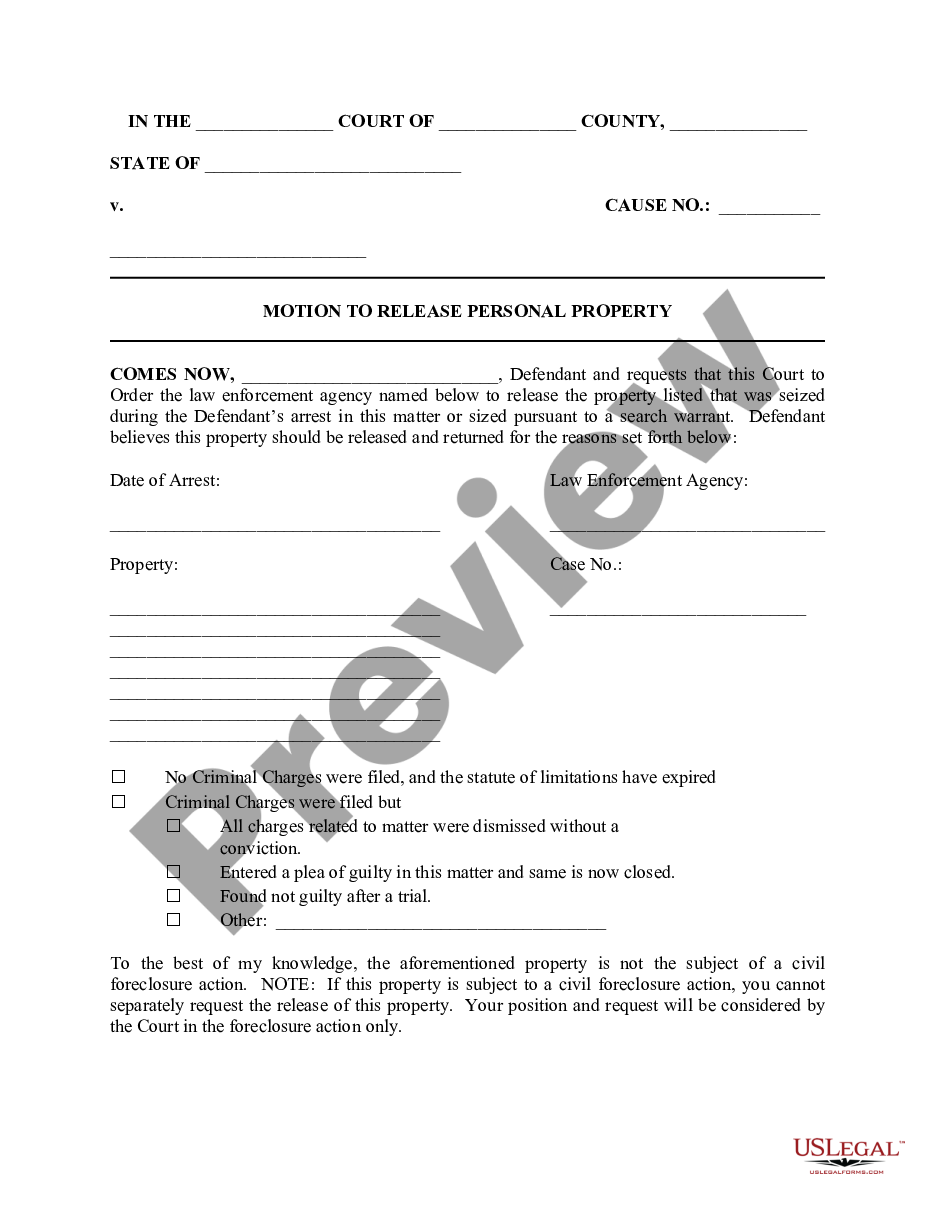

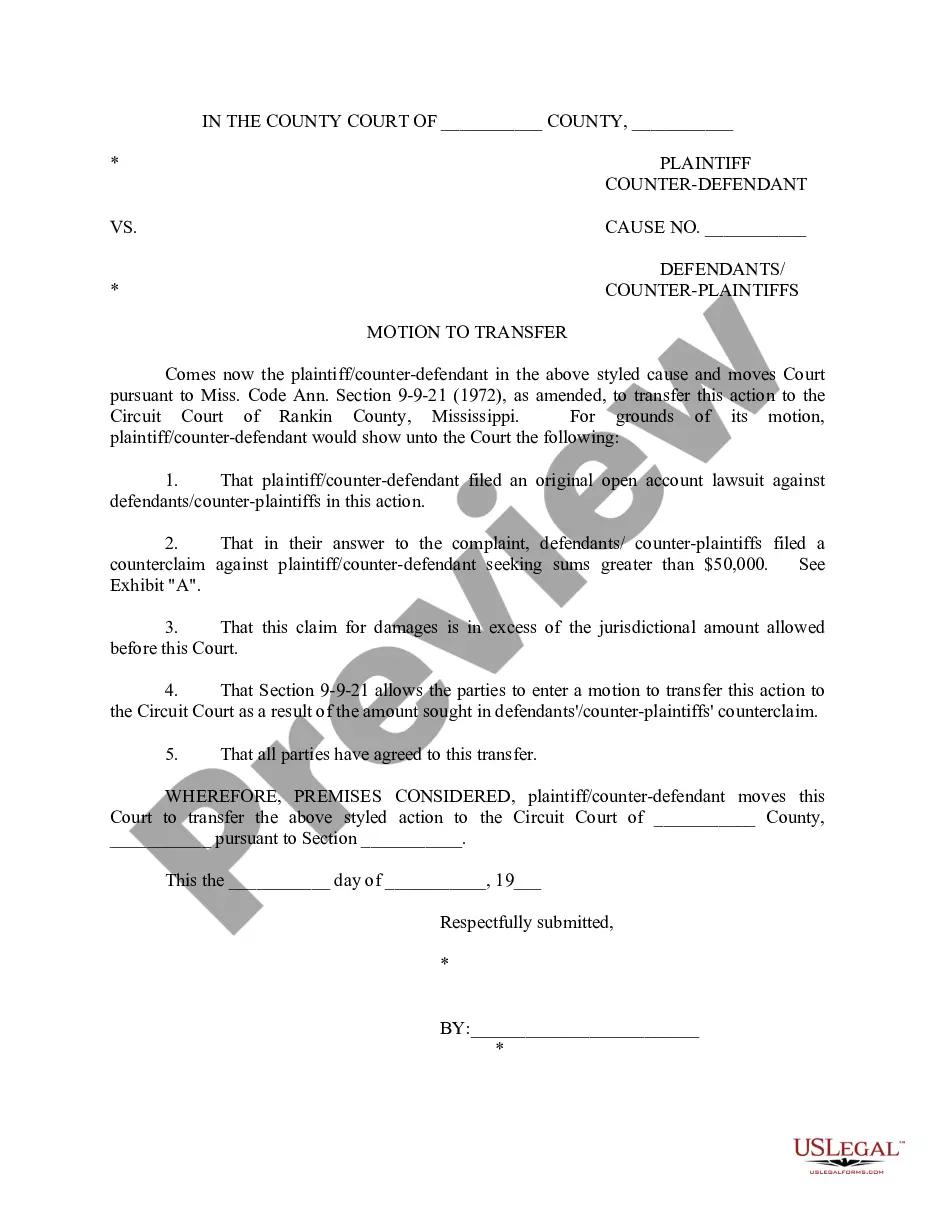

Attachment in legal terminology means a preliminary legal seizure of property to force compliance with a decision which may be obtained in a pending suit. Before a final judgment is issued, the court may order the sheriff or other proper officer to seize any property; credit, or right, belonging to the defendant, in whatever hands the same may be found, to satisfy the claim which the plaintiff has against him. In some states, an order of attachment can only be issued when a debtor is shown to be fleeing or concealing themselves from the legal process, so that the attached property can satisfy a judgment that may be awarded in the complainant's favor. In criminal law practice, it may refer to a writ requiring a sheriff to apprehend a particular person, who has been guilty of a contempt of court, and to bring the offender before the court.

