Tarrant Texas Complaint for Impropriety Involving Loan Application

Description

How to fill out Complaint For Impropriety Involving Loan Application?

A documentation process consistently accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job offer, transferring assets, and various other life situations necessitate the preparation of formal documents that differ across the nation.

This is why having everything organized in one location is extremely beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal templates.

This is the most straightforward and dependable method to acquire legal documents. All templates available in our library are expertly prepared and validated for compliance with local laws and regulations. Organize your paperwork and handle your legal matters effectively with US Legal Forms!

- Here, you can quickly locate and obtain a document for any personal or business purpose used in your region, including the Tarrant Complaint for Impropriety Regarding Loan Application.

- Finding forms on the site is remarkably straightforward.

- If you already hold a subscription to our service, Log In to your account, search for the sample via the search bar, then click Download to store it on your device.

- Subsequently, the Tarrant Complaint for Impropriety Regarding Loan Application will be available for further use in the My documents section of your profile.

- If you are using US Legal Forms for the first time, follow this brief guide to access the Tarrant Complaint for Impropriety Regarding Loan Application.

- Ensure you have accessed the correct page with your regional form.

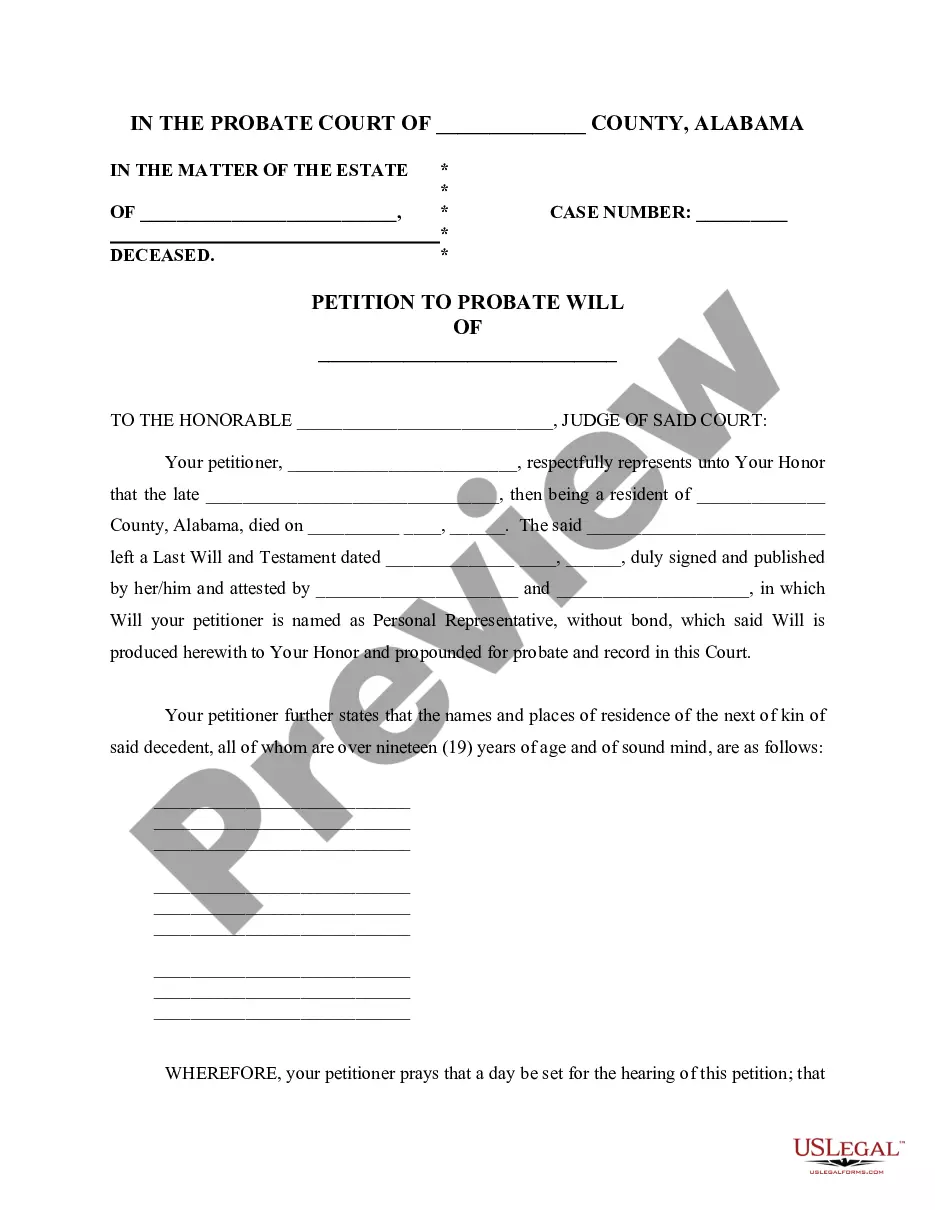

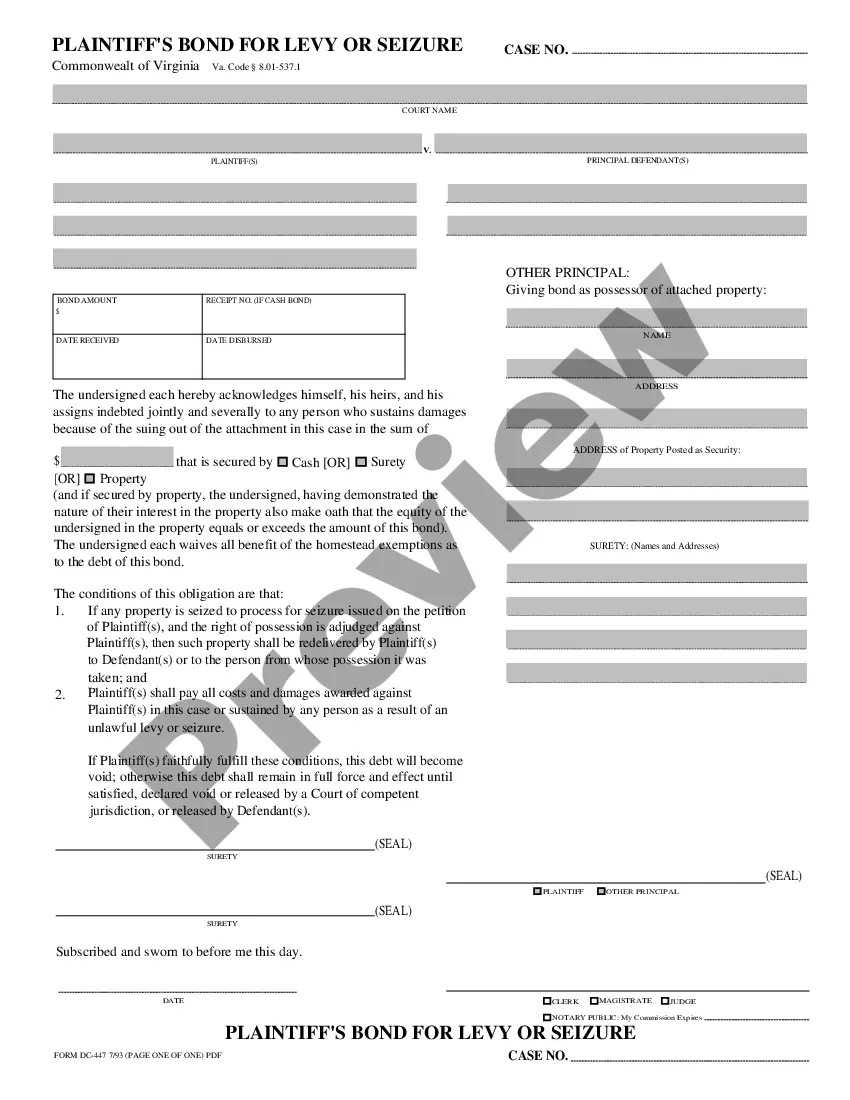

- Utilize the Preview mode (if available) and navigate through the template.

Form popularity

FAQ

Step 1: Visit . and click on click on file a complaint link. Step 5: Enter details such as Name of complaint, mobile number, Email, complaint category from drop down. Enter details also of entity you want to complaint.

