King Washington Sample Letter to Beneficiaries regarding Trust Money

Description

How to fill out Sample Letter To Beneficiaries Regarding Trust Money?

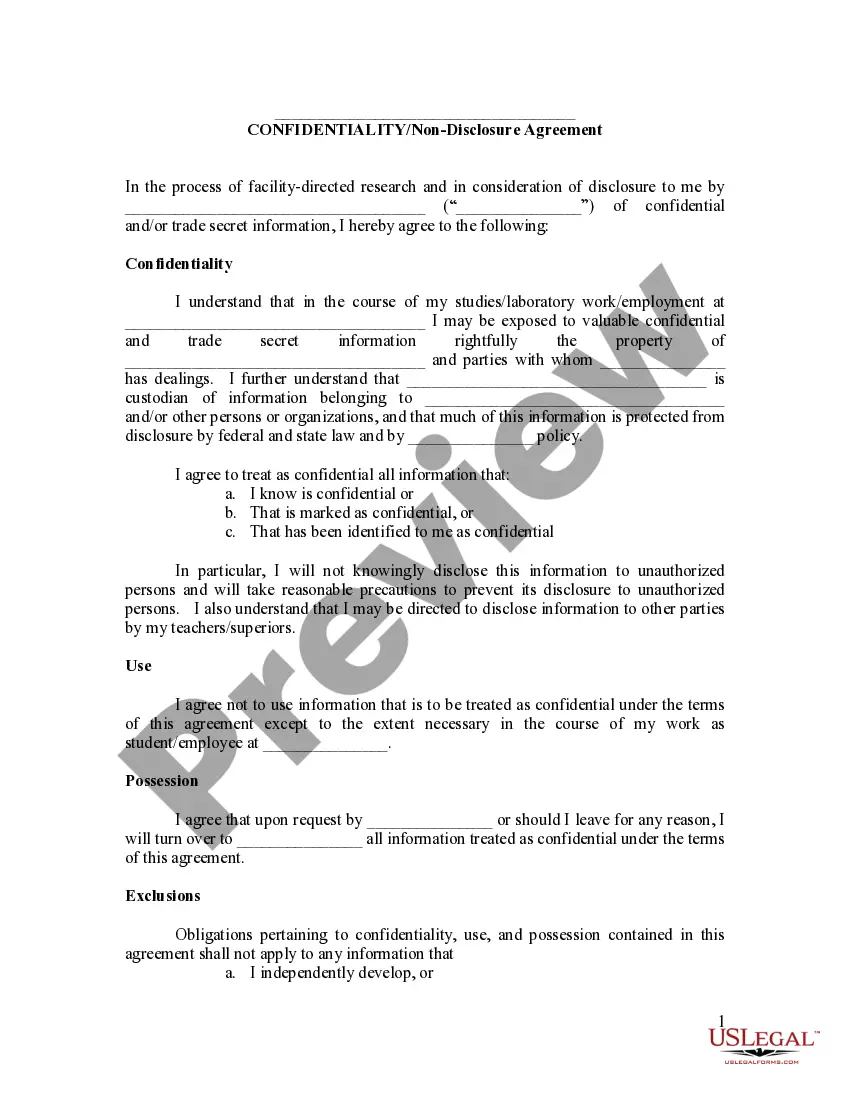

Creating legal documents, such as the King Sample Letter to Beneficiaries concerning Trust Funds, for managing your legal affairs can be a demanding and time-intensive endeavor.

Many situations necessitate an attorney's involvement, which can render this process quite costly.

However, you can take control of your legal situations and address them independently.

