Collin Texas Affidavit That There Are No Creditors

Description

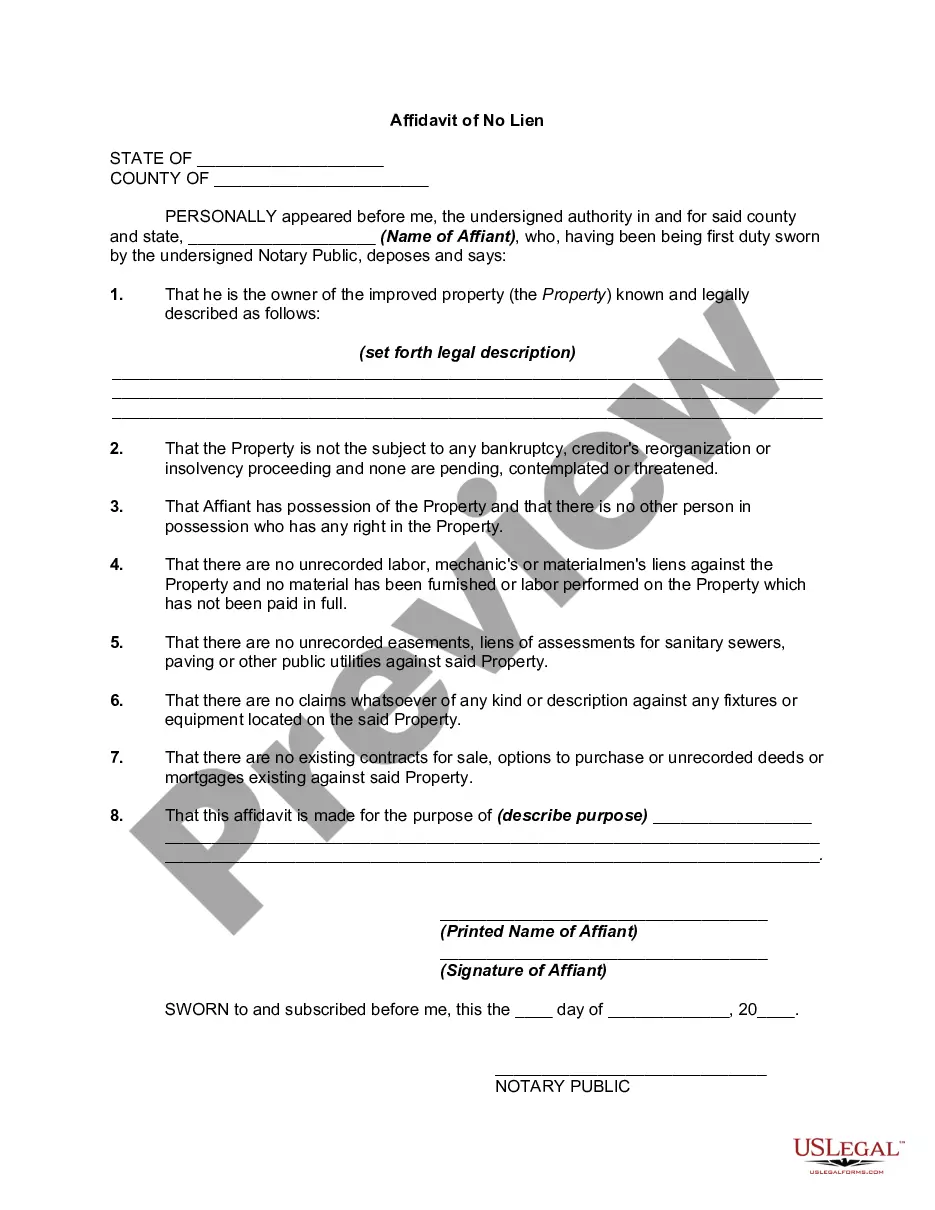

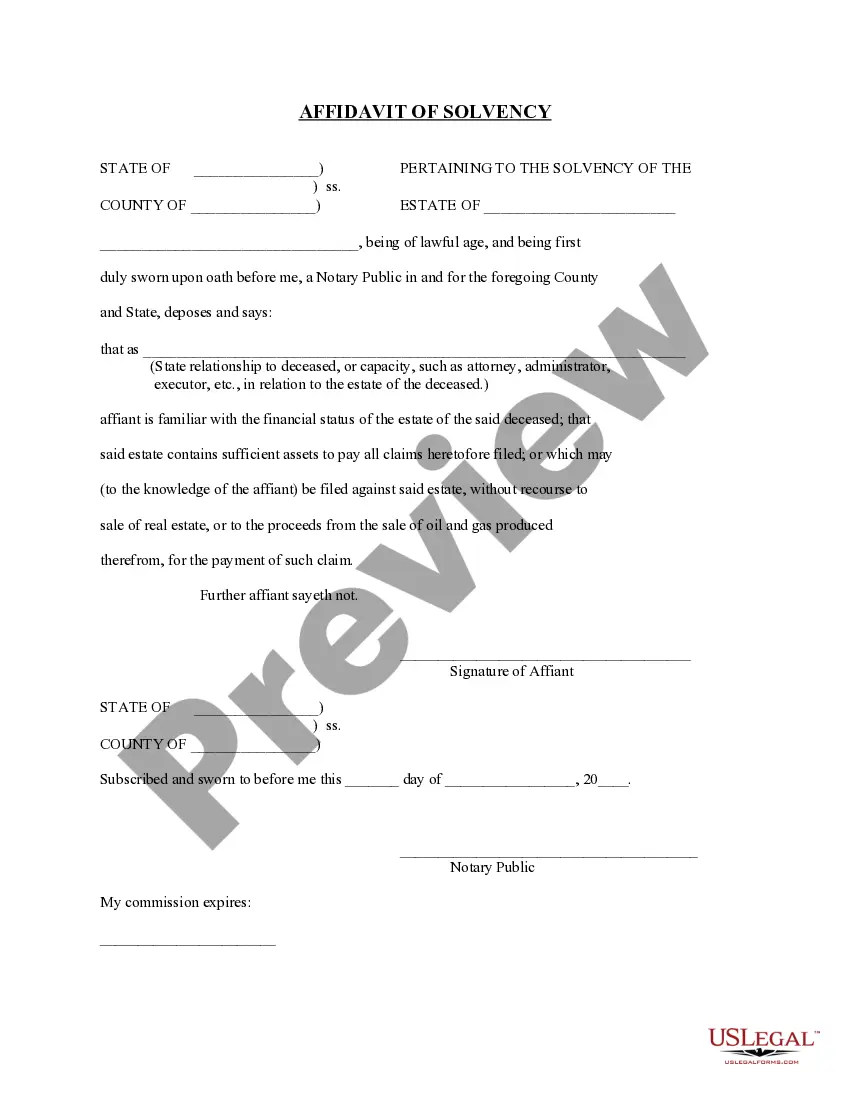

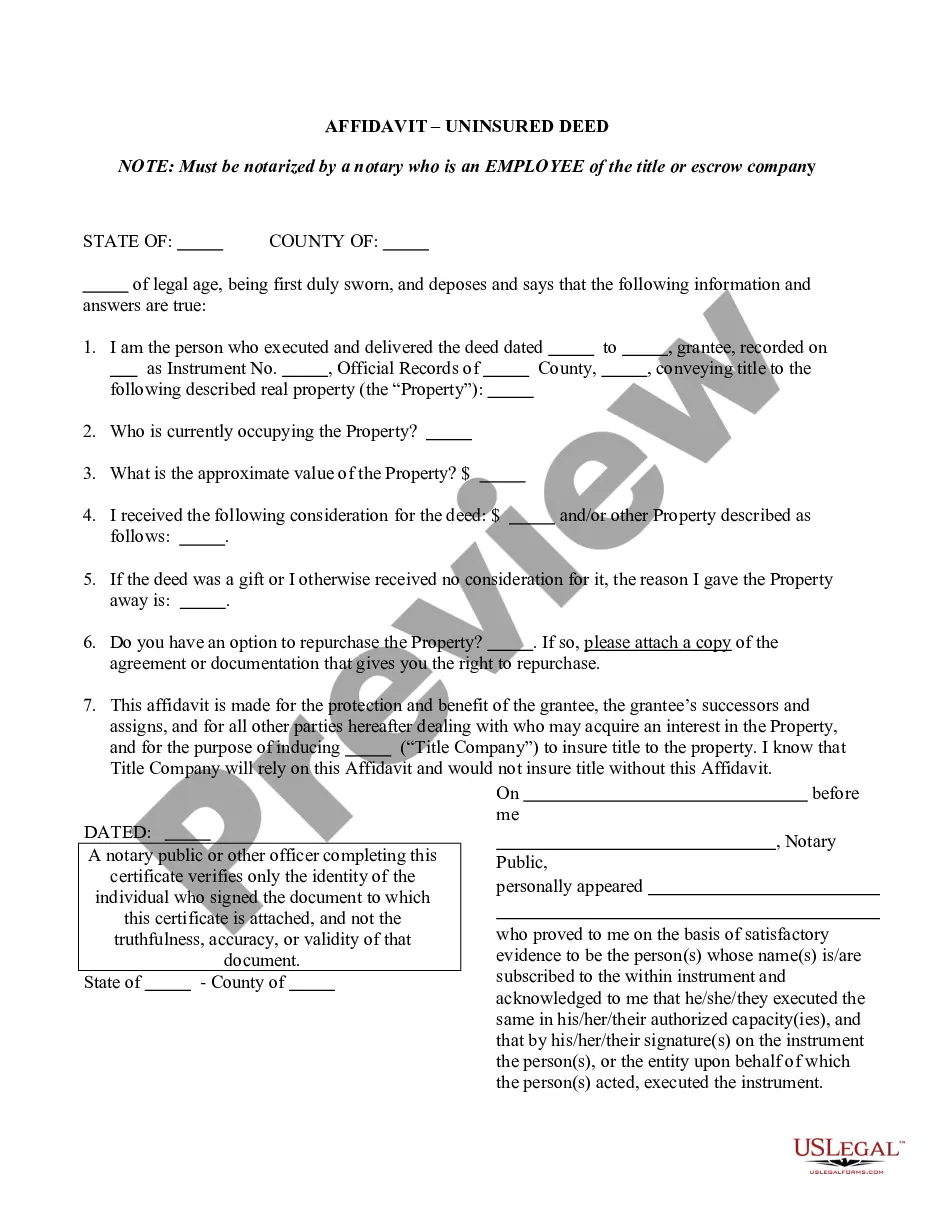

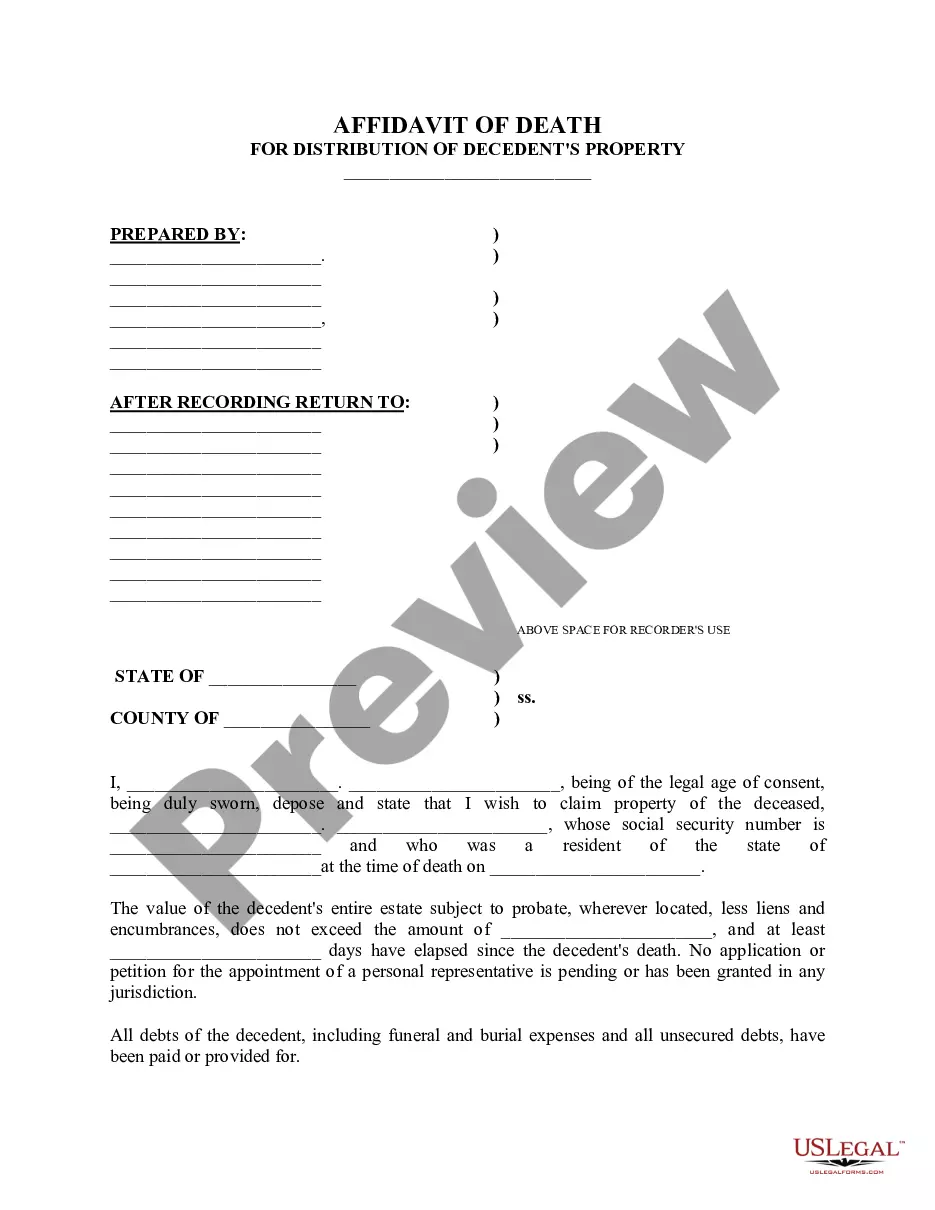

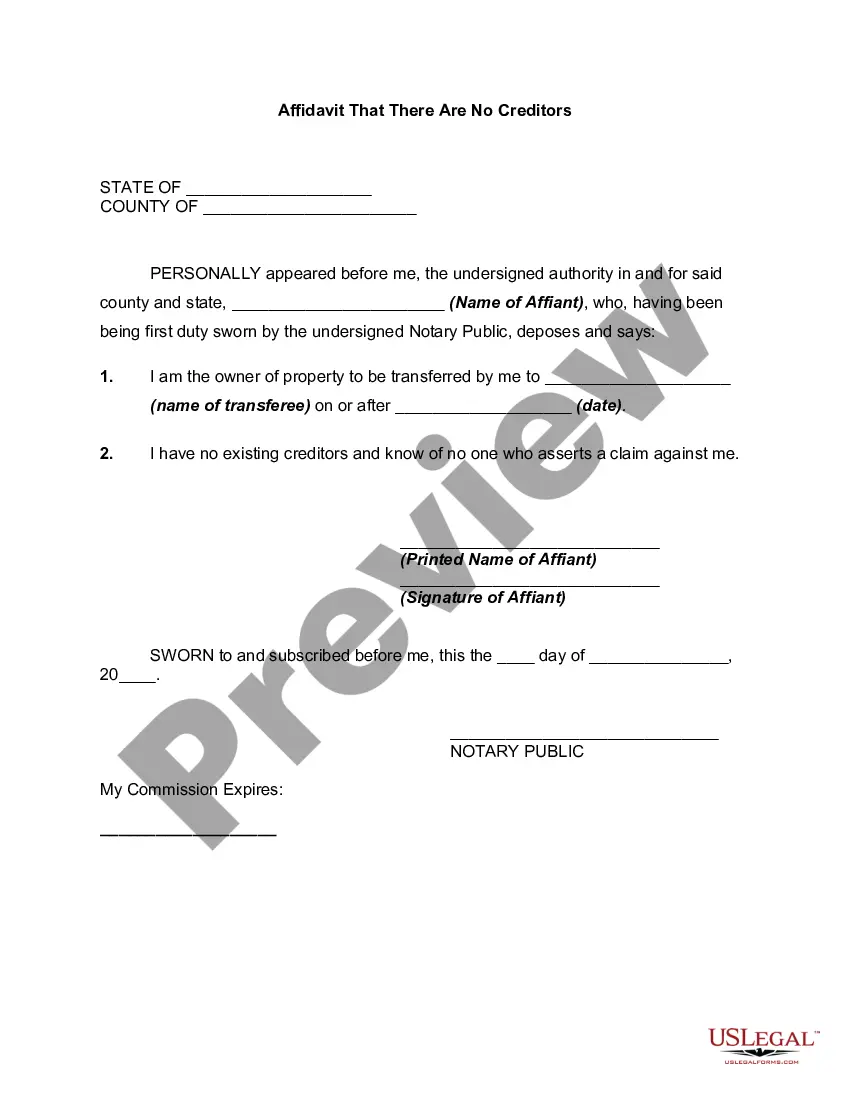

How to fill out Affidavit That There Are No Creditors?

Are you seeking to promptly compose a legally-binding Collin Affidavit That There Are No Creditors or perhaps any alternative document to manage your personal or business matters? You can choose between two alternatives: engage a specialist to create a legal document for you or compose it completely on your own. Fortunately, there’s a third option - US Legal Forms. It will assist you in acquiring well-crafted legal documents without incurring excessive charges for legal services.