We study how consumers interact with financial products and services to help identify potential problems in the marketplace and achieve better outcomes for all. Review our reports and analyses to help inform your decisions, policies, and practices.

The Consumer Financial Protection Bureau (CFPB), a federal government agency, collects consumer complaints about credit cards, mortgages, bank accounts, student loans, consumer loans, credit reporting, money transfers, and debt collection.

To file a complaint, you need to visit . After that, click on file a complaint link. CMS is accessible on desktop and there is app as well that you can use. Select the language from the dropdown and then 'File a complaint with ombudsman against an eligible regulated entity'.

The company will communicate with you as needed and respond to the issues in your complaint. Companies generally respond in 15 days. In some cases, the company will let you know their response is in progress and provide a final response in 60 days.

We're the Consumer Financial Protection Bureau, a U.S. government agency dedicated to making sure you are treated fairly by banks, lenders and other financial institutions.

Banks Federal Financial Institutions Examination Council. Office of the Comptroller of Currency. 214-720-0656. 800-613-6743 (Toll-free) Texas Department of Banking. 512-475-1300.Department of Savings and Mortgage Lending. 512-475-1350.Federal Deposit Insurance Company (FDIC) Dallas. 800-568-9161 (Toll-free)

According to the CFPB report: Credit and consumer reporting complaints accounted for more than 58% of complaints received, followed by debt collection (15%), credit card (7%), checking or savings (6%), and mortgage complaints (5%).

The Department of Savings and Mortgage Lending is an agency of the State of Texas and is subject to the oversight and under the jurisdiction of the Finance Commission of Texas.

Ways to Report Complete the Residential Mortgage Fraud Report form. Mail or Deliver to: Texas Department of Banking. Consumer Assistance Activities. 2601 N. Lamar Blvd. Austin, Texas 78705-4294. Fax#: (512) 475-1313 or e-mail. Call: 877-276-5554.