King Washington Assignment of Accounts Receivable

Description

How to fill out King Washington Assignment Of Accounts Receivable?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life situation, locating a King Assignment of Accounts Receivable suiting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Apart from the King Assignment of Accounts Receivable, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Professionals verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your King Assignment of Accounts Receivable:

- Examine the content of the page you’re on.

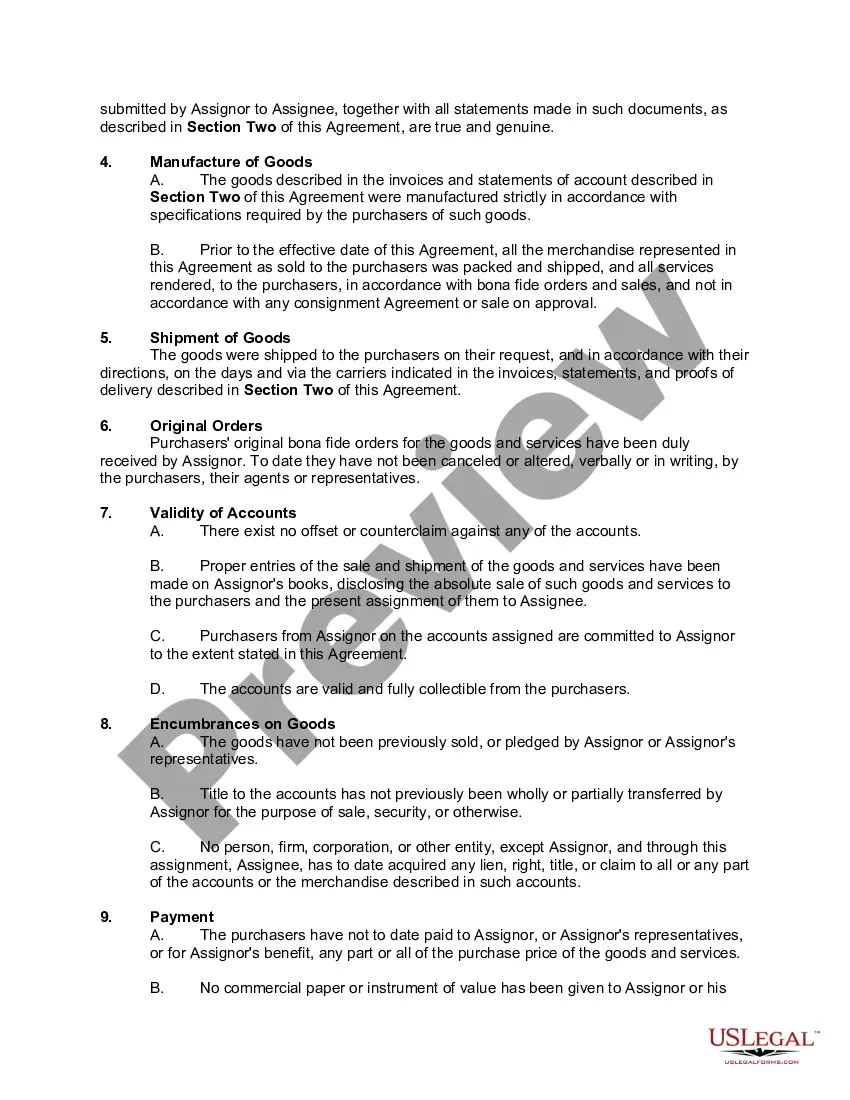

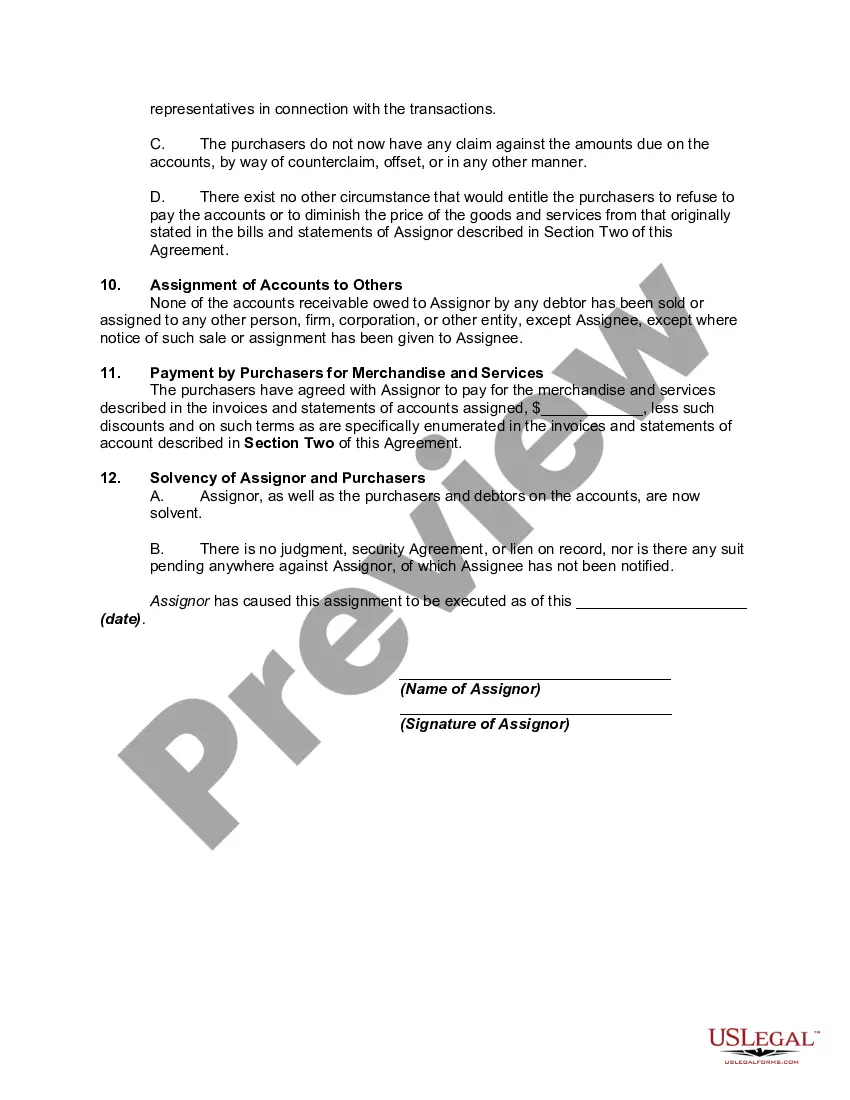

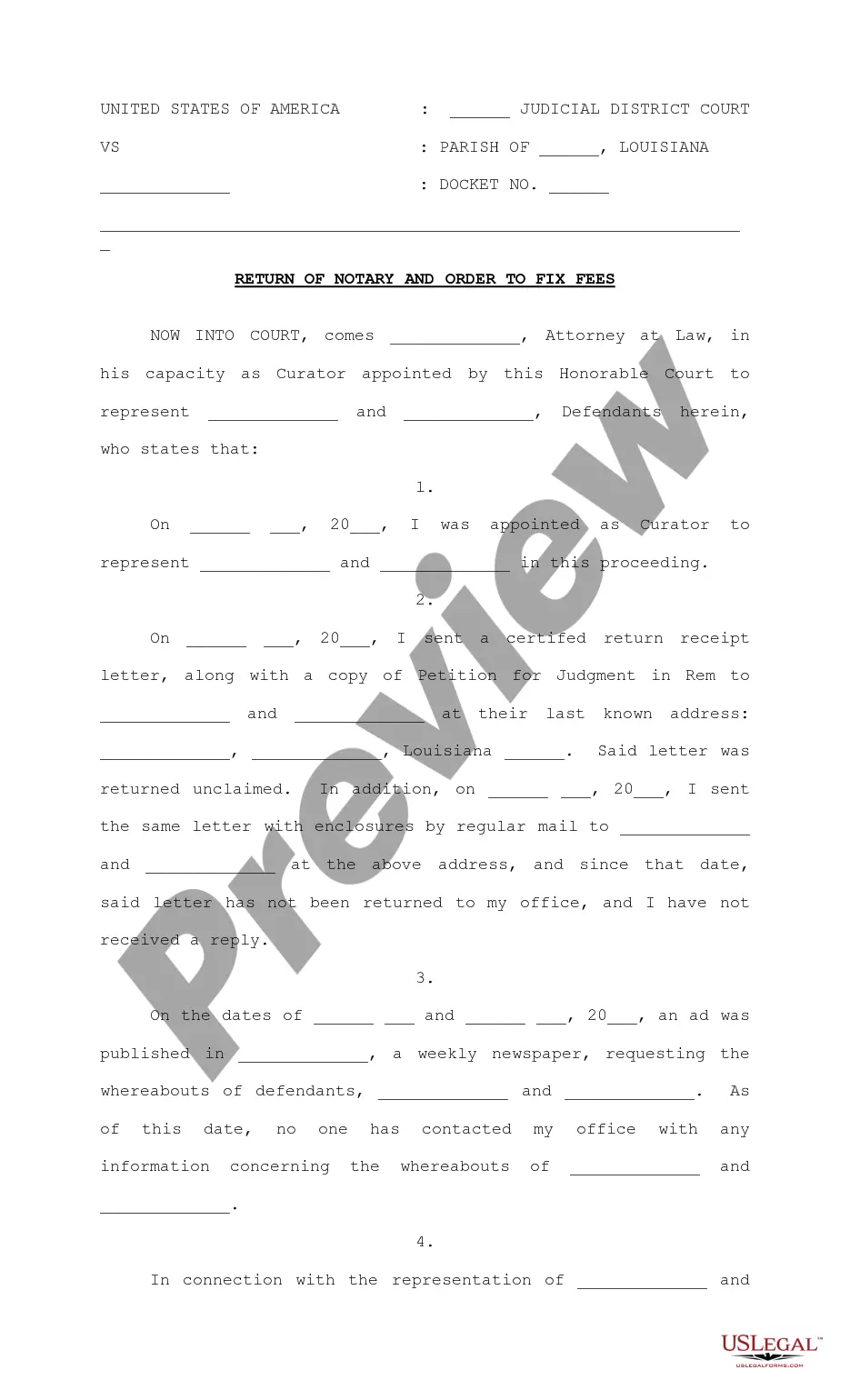

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the King Assignment of Accounts Receivable.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

Accounts receivable is an informal, short-term payment and usually no interest, whereas notes receivable is a legal contract, long-term payment, and usually has interest.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

Negotiability: Notes receivables, compared to accounts receivable, are negotiable. This means that you can transfer the note as a way to sell your ownership of it to another party. The new owner of the note would claim it the same way as the original payee.

Accounts receivable pledging occurs when a business uses its accounts receivable asset as collateral on a loan, usually a line of credit. When accounts receivable are used in this manner, the lender typically limits the amount of the loan to either: 70% to 80% of the total amount of accounts receivable outstanding; or.

Factoring is the sale of receivables, whereas invoice discounting ("assignment of accounts receivable" in American accounting) is a borrowing that involves the use of the accounts receivable assets as collateral for the loan.

The receivables are not actually sold to the lender, which means that the borrower retains the risk of not collecting payments from customers. The amount loaned is usually a percentage of the outstanding receivables in the accounts assigned to the lender.

Accounts receivable can be sold to a financial institution for a fee. This action is known as discounting or factoring accounts receivable. Accounts receivable can't be used as a negotiable financial instrument like note receivable.