Salt Lake Utah Sample Letter for Employee Automobile Expense Allowance

Description

How to fill out Sample Letter For Employee Automobile Expense Allowance?

Whether you intend to launch your business, engage in a contract, request your ID renewal, or settle family-related legal issues, you must assemble specific paperwork that aligns with your local laws and regulations.

Locating the necessary documents may require significant time and effort unless you utilize the US Legal Forms library.

This service offers users access to over 85,000 expertly crafted and validated legal templates for any personal or professional scenario. All documents are organized by state and area of application, making it quick and straightforward to select a version such as Salt Lake Sample Letter for Employee Automobile Expense Allowance.

The forms provided by our site are reusable. With an active subscription, you can access all of your previously obtained documents anytime in the My documents section of your account. Stop squandering time on continual searches for current official paperwork. Join the US Legal Forms platform and maintain your documents in order with the most extensive online library of forms!

- Ensure the example fulfills your personal requirements and complies with state law regulations.

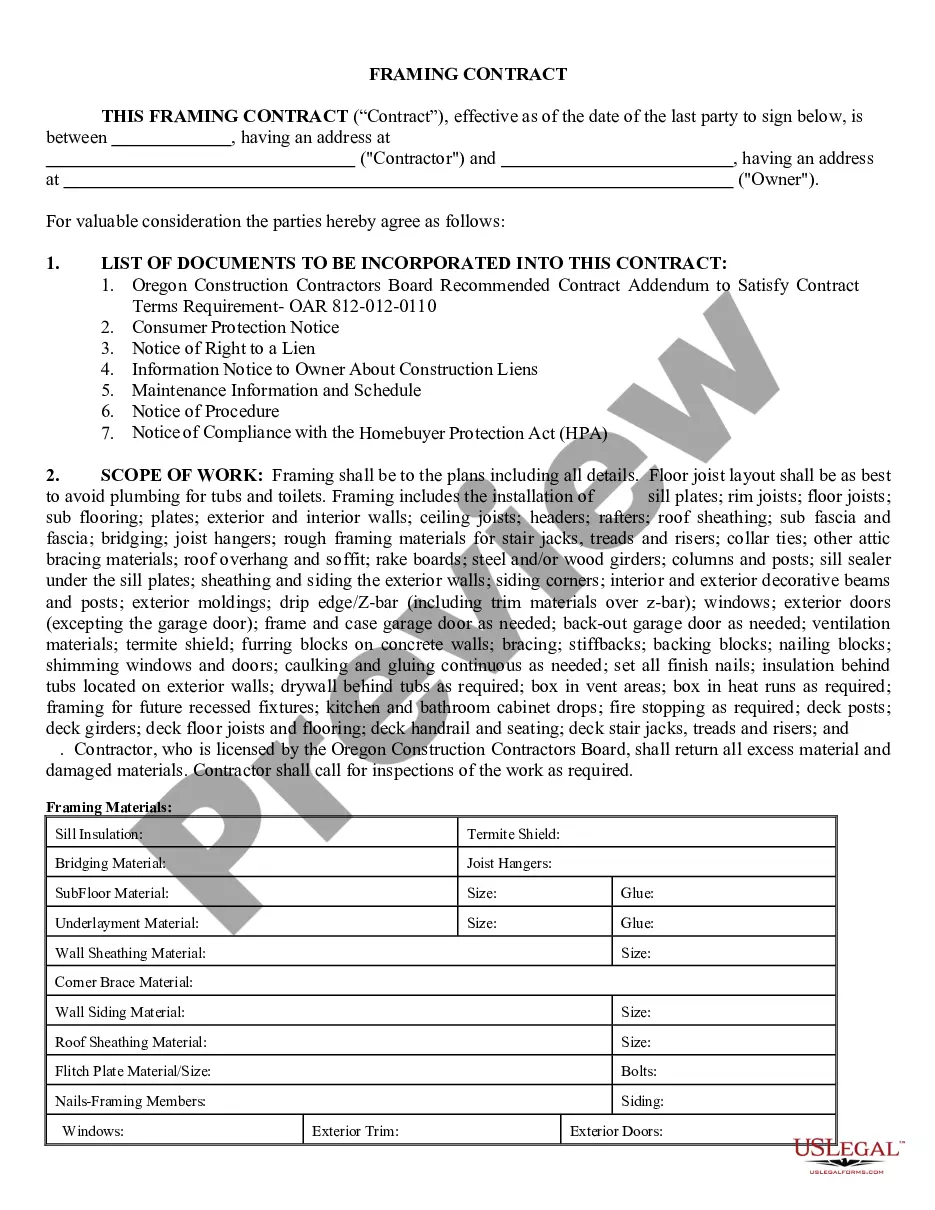

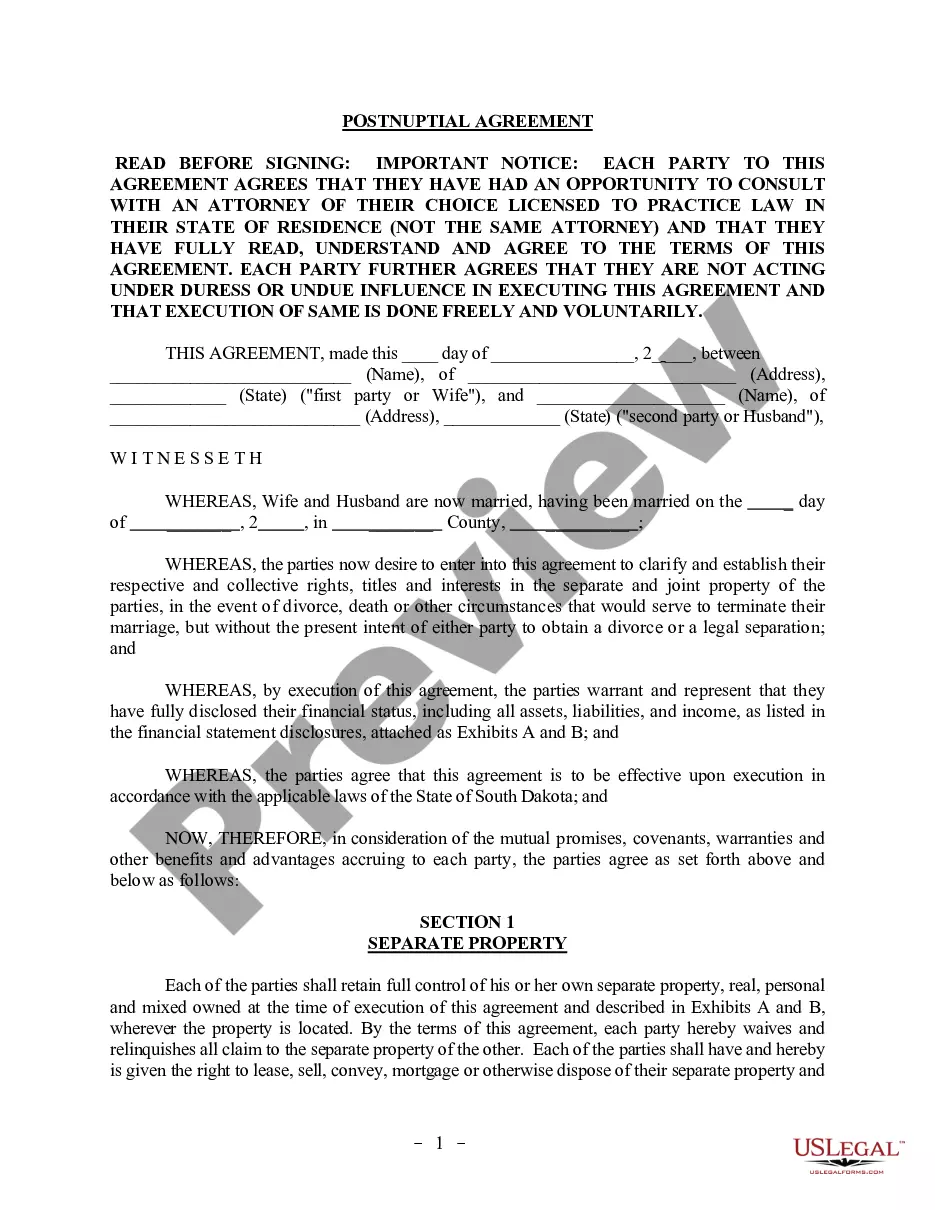

- Review the form description and examine the Preview if accessible on the page.

- Utilize the search function specifying your state above to discover another template.

- Click Buy Now to secure the document once you identify the appropriate one.

- Choose the subscription plan that best fits your needs to proceed.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Salt Lake Sample Letter for Employee Automobile Expense Allowance in the needed file format.

- Print the document or fill it out and sign it electronically using an online editor to save time.

Form popularity

FAQ