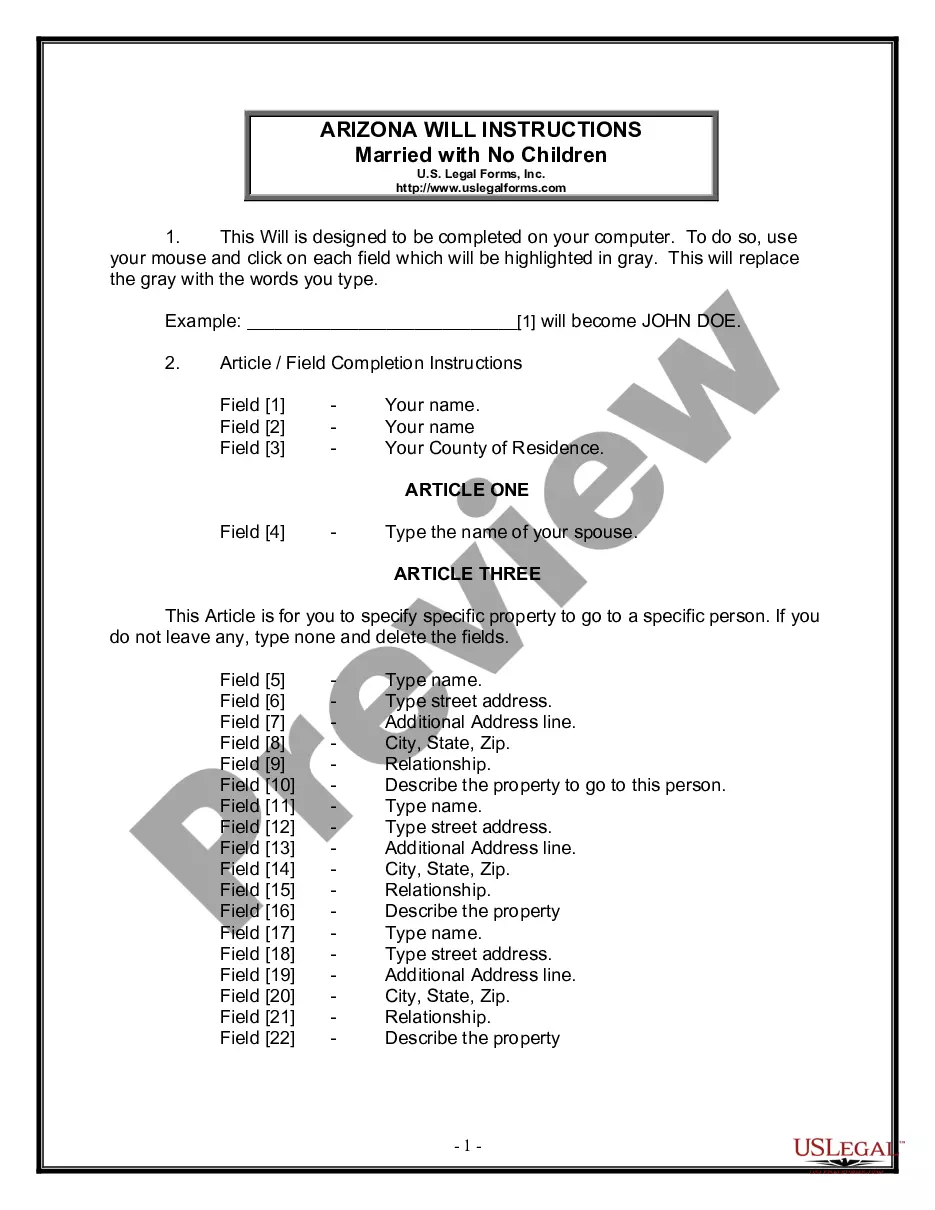

The process for onboarding new users is quite straightforward! Here’s what you need to complete before obtaining the King Sample Letter to Beneficiaries regarding Trust Funds: Ensure that your document conforms to your state's or county's regulations as the guidelines for drafting legal documents can vary significantly. Explore the form by reviewing it or reading a short description. If the King Sample Letter to Beneficiaries regarding Trust Funds isn’t what you were searching for, use the header to find an alternative. Log In or create an account to start using our website and download the document. Everything appears satisfactory on your end? Click the Buy now button and choose your subscription plan. Select the payment method and enter your payment details. Your template is now ready for download. Finding and purchasing the required template is simple with US Legal Forms. Countless businesses and individuals are already benefiting from our extensive collection. Sign up today if you'd like to discover additional advantages offered by US Legal Forms!

- US Legal Forms is here to assist you.

- Our platform features over 85,000 legal documents designed for various situations and life events.

- We guarantee that each form complies with state regulations, alleviating your concerns regarding legal compliance.

- If you are already acquainted with our offerings and possess a subscription with US Legal Forms, you already recognize the convenience of accessing the King Sample Letter to Beneficiaries concerning Trust Funds form.

- Feel free to Log In to your profile, download the form, and adapt it to suit your requirements.

- If you've misplaced your form, there's no need to fret. You can retrieve it through the My documents section in your account—accessible via desktop or mobile.

Form popularity

FAQ

The trust itself must report income to the IRS and pay capital gains taxes on earnings. It must distribute income earned on trust assets to beneficiaries annually. If you receive assets from a simple trust, it is considered taxable income and you must report it as such and pay the appropriate taxes.

Once the trustee has determined what represents the income or the capital of the trust, the trustee must then confirm his powers to distribute that income and capital and his discretion to choose the beneficiaries who will receive the distributions of that income or capital.

To distribute real estate held by a trust to a beneficiary, the trustee will have to obtain a document known as a grant deed, which, if executed correctly and in accordance with state laws, transfers the title of the property from the trustee to the designated beneficiaries, who will become the new owners of the asset.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

To request a withdrawal from the trust, put the request in writing, so you'll have a record of it. The trustee is required to fulfill his fiduciary duty, which includes complying with the trust terms and acting fairly and honestly.

A beneficiary should be addressed in a letter in the same manner as any other professional person. The letter should be addressed to the beneficiary, using her title and full name. Begin the salutation with the word dear and then state all relevant issues in a concise and clear manner.

If the trust earned any ordinary income or accumulated ordinary income from previous years, the distributions must first come from the ordinary income. If the distribution exceeds the trust's ordinary income, the balance of the distribution is treated as coming from capital gains (both current and accumulated).

The grantor can set up the trust, so the money distributes directly to the beneficiaries free and clear of limitations. The trustee can transfer real estate to the beneficiary by having a new deed written up or selling the property and giving them the money, writing them a check or giving them cash.

The letter to your heirs and beneficiaries may contain information about valuable possessions as well as sentimental pieces. Specify which beneficiaries are to receive less valuable possessions. Include important contact information in the letter to your heirs and beneficiaries.

Revocable Trust Rights as a Trustor Write the name of the trustee, his address, city, state, and zip code about one-quarter inch below the date. Reference the name of your trust, and your trust account number if applicable. Write a salutation followed by a colon, for example, "Dear Mr.