Franklin Ohio Conveyance of Deed to Lender in Lieu of Foreclosure

Description

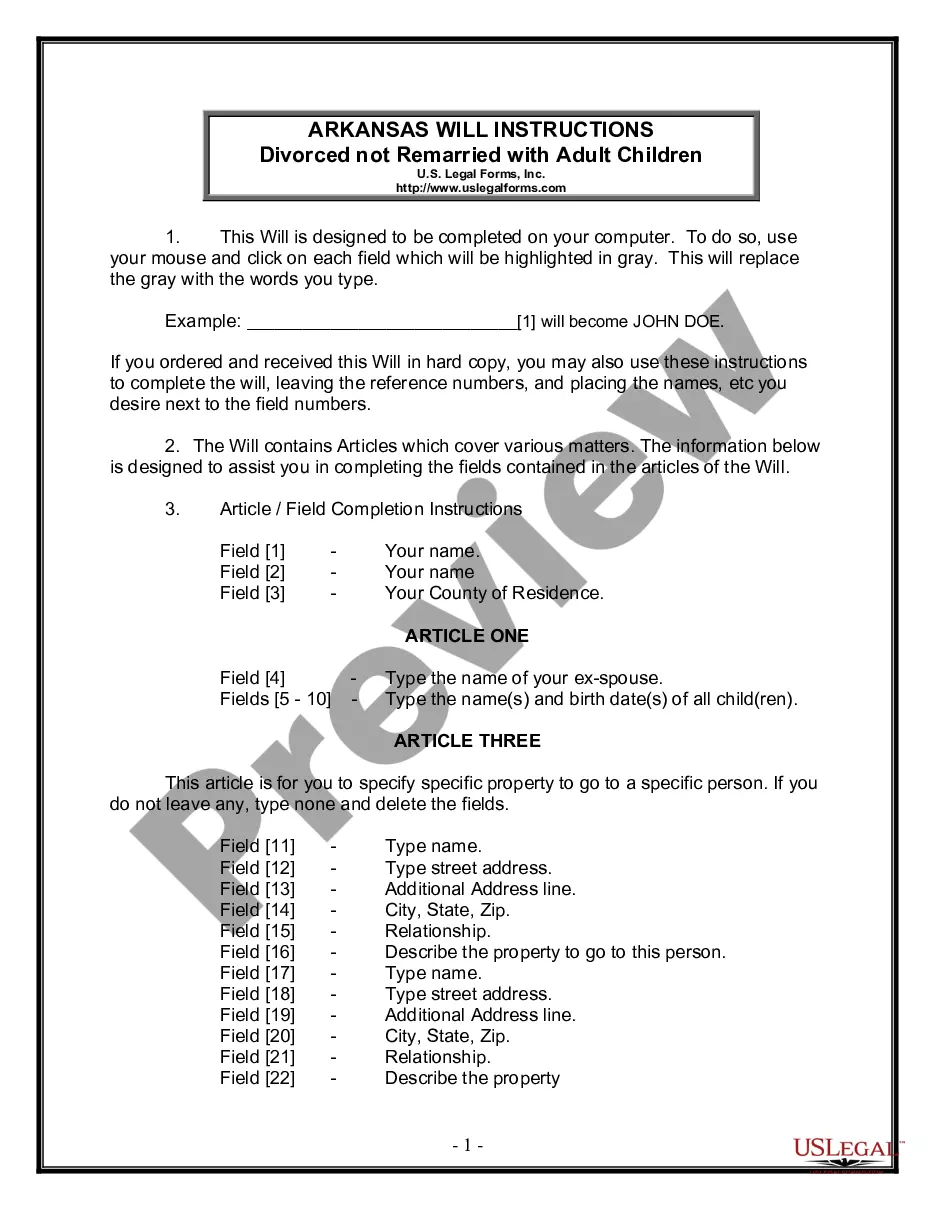

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Regulations and statutes in each area vary across the nation.

If you are not a lawyer, it's simple to become confused by numerous standards when it comes to creating legal documents.

To evade costly legal support when drafting the Franklin Conveyance of Deed to Lender in Lieu of Foreclosure, you need a validated template that is authentic for your jurisdiction.

That's the simplest and most budget-friendly approach to acquire current templates for any legal circumstances. Discover them all in moments and maintain your paperwork organized with the US Legal Forms!

- Examine the page content to ensure you've located the correct sample.

- Make use of the Preview feature or review the form description if it's accessible.

- Search for an alternative document if there are discrepancies with any of your needs.

- Use the Buy Now button to acquire the template once you discover the suitable one.

- Choose one of the subscription plans and Log In or create an account.

- Decide how you wish to pay for your subscription (using a credit card or PayPal).

- Select the format you prefer to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

Form popularity

FAQ

At closing, the seller signs a deed transferring title to the buyer/borrower. The buyer/borrower signs a promissory note, which obligates him or her to make payments to the lender, and a security instrument, such as a deed of trust, which conveys an interest in the property to the lender.

What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure? The lender takes the real estate subject to all junior liens.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. They can simply reject your proposal. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

After a deed-in-lieu of foreclosure, your credit score may drop by a range of 50 to 125 points, depending on where it stood before the deed-in-lieu, according to FICO data. The impact isn't as severe as a foreclosure filing, though, which may drop your credit score by as much as 160 points.

Deed in Lieu of Foreclosure. Distress Sale. Notice of Default.

Unlike with a short sale, one benefit to a deed in lieu is that you don't have to take responsibility for selling your house. Generally, a bank will approve a deed in lieu only if the property has no liens other than the mortgage.

Texas offers many different types of deeds specific to each type of real estate transaction. A Deed in Lieu of Foreclosure provides a process for allowing a borrower to avoid foreclosure by transferring a title of property to a lender.

After a deed-in-lieu of foreclosure, your credit score may drop by a range of 50 to 125 points, depending on where it stood before the deed-in-lieu, according to FICO data. The impact isn't as severe as a foreclosure filing, though, which may drop your credit score by as much as 160 points.