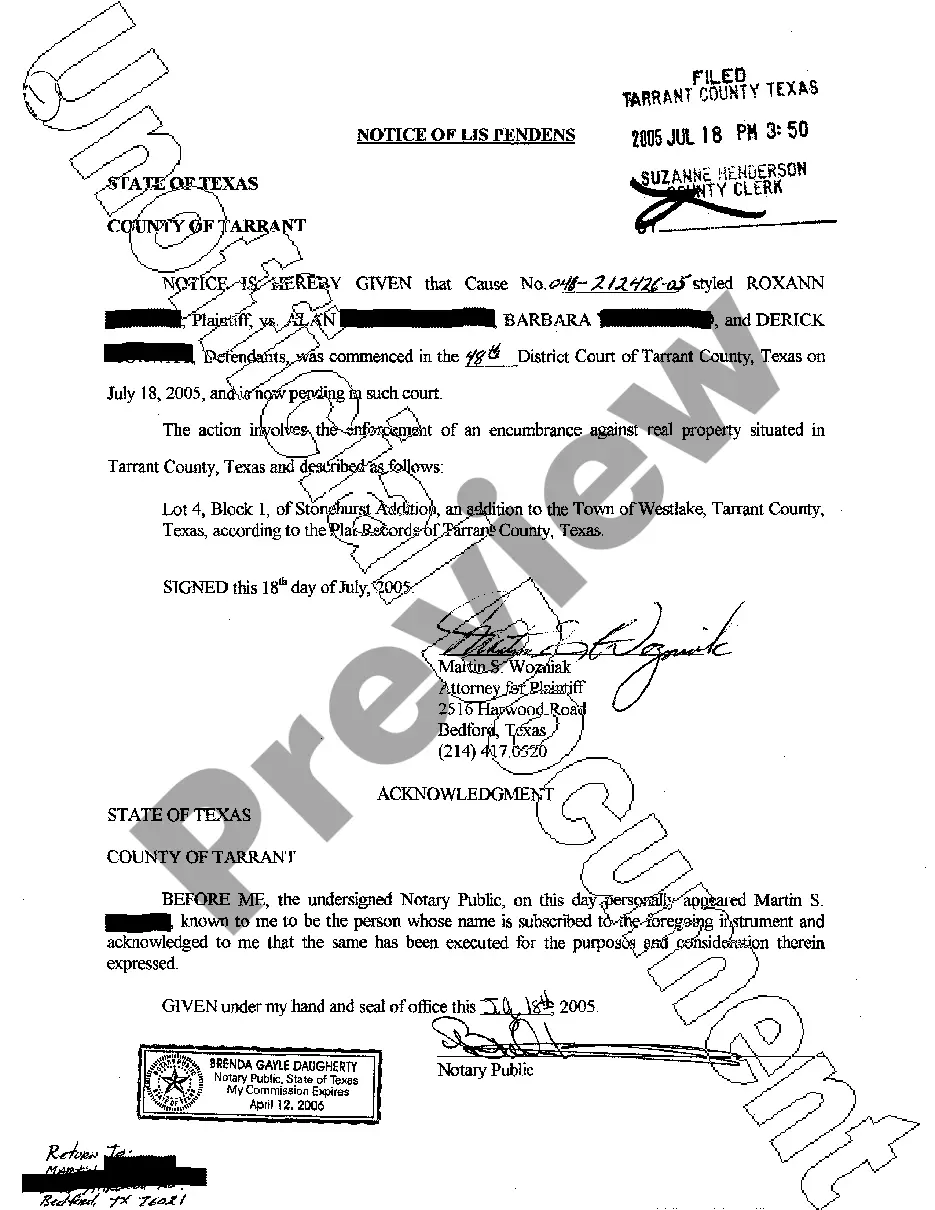

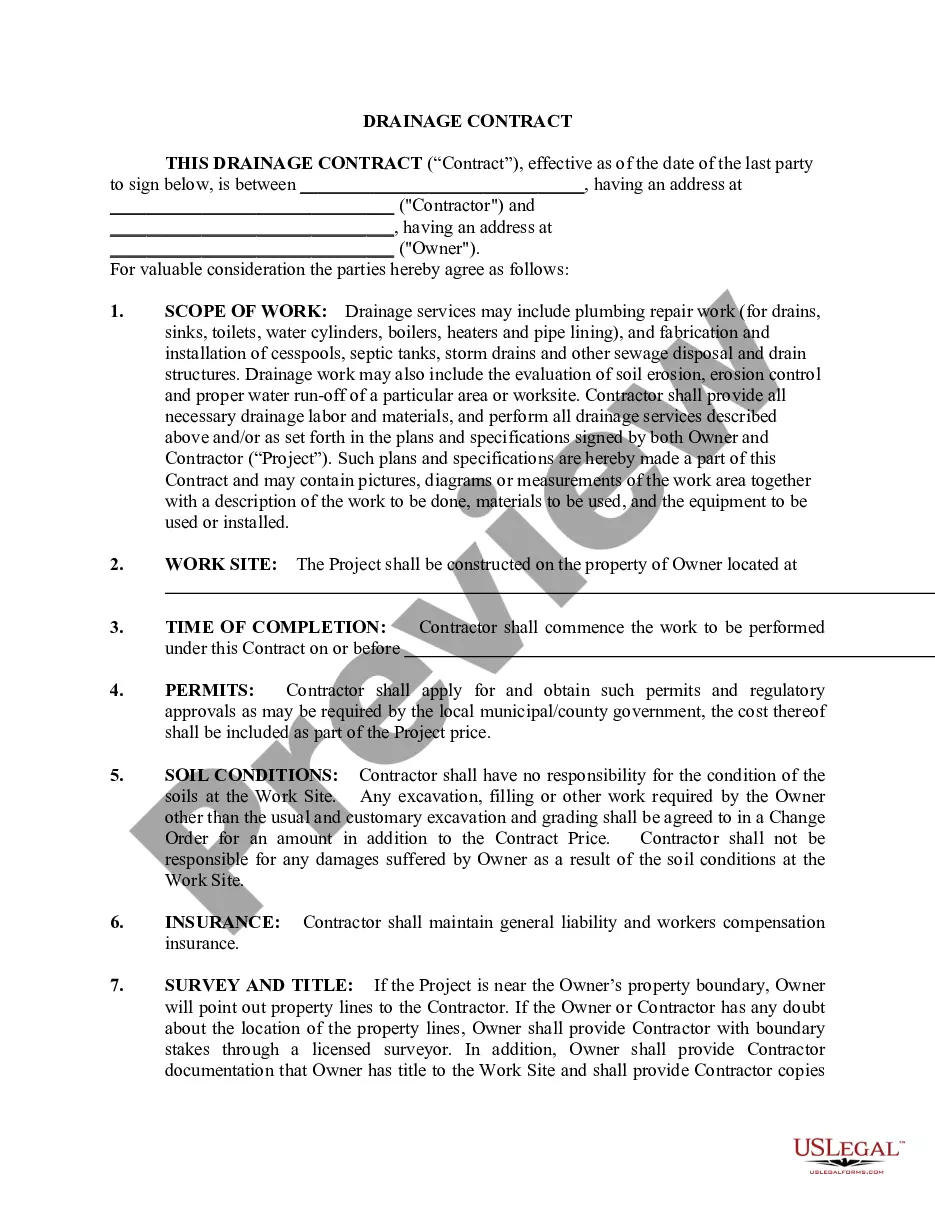

- Review the page content to ensure you've located the correct sample.

- Use the Preview feature or examine the form description if available.

Form popularity

FAQ

Here's the key takeaways. No matter the legal status of your business, you can finalise a shareholders' agreement. A shareholders' agreement should be put down in writing, and signed privately by each party or third party.

A constitution can be changed by a special resolution of the shareholders, which is generally 75% of the shareholders entitled to vote, whereas a shareholders' agreement will generally provide that changes can only be made with 100% shareholder approval.

The shareholders agreement is a document that is highly customized to the specific shareholders and their relationship. It should take priority over the bylaws, and if a conflict is identified the bylaws should be amended to address the issue.

Shareholders' agreements are optional. They're not regulated by law. Most companies don't have them, and yet they're a vital part of many transactions. In the companies that have them, no person or entity can become a shareholder without agreeing to conditions set out in the shareholders' agreement.

However they must be drafted so as to ensure that the agreement is valid and enforceable. A shareholder agreement needs the consent of all shareholders and, unless otherwise specified, all the existing shareholders must consent to any changes or alterations.

Contents Introduction. Step 1: Decide on the issues the agreement should cover. Step 2: Identify the interests of shareholders. Step 3: Identify shareholder value. Step 4: Identify who will make decisions - shareholders or directors. Step 5: Decide how voting power of shareholders should add up.

Sign to Make it Legal The shareholders agreement is a special type of contract called a deed. This means it must be signed in a special way: Print a copy for each shareholder and one for the company directors. You cannot sign online.

Shareholders' agreements are optional. They're not regulated by law. Most companies don't have them, and yet they're a vital part of many transactions. In the companies that have them, no person or entity can become a shareholder without agreeing to conditions set out in the shareholders' agreement.

According to the Canada Business Corporations Act (CBCA), a unanimous shareholder agreement (USA) is an agreement that is among all the shareholders of a corporation and that restricts the powers of directors to manage, or supervise the management of, the business and affairs of the corporation. This is different

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.