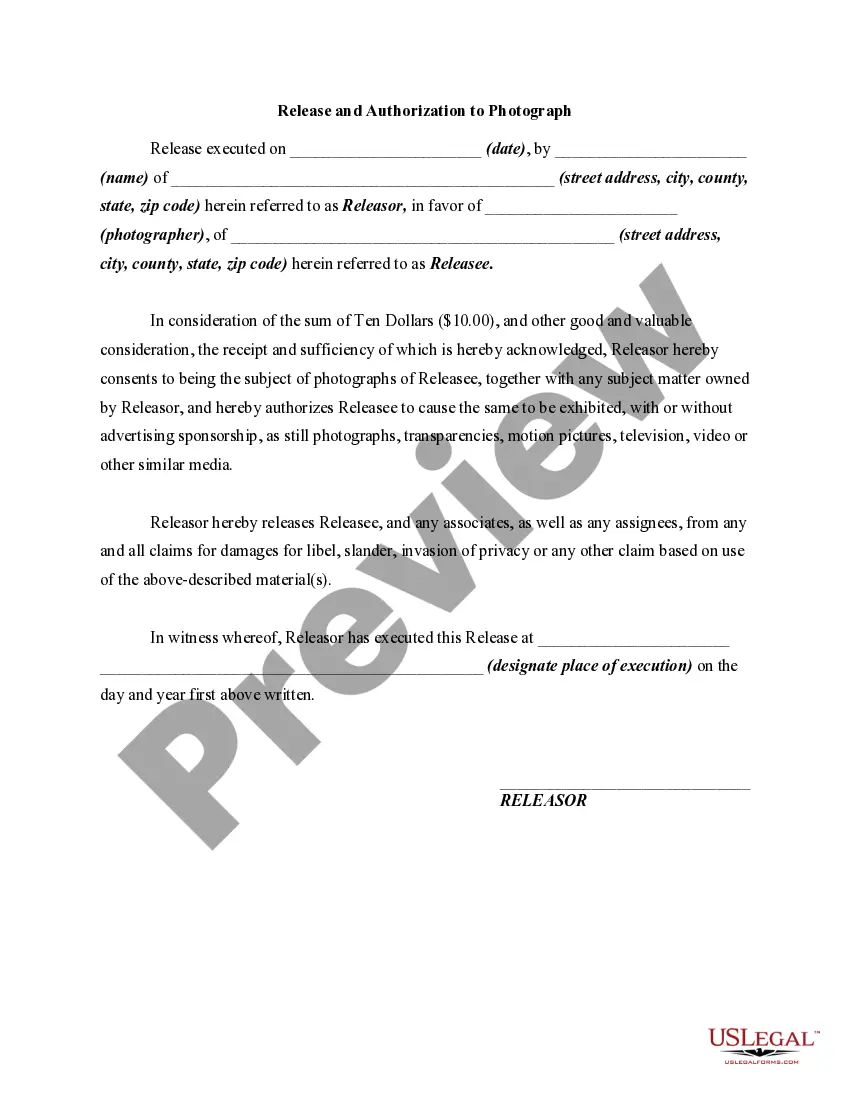

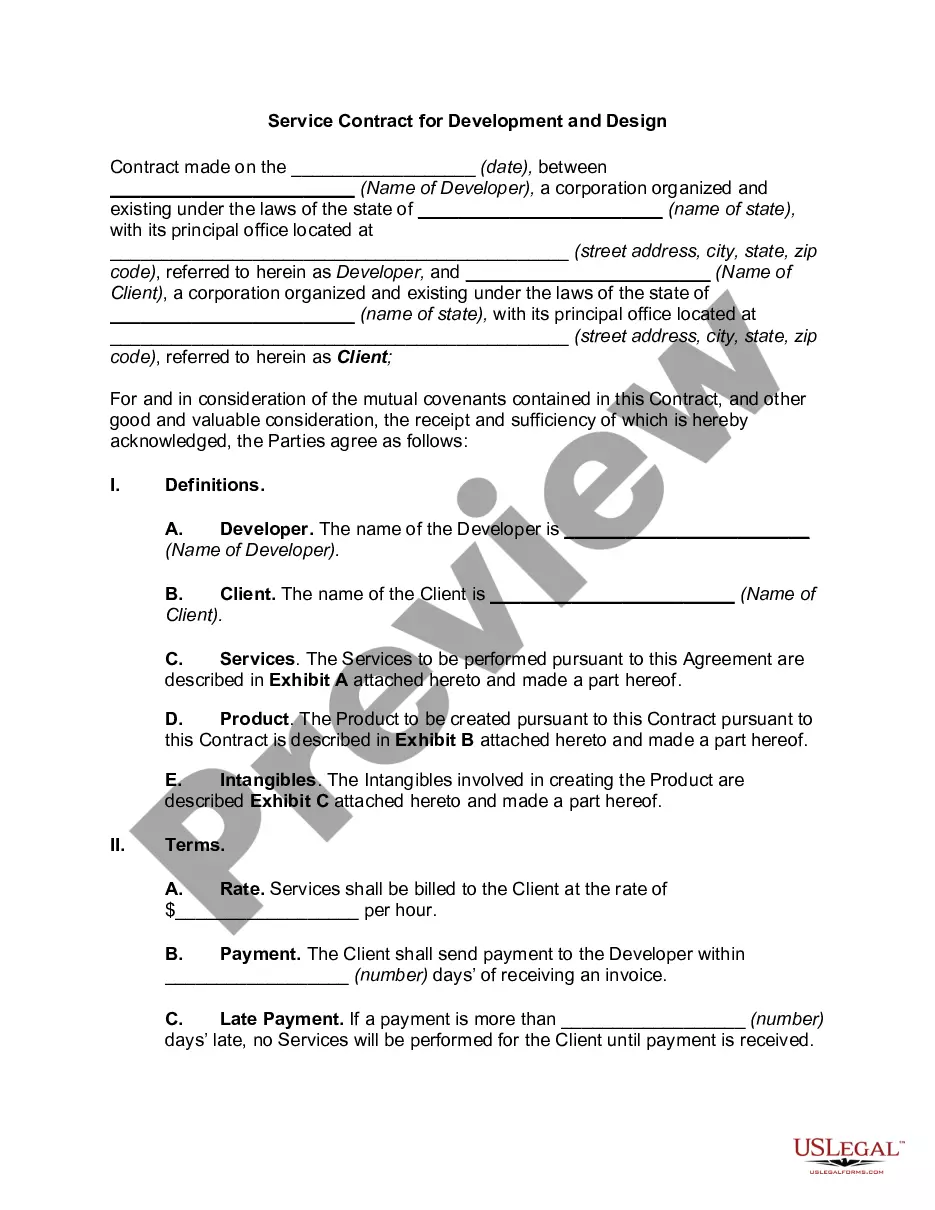

