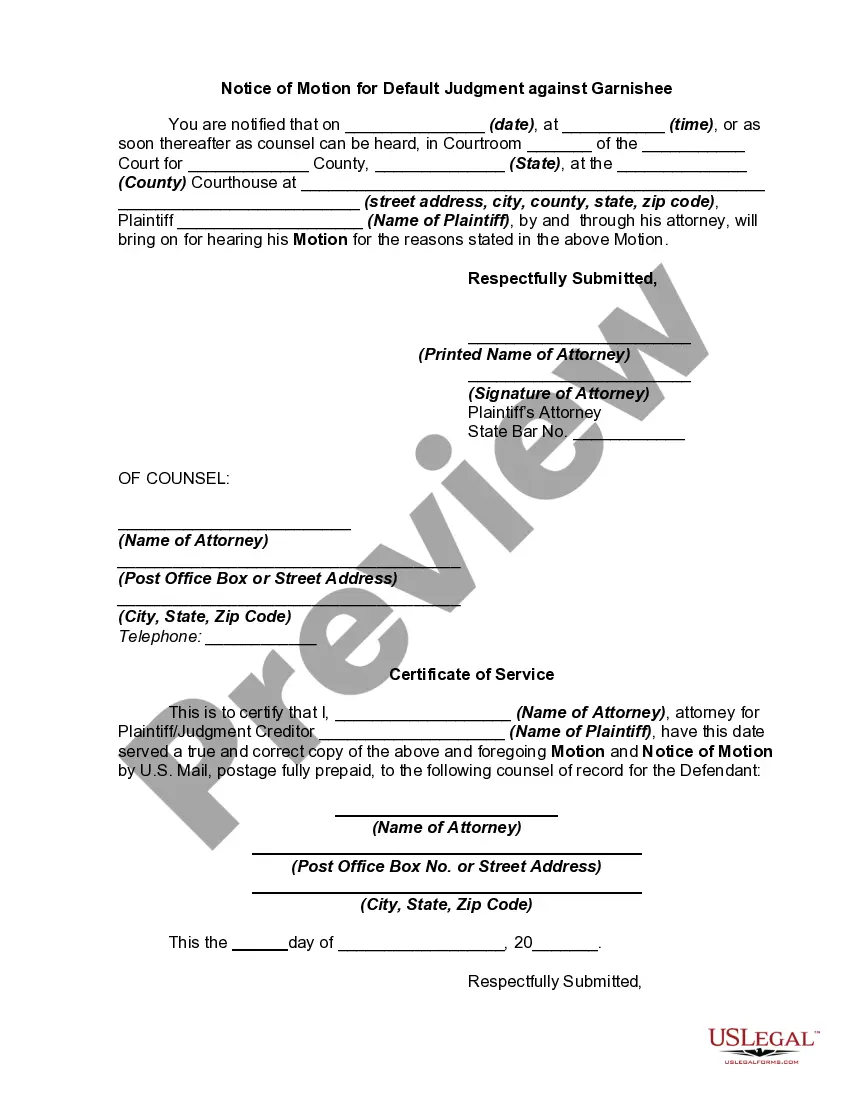

Most states have laws that provided that if a garnishee, personally summoned, shall fail to answer as required by law, the court shall enter a judgment against him for the amount of plaintiff's demand.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.