Middlesex Massachusetts Notice of Returned Check

Description

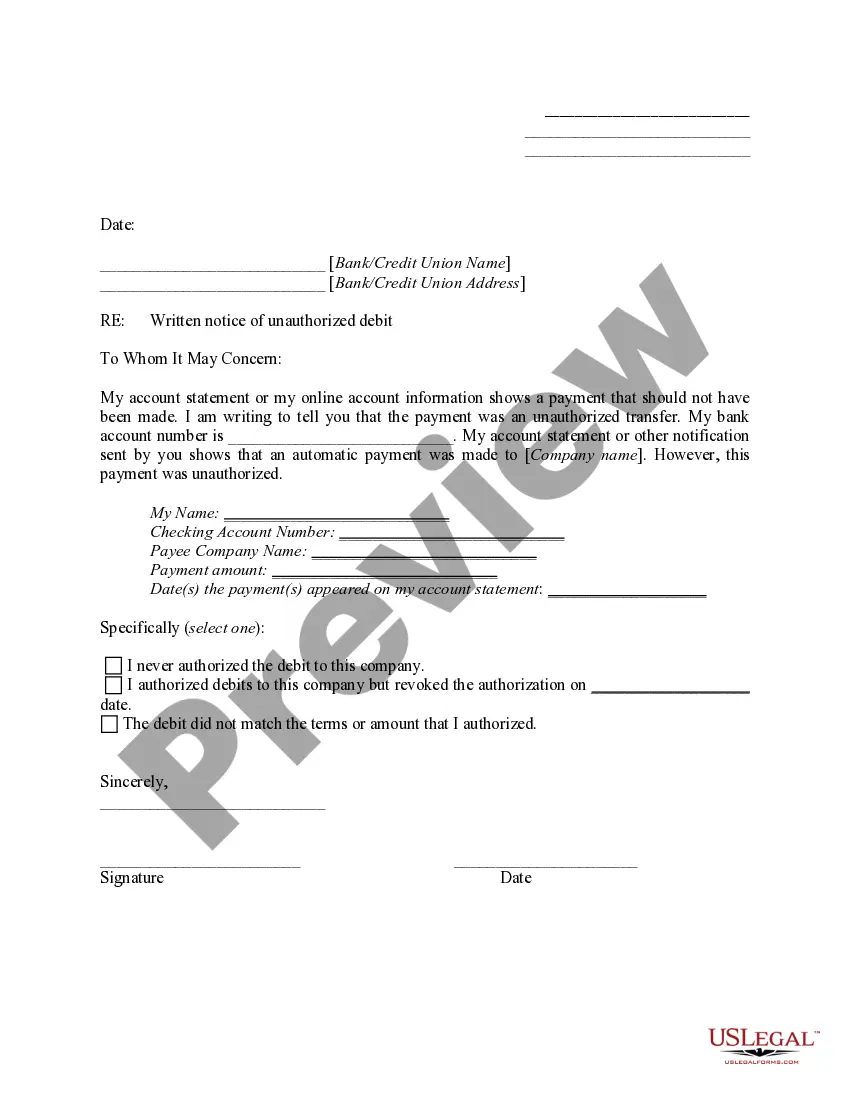

How to fill out Notice Of Returned Check?

If you are looking for a reliable legal document service to obtain the Middlesex Notice of Returned Check, think about US Legal Forms. Whether you intend to establish your LLC business or manage your asset distribution, we have you covered. You don’t need to have extensive legal knowledge to find and download the correct form.

Simply opt to search for or browse the Middlesex Notice of Returned Check, using either a keyword or the state/county the document is designated for.

After locating the needed form, you can Log In and download it or save it in the My documents section.

Don’t have an account? It's simple to get started! Just find the Middlesex Notice of Returned Check template and review the form's preview and description (if accessible). If you're sure about the template’s phrasing, proceed to click Buy now. Create an account and select a subscription plan. The template will be readily available for download as soon as the payment is completed.

Managing your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate that. Our vast collection of legal forms makes this process more affordable and accessible. Set up your first business, organize your advance care planning, draft a property agreement, or complete the Middlesex Notice of Returned Check—all from the ease of your couch. Sign up for US Legal Forms today!

- You can choose from over 85,000 forms organized by state/county and case.

- The intuitive interface, range of supporting materials, and dedicated support team make it easy to search for and complete various documents.

- US Legal Forms is a reputable service offering legal forms to millions of customers since 1997.

Form popularity

FAQ

If you withdraw funds early from a Middlesex Savings Bank Certificate of Deposit (CD), you may incur penalties that can affect your earnings. The exact penalty will depend on the terms of your specific CD agreement, including the duration and interest rate. It’s important to understand these terms to avoid misunderstandings, especially if you plan on making financial decisions that might relate to a Middlesex Massachusetts Notice of Returned Check.

The 18-65 law in Massachusetts pertains to the legal implications and requirements surrounding returned checks. This law outlines the penalties for issuing a check without sufficient funds, including potential criminal charges. Understanding this statute can help you manage any legal ramifications related to a returned check. For comprehensive guidance, consider utilizing resources like uslegalforms.

A statement indicating 'this is a legal copy of your check' means that the document provided is an official reproduction of the original check. This copy may be used in legal matters or disputes, but it cannot be cashed or deposited at the bank. It is crucial to retain the original for financial transactions. For issues related to returned checks in Middlesex, refer to proper documentation.

Federal law requires your bank to make the funds available to you within a certain amount of time, whether the funds actually arrived from the other bank or not. Checks typically take two to three business days to clear or bounce.

A returned check is a check that the receiving bank does not honor. If you're the check writer, having a check boomerang means that your bank will not pay the person or business to whom you wrote it. If you are the payee, a returned check is one for which you won't get paid?at least not right away.

A returned check is a check that the receiving bank does not honor. If you're the check writer, having a check boomerang means that your bank will not pay the person or business to whom you wrote it. If you are the payee, a returned check is one for which you won't get paid?at least not right away.

Also, certain means of payment, such as remittance drafts, may be used only with the agreement of the returning bank. 2. The depositary bank must pay for a returned check by the close of the banking day on which it received the returned check.

Generally, a returned check is one that a bank declines to honor ? typically because there's not enough money in the check writer's account to cover the amount of the payment. You might know this situation as a ?bounced check,? while the bank calls it ?nonsufficient funds,? or NSF.

Generally, a returned check is one that a bank declines to honor ? typically because there's not enough money in the check writer's account to cover the amount of the payment. You might know this situation as a ?bounced check,? while the bank calls it ?nonsufficient funds,? or NSF.

A returned check means that the check payment did not clear the bank account of the payer.