Hillsborough Florida Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

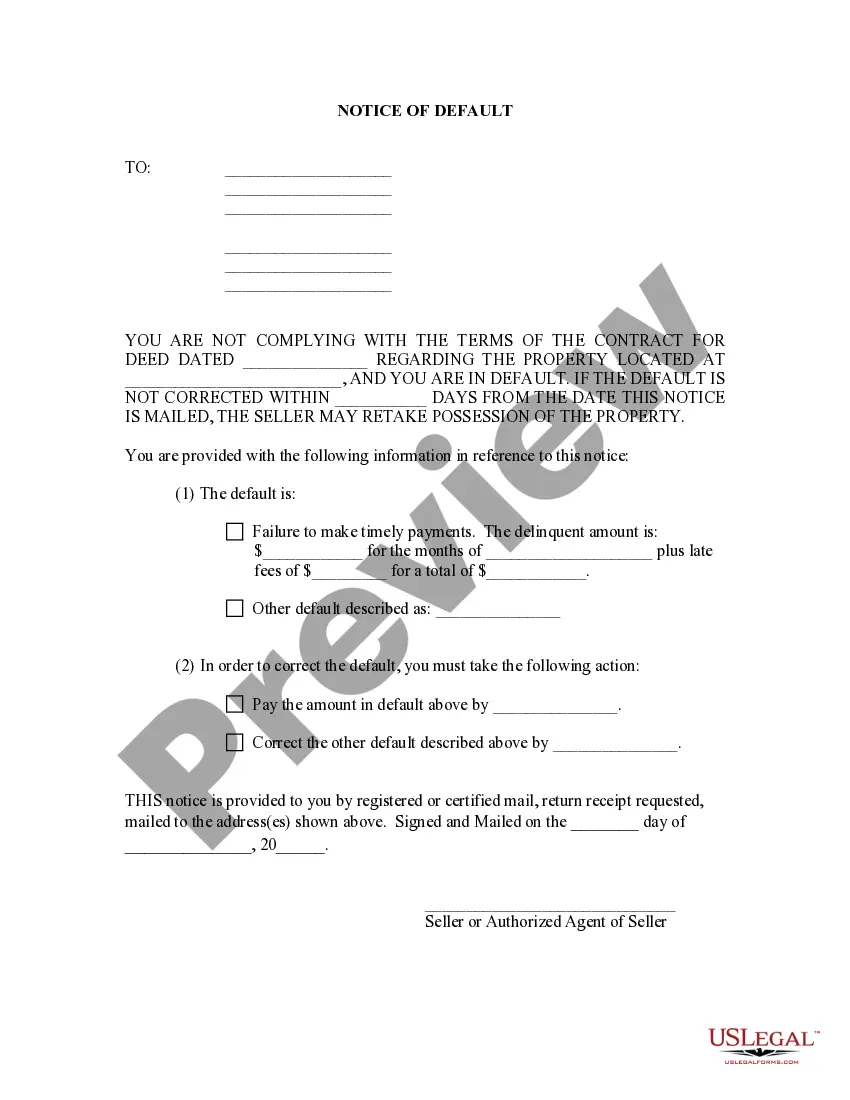

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

Creating legal documents, such as the Hillsborough Notice of Default under Security Agreement in Purchase of Mobile Home, to manage your legal matters is a difficult and time-consuming task.

Numerous circumstances necessitate the participation of a lawyer, which can render this endeavor quite expensive.

Nonetheless, you have the option to take charge of your legal needs independently.

The onboarding process for new clients is equally straightforward! Here’s what you need to do before acquiring the Hillsborough Notice of Default under Security Agreement in Purchase of Mobile Home: Ensure the document is suitable for your state/county as the rules for drafting legal documents may differ from one state to another. Explore more about the form by previewing it or reviewing a brief description. If the Hillsborough Notice of Default under Security Agreement in Purchase of Mobile Home is not what you were seeking, utilize the search bar in the header to locate an alternative. Log In or create an account to commence using our service and obtain the form. Is everything satisfactory on your part? Click the Buy now button and select the subscription plan. Choose your payment gateway and enter your payment information. Your template is ready for download. Finding and acquiring the suitable template with US Legal Forms is simple. Thousands of businesses and individuals are already reaping the benefits of our comprehensive collection. Subscribe now if you wish to discover what additional advantages await you with US Legal Forms!

- US Legal Forms is here to assist you.

- Our platform offers over 85,000 legal documents tailored for diverse situations and life circumstances.

- We ensure that every document adheres to the laws of each state, alleviating your worries about possible compliance issues.

- If you're familiar with our services and possess a subscription with US, you understand how simple it is to access the Hillsborough Notice of Default under Security Agreement in Purchase of Mobile Home form.

- Just Log In to your account, download the document, and customize it according to your requirements.

- Have you misplaced your document? No problem. You can locate it in the My documents section of your account - available on both desktop and mobile.

Form popularity

FAQ

I The following transactions are exempt from Regulation Z: Credit given primarily for a business, commercial, or agricultural purpose; Credit extended to any entity other than a natural person (including credit to government agencies or instrumentalities);

The Florida Building Code and the Florida Fire Prevention and Lifesafety Codes contain the minimum construction requirements governing the manufacture, design, construction, erection, alteration, modification, repair, and demolition of manufactured buildings.

Once a mobile home arrives on site, it must be installed according to the HUD standards. However, the mobile home must comply with the floodplain requirements of the FBC Residential and the local floodplain ordinance. Additionally, any appurtenant structures built on site are required to comply with the FBC.

A mobile home park owner shall at all times: (1) Comply with the requirements of applicable building, housing, and health codes. (2) Maintain buildings and improvements in common areas in a good state of repair and maintenance and maintain the common areas in a good state of appearance, safety, and cleanliness.

In a Chattel Loan transaction, a disclosure is not required at the time of application and the disclosure at closing is less than a page.

The provisions of the act apply to most types of consumer credit, including closed-end credit, such as car loans and home mortgages, and open-end credit, such as a credit card or home equity line of credit.

(1) A mobile home park owner may evict a mobile home owner, a mobile home tenant, a mobile home occupant, or a mobile home only on one or more of the following grounds: (a) Nonpayment of the lot rental amount.

Sample disclosures required under TILA include: Annual percentage rate. Finance charges. Payment schedule. Total amount to be financed. Total amount made in payments over the life of the loan.

Level 1 - Ordinary Repair and Remodel These are types of construction and repair that neither local government nor the department may require permitting or other oversight. Thus, a mobile home owner can perform these repairs without the necessity of local permitting or department approval.

The TILA-RESPA rule applies to most closed-end consumer credit transactions secured by real property, but does not apply to: HELOCs; 2022 Reverse mortgages; or 2022 Chattel-dwelling loans, such as loans secured by a mobile home or by a dwelling that is not attached to real property (i.e., land).