US Legal Forms offers an extensive catalog of over 85,000 state-specific document templates, including the Collin Affidavit That There Are No Creditors and various form packages. We provide documents for a wide array of life situations: from divorce documentation to real estate document templates. We have been operating for more than 25 years and have established a robust reputation among our clients. Here’s how you can join them and obtain the necessary document without additional hassles.

If you have already created an account, you can easily Log In, locate the Collin Affidavit That There Are No Creditors template, and download it. To obtain the form again, just navigate to the My documents tab.

It’s effortless to locate and download legal forms when you utilize our services. Additionally, the templates we supply are evaluated by industry professionals, which enhances your assurance when managing legal issues. Experience US Legal Forms today and witness the difference!

- Firstly, confirm whether the Collin Affidavit That There Are No Creditors is designed to comply with your state’s or county’s regulations.

- If the document includes a description, ensure to check its intended purpose.

- If the template doesn’t align with your needs, restart the search using the search box in the header.

- Choose the subscription that best meets your requirements and proceed with the payment.

- Select the format in which you wish to receive your document and download it.

- Print it, complete it, and sign on the designated line.

Form popularity

FAQ

Transferring property after the death of a parent without a will in Texas typically involves filing an affidavit of heirship. This document establishes the heirs of the deceased and helps in the legal transfer of property. If you are navigating this process, utilizing the Collin Texas Affidavit That There Are No Creditors can streamline your efforts and clarify ownership.

An affidavit of non-prosecution in Collin County is a legal document where a victim declares they do not wish to pursue criminal charges against a defendant. This affidavit can significantly affect the case's outcome, as it indicates the victim's desire for the charges to be dropped. Understanding this process is vital, especially in cases involving disputes over Collin Texas Affidavit That There Are No Creditors.

Texas has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

According to Section 42.001 of the Texas Property Code, exempt assets for a married decedent include a homestead for the use and benefit of a surviving spouse or minor children and up to $100,000 worth of personal property that will be used for the benefit of a surviving spouse, minor children, unmarried children who

Obtaining a Grant of Probate is needed in most cases where the total value of the deceased's estate is deemed small... Going through the process of probate is often required to deal with a person's estate after they've passed away.

Not all assets are subject to probate in Texas....The Non-Probate Asset Bank Accounts. Investment Accounts. Retirement Accounts (IRAs & Pension Plans) Life Insurance Policies. Annuity Contracts. Real Estate. Vehicles.

