Franklin Ohio Sample Letter for Assets and Liabilities of Decedent's Estate

Description

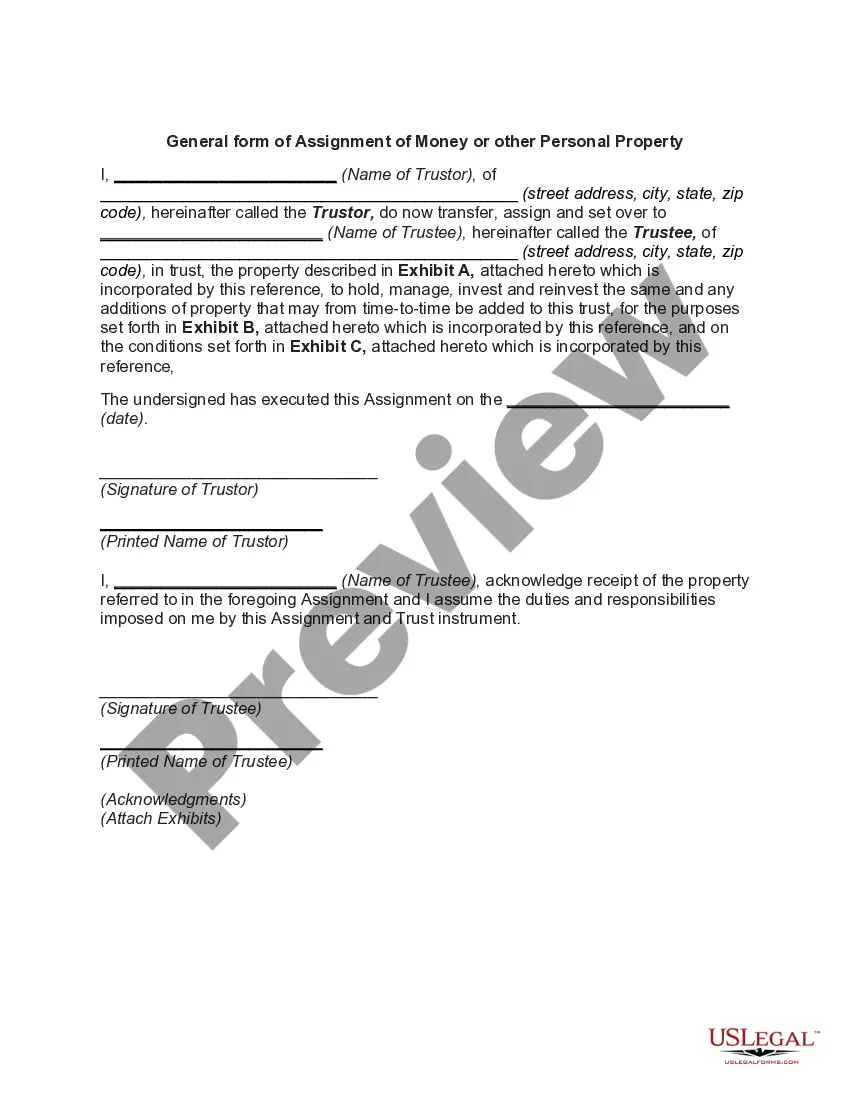

How to fill out Sample Letter For Assets And Liabilities Of Decedent's Estate?

Creating documents for professional or personal needs is always a significant obligation.

When formulating a contract, a public service petition, or a power of attorney, it is essential to take into account all federal and state laws relevant to the particular jurisdiction.

Nonetheless, smaller counties and even municipalities also have legislative processes that must be considered.

The excellent aspect of the US Legal Forms library is that all the documents you have ever secured remain accessible—you can find them in your profile under the My documents tab at any time. Join the platform and swiftly acquire verified legal forms for any purpose with just a few clicks!

- All these elements contribute to the stress and time-consuming nature of producing a Franklin Sample Letter for Assets and Liabilities of Decedent's Estate without expert assistance.

- You can prevent incurring expenses on lawyers for drafting your paperwork and create a legally binding Franklin Sample Letter for Assets and Liabilities of Decedent's Estate independently by utilizing the US Legal Forms online library.

- It is the largest online compilation of state-specific legal documents that are professionally validated, so you can trust their legitimacy when choosing a sample for your region.

- Previously subscribed users just need to Log In to their accounts to retrieve the necessary form.

- If you do not possess a subscription yet, follow the step-by-step guidance below to obtain the Franklin Sample Letter for Assets and Liabilities of Decedent's Estate.

- Review the page you have accessed and verify if it contains the document you seek.

- To do this, utilize the form description and preview if these features are available.

Form popularity

FAQ

The final accounting is a summary of accounts filed by the probate executor, showing details of important financial undertakings during the accounting period. This form may not outline all the information, but those records are kept for future use.

The estate includes a person's belongings, physical and intangible assets, land and real estate, investments, collectibles, and furnishings. Estate planning refers to the management of how assets will be transferred to beneficiaries when an individual passes away.

The final distribution of probate is the transfer of title and assets to the heirs and beneficiaries named in the decedent's estate. This takes place after the probate has been fully administered and the judge signs off that the estate is settled and can be distributed.

Debtsones the deceased person incurred while alive, or expenses the estate has after the deathshould be paid for with estate property. For example, if the deceased person left a checking or savings account, the executor should transfer those funds into an estate bank account and use the money to pay bills.

Generally, the deceased person's estate is responsible for paying any unpaid debts. When a person dies, their assets pass to their estate. If there is no money or property left, then the debt generally will not be paid. Generally, no one else is required to pay the debts of someone who died.

The assets and liabilities that form part of the estate include: Real property (real estate) Stocks and bonds. Life insurance.

Assets Subject to the California Probate Court Probate assets include any personal property or real estate that the decedent owned in their name before passing. Nearly any type of asset can be a probate asset, including a home, car, vacation residence, boat, art, furniture, or household goods.

Do not show any income earned after death as adjustments to inventory. To prepare this schedule, list any and all income earned by the estate after the date of death, such as interest on bank accounts or investments, rental income, and dividends. To prepare this schedule, list the disbursements paid by the estate.

Yes. Before the executor distributes the estate, they have to give the beneficiaries a final accounting of their administration of the estate, including any fee they're charging. And the beneficiaries must agree with it for the executor to proceed.

The California petition for final distribution gives the court a detailed history of the probate case. More specifically, it explains why the estate is ready to close and outlines the distributions to beneficiaries.