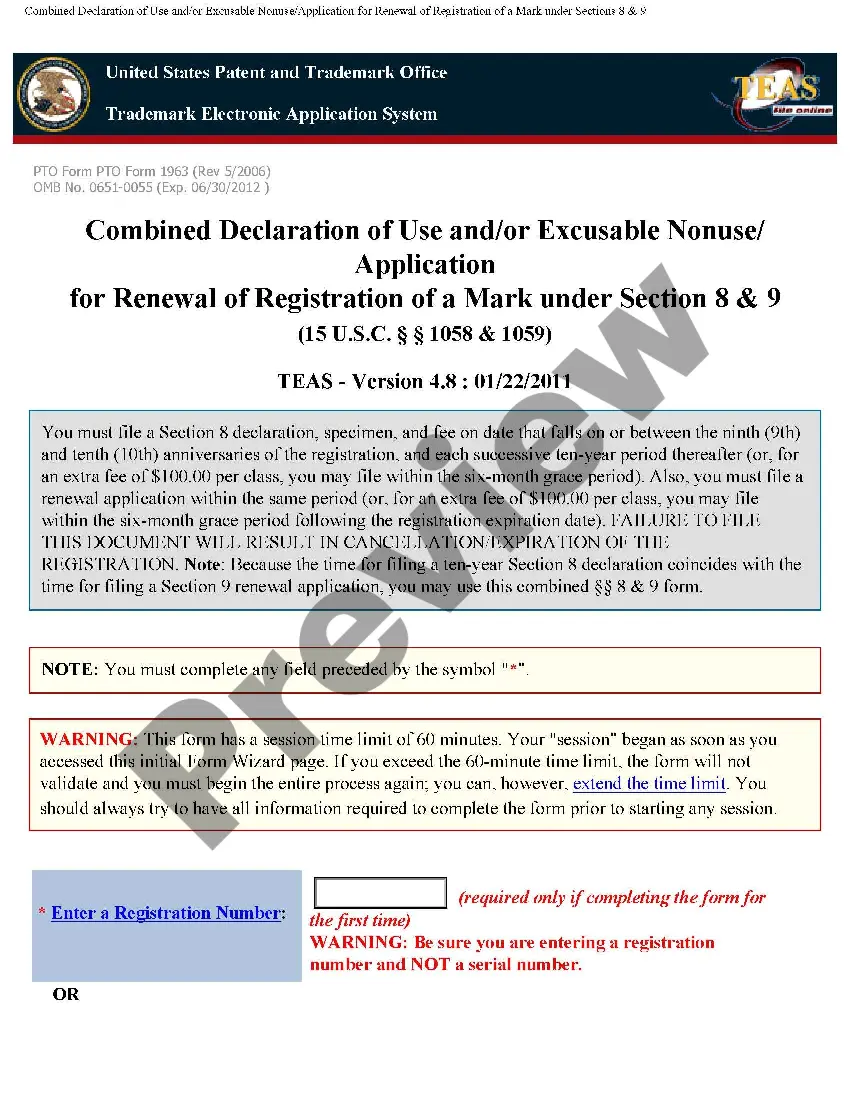

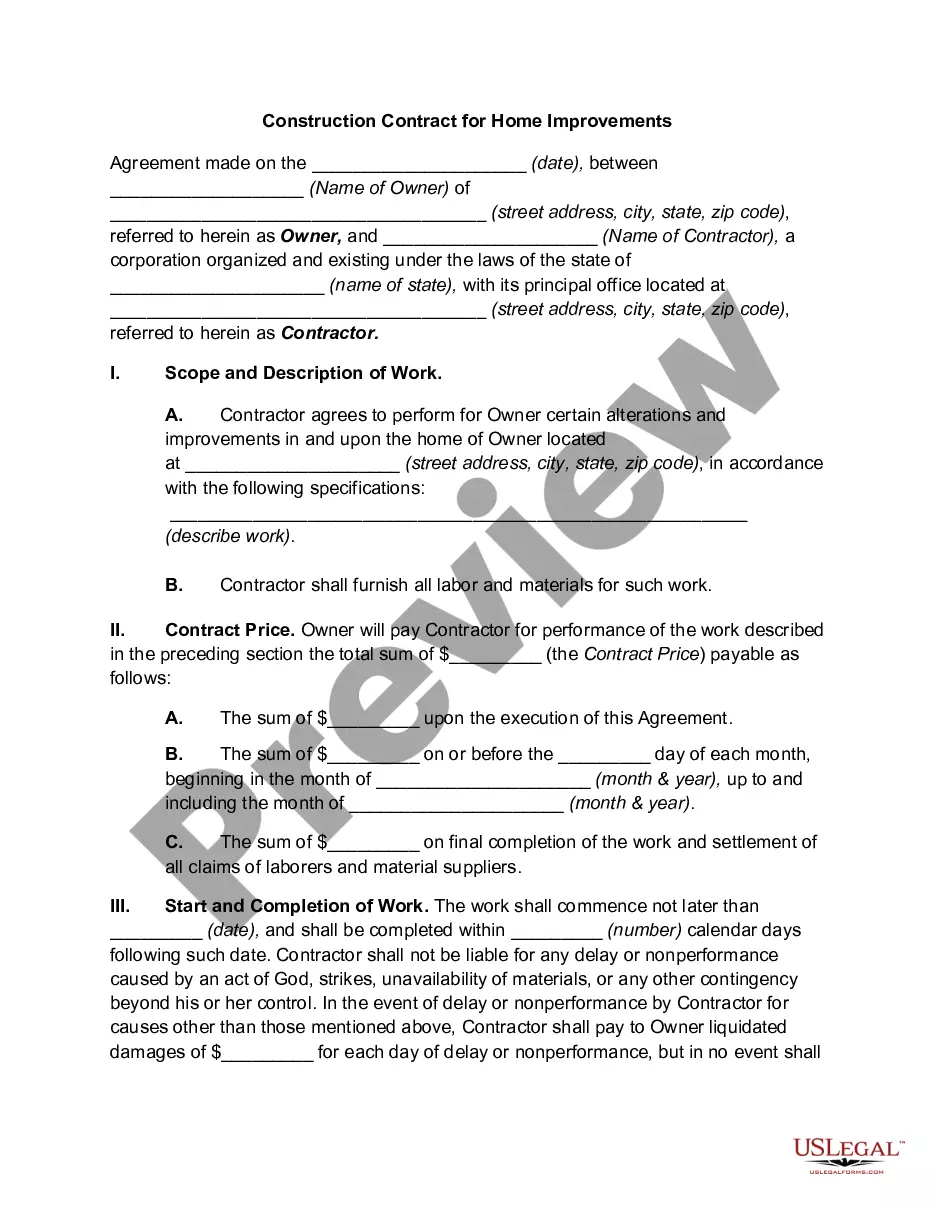

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.