A quiet title action is filed by a person or entity claiming title to all or a portion of a specific parcel of property and asks for a ruling that plaintiff's title is superior to any interest held or claimed by any of the named defendants. It is a mechanism to cure defects in the title to property, thereby providing assurance to the owner who brings the action, as well as subsequent purchasers, of the status of title and accuracy of the real property records.

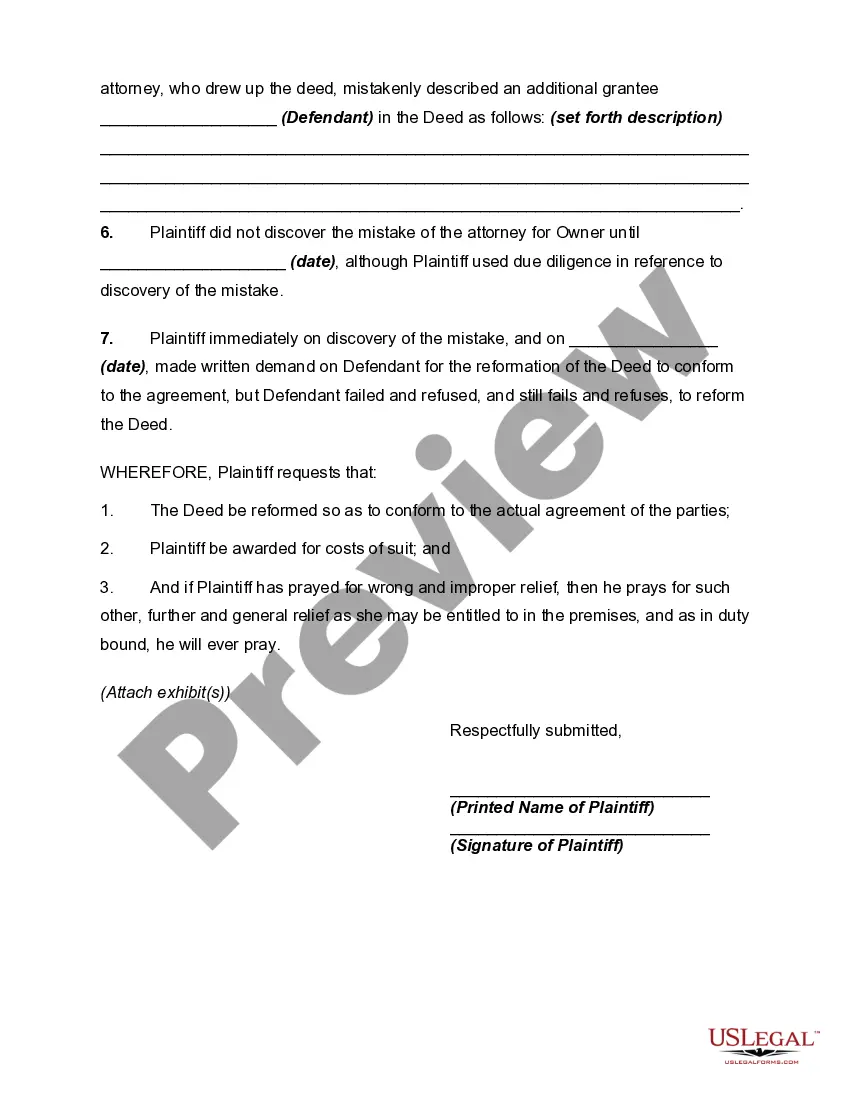

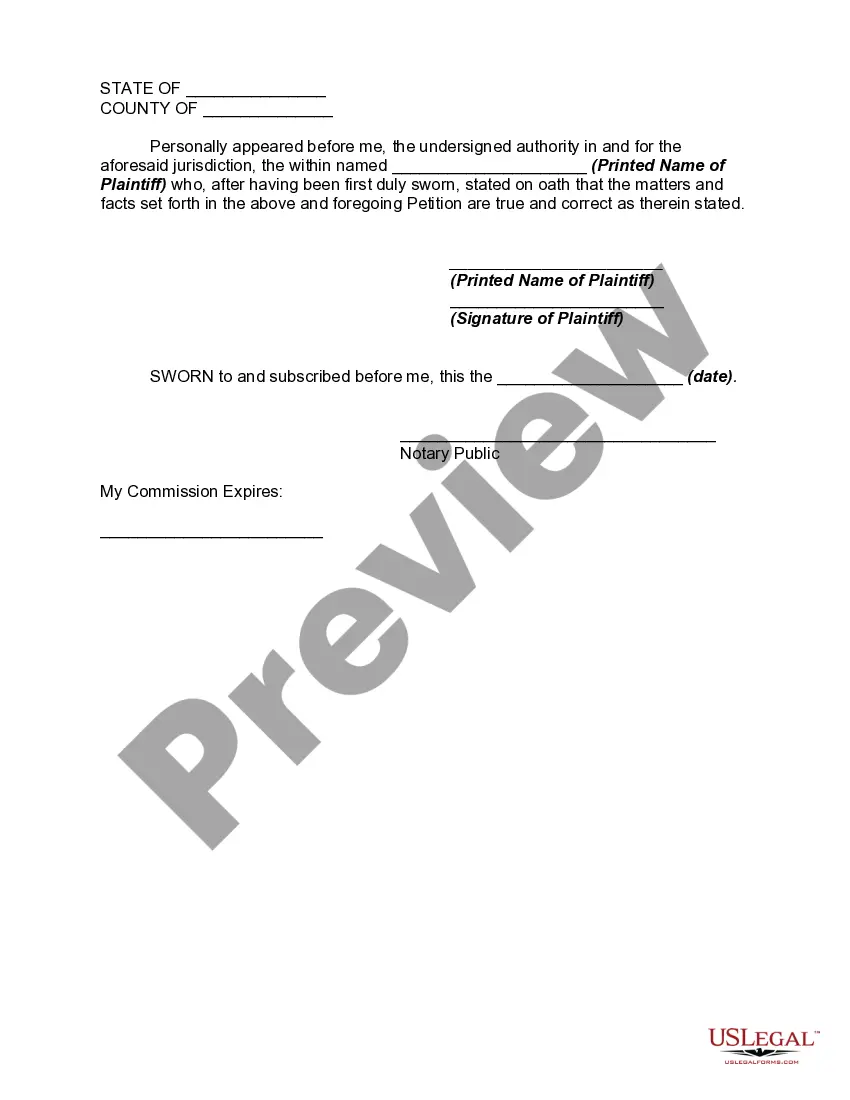

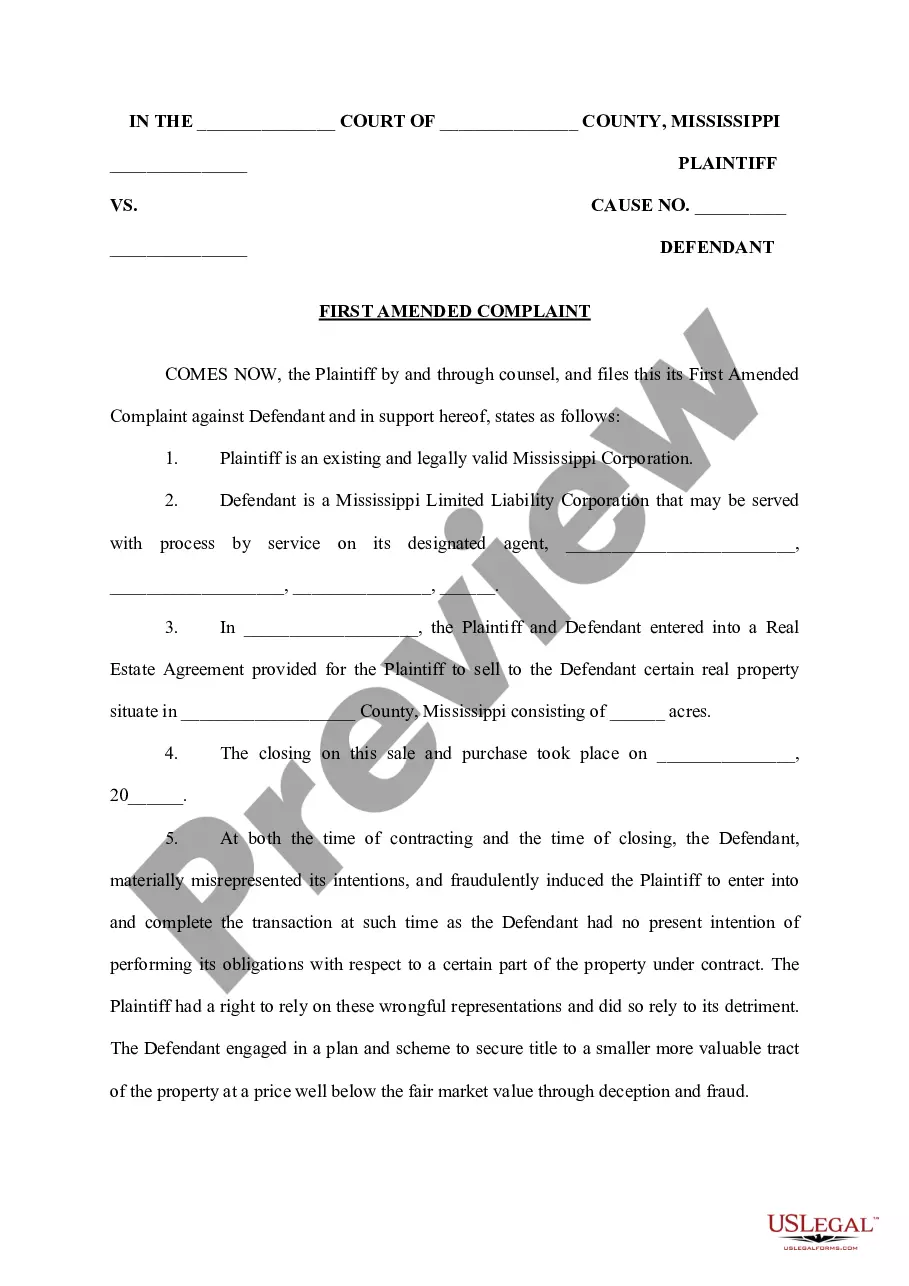

Although a deed expresses the intention of the parties, if there is a material mistake, a court of equity may grant appropriate relief. A court of equity will order the cancellation or reformation of a deed where it appears that a material mistake has been made.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.