Divide the yearly cost by 12 to determine a monthly rate. Determine approximate fuel costs and mileage. Assume the following factors as an example: Your employees live an average of 10 miles from work, the price of fuel in your area is $2.50 per gallon, and the average miles per gallon of a vehicle is 20.

The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses from employee wages under an accountable plan; or (2) employers can consider all payments to employees as wages under a non-accountable

Travel Expenses California labor laws require employers to reimburse employees for all losses and expenditures that are a direct consequence of an employee's work duties.

A recent survey found that the average car allowance in the UK is as follows: £10,300 for company heads (directors & c-suite individuals). £8,200 for senior managers. £6,500 for middle managers.

Reimbursing Employees You can pay for actual costs or the IRS standard mileage rate. All reports must show detailed mileage and business purpose for each trip. For the standard mileage rate, use the IRS mileage rate for the year and multiply it by the actual business miles for the employee for the month.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.

2021 Average Car Allowance The average car allowance in 2021 is $575. And, believe it or not, the average car allowance in 2020 was also $575. This allowance may be greater for different positions in the company. Executives for example may receive an allowance of around $800.

A single rate is used, the rate is: 72 cents per kilometre from 1 July 2020 for the 202021 income year. 68 cents per kilometre for 201819 and 201920.

Q: Is Travel Pay Required? A: Employers are required to pay the reasonable business expenses, including travel, lodging, and meals, for work-related expenses.

With regard to reimbursement for travel expenses, federal law does not require employers to reimburse employees for travel expenses, but employers generally do so.