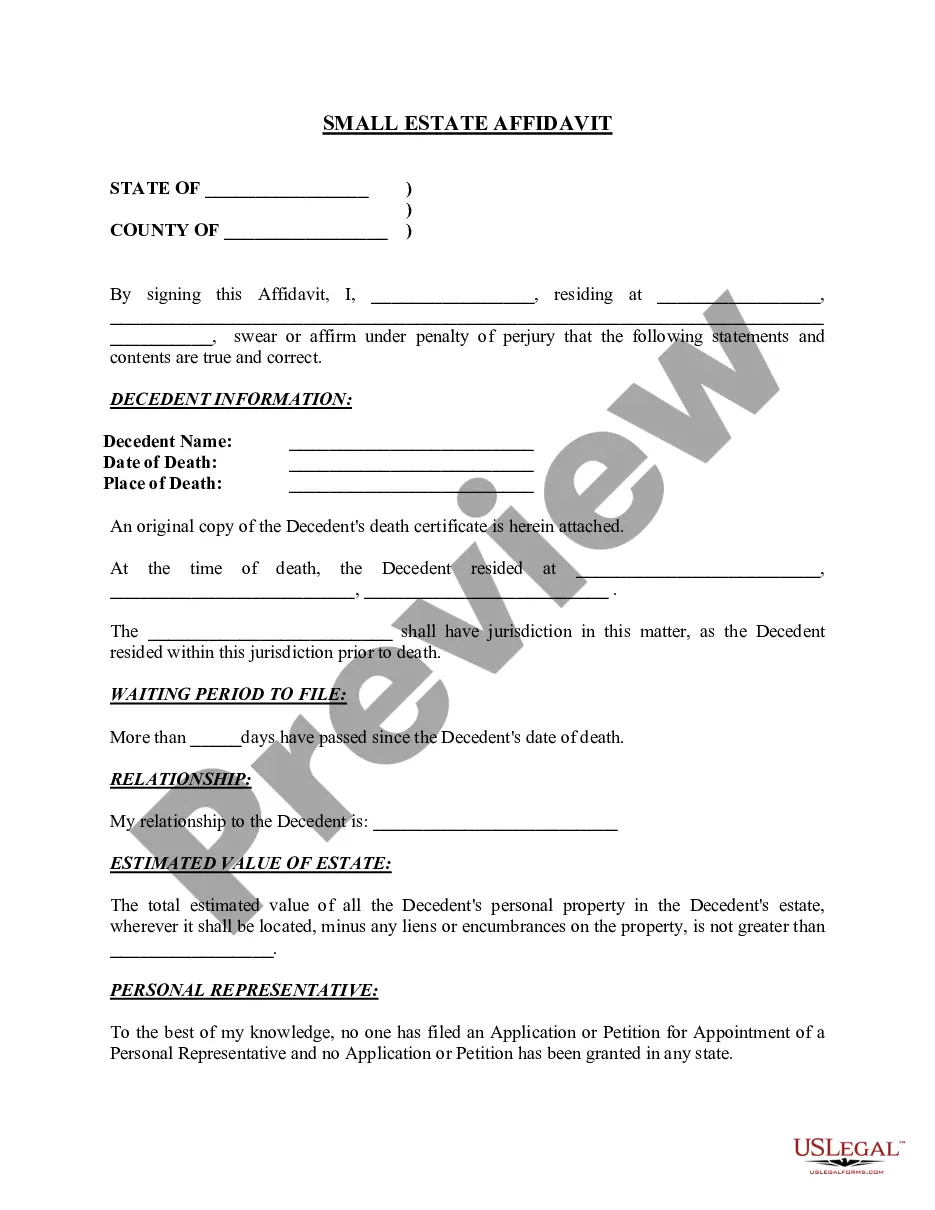

Once you complete the Small Estate Affidavit and the Affidavit of Heirship, you must file them with the clerk of the court at the probate court in the county where the deceased was a resident. Some courts require a copy of the death certificate to be filed with the forms. The fee to file the forms will vary by county.

How Do I Get Letters Testamentary or Letters of Administration? First, file an application for probate. You'll need to file with the court in the county in which the decedent died. Notify interested parties.Appear at a hearing.Be appointed by a judge.Perform the duties as an Executor or Administrator.

Step 1 Gather Information. The law requires you to wait thirty (30) days before you file a small estate affidavit.Step 2 Prepare Affidavit.Step 3 Identify Witnesses.Step 4 Get Forms Notarized.Step 5 File with Probate Court.Step 6 Distribute Affidavit.

No form should be completed or filed until thirty (30) days have elapsed since death. The value of the entire estate, not including homestead and exempt property, does not exceed $75,000.