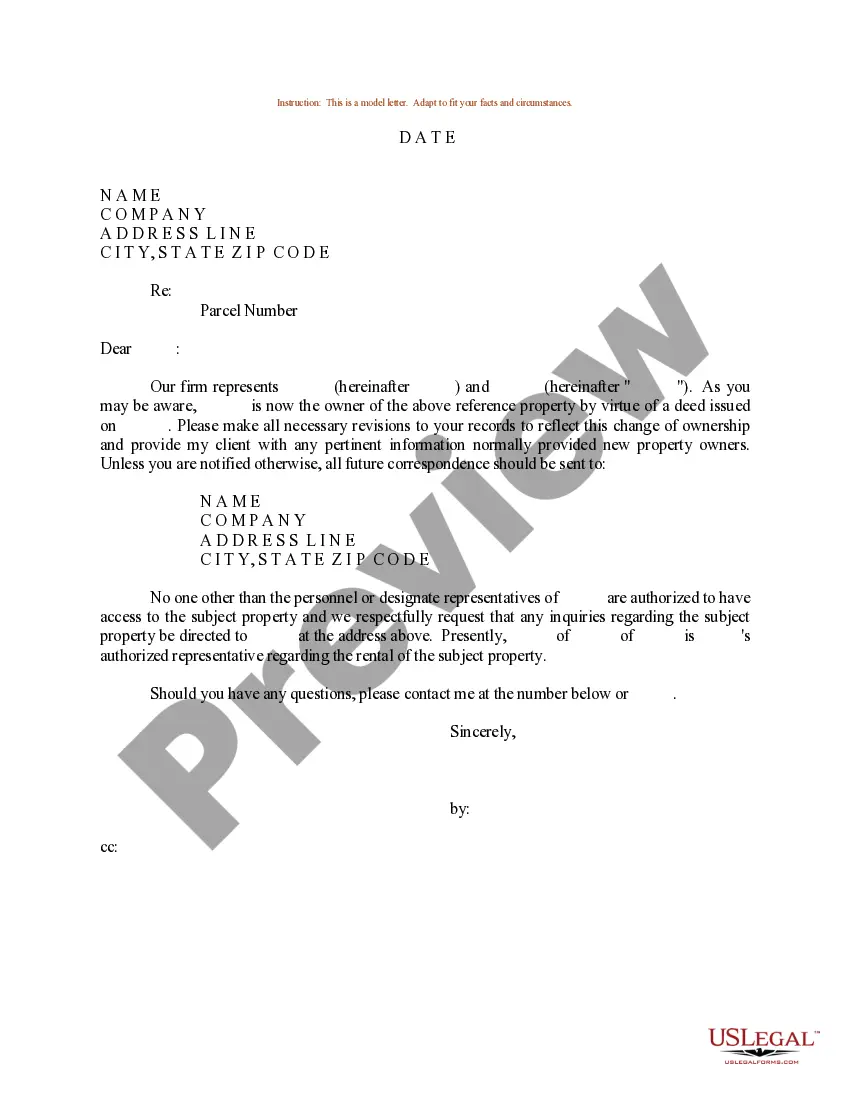

Tarrant Texas Sample Letter for Change of Ownership

Description

How to fill out Sample Letter For Change Of Ownership?

Preparing documentation for business or individual requests is consistently a major duty.

When formulating a contract, a public service application, or a power of attorney, it’s essential to consider all federal and state regulations of the specific region.

Nonetheless, minor counties and even municipalities have legislative stipulations that you must take into account.

To locate the form that suits your needs, make use of the search tab located in the page header.

- All these factors make it tedious and lengthy to draft a Tarrant Sample Letter for Change of Ownership without expert assistance.

- You can prevent incurring expenses on attorneys for the preparation of your papers and create a legally acceptable Tarrant Sample Letter for Change of Ownership independently, utilizing the US Legal Forms online repository.

- It is the largest online assortment of state-specific legal documents that are professionally verified, ensuring their validity when selecting a template for your county.

- Previously subscribed users simply need to Log In to their accounts to retrieve the necessary form.

- If you do not have a subscription yet, follow the step-by-step instructions below to acquire the Tarrant Sample Letter for Change of Ownership.

- Browse the page you’ve opened and verify if it contains the sample you need.

- To facilitate this, utilize the form description and preview features if available.

Form popularity

FAQ

If you are dissatisfied with your appraised value or if errors exist in the appraisal records regarding your property, you should file a Form 50-132, Notice of Protest (PDF) with the ARB. In most cases, you have until May 15 or 30 days from the date the appraisal district notice is delivered whichever date is later.

Just search for your account and select the red E-STATEMENT button from the account options to access your statement. You may also contact our office at 817-884-1100 to request a statement or email us at taxoffice@tarrantcounty.com.

You may apply to the appraisal district the year you become age 65 or qualify for disability. If your application is approved, you will receive the exemption for the entire year in which you become age 65 or disabled and for subsequent years as long as you own a qualified residence homestead.

Please contact the operator to update the mailing address as well as contacting the Tarrant Appraisal District mineral department at mineral@tad.org.

An over 65 exemption is available to property owners the year they become 65 years old. By state law, this exemption is $10,000 for school districts. Other taxing units may adopt this exemption and determine its amount.

(817) 284-0024.

Each year, Texas property owners see the values of their homes creeping up. The state caps property value increases at 10% each year, but this cap does not protect new homeowners or commercial properties. Even a 10% increase in appraised value is significant.

Go to , Login and CREATE AN ACCOUNT. Filing online will allow you the opportunity to submit an opinion of value, and possibly reach an agreement with TAD. If an agreement is not reached, you will have the opportunity to continue and file a protest.

Please visit the Tarrant County Clerk's Fee page for fee information....The locations are: 200 Taylor Street, 3rd Floor, Fort Worth, TX. 6551 Granbury Rd, Ft.700 E.645 Grapevine Hwy.6713 Telephone Rd, Lake Worth, TX. 